Most precious metal assets staged a solid “comeback rally” against government fiat yesterday.

Double-click to enlarge this key GDX chart.

There’s decent intermediate trend technical support in the $21 area.

Hardcore accumulators can place buy orders for GDX in the $23 to $18 price zone.

To understand why this is a good idea, please look below.

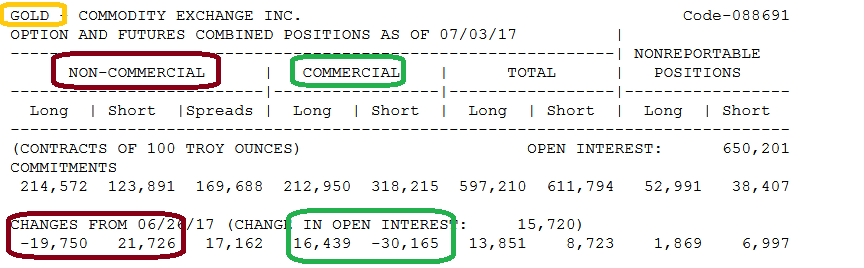

The deep-pocketed commercial traders are serious gold buyers now.

They are likely anticipating the resumption of gold imports in India. Imports were halted at almost the exact intermediate trend high of $1300, partly because of uncertainly about the GST tax.

Commercial traders sold aggressively as gold approached $1300. Hedge funds bought, and gold gently swooned down towards support at $1200 where it sits now.

The commercial traders are now very aggressive buyers. The leveraged hedge funds are booking losses on long positions and adding short positions…into what is essentially a $100 gold price sale!

US coin sales are currently just a gold price discovery sideshow; there’s simply not enough physical market tonnage involved with these coin sales to cause the commercial traders to take serious buy or sell action on the COMEX.

Their focus was, is, and will be mainly on the changing flows of gold in the physical markets of China and India.

The commercial trader focus now suggests they are anticipating massive tonnage imports to begin again in India. Clearly, their aggressive COMEX buying is very good news for all gold bugs.

While US financial news isn’t that important for bullion price discovery, it’s very important for the gold and silver stocks.

Several years ago, I made the bold prediction that QE to infinity and rate cuts would become a taper to zero and rate hikes.

That occurred, and I have predicted that these hikes and what I call “QT to infinity” (quantitative tightening for many years) will create serious wage inflation and ultimately a major bull cycle in money velocity.

Leave A Comment