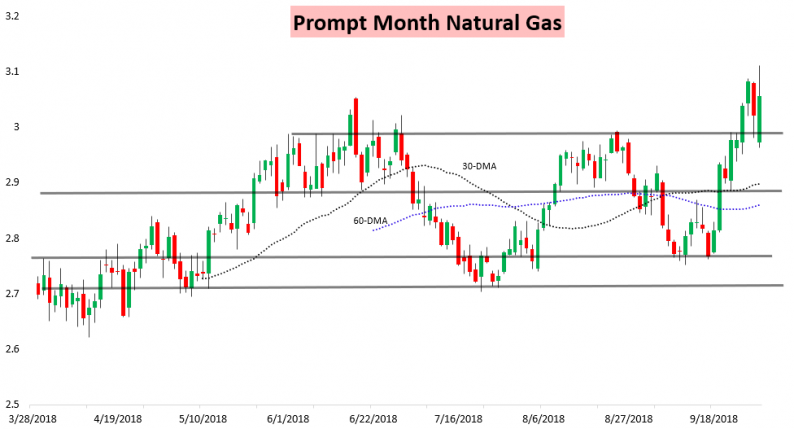

It was another wild day for the newly-prompt November natural gas contract, as it shot higher when the EIA announced that far less gas was injected into storage last week than many expected.

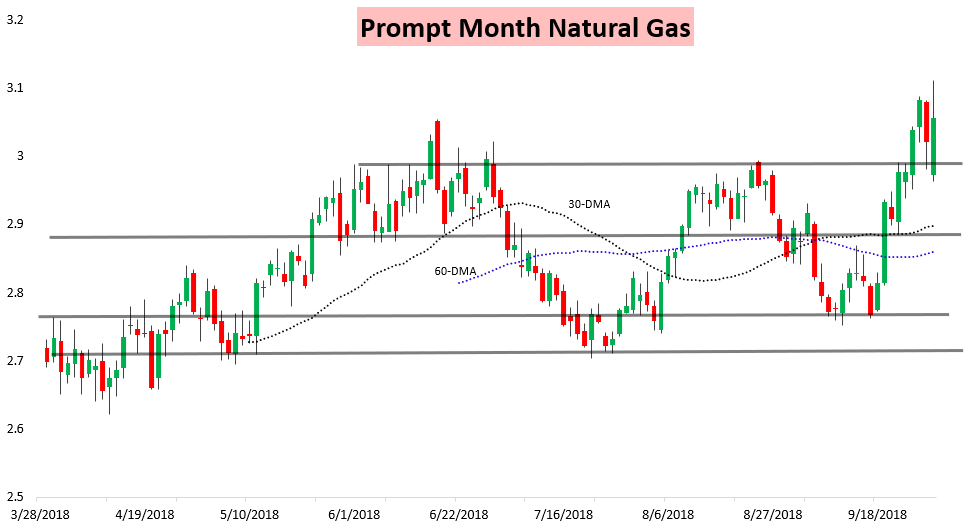

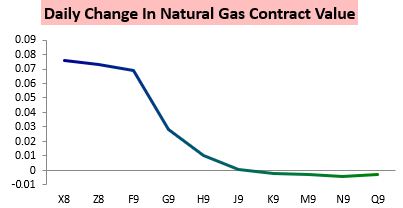

The front of the strip shot higher off the report, eventually reversing on some warmer long-range forecasts in the afternoon but still ending up solidly higher. Meanwhile, later contracts did not move nearly as much.

The average daily trading range has recently shot higher as the market has become more volatile with low storage levels and record production levels headed into the winter heating demand season.

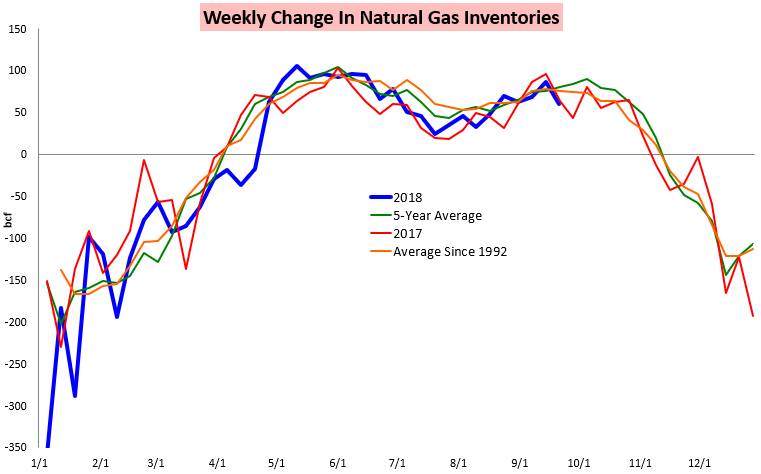

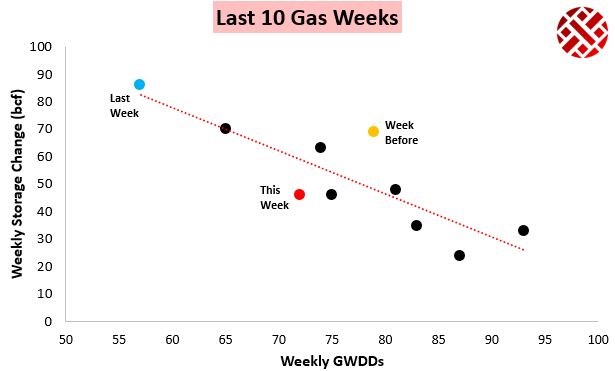

Today’s spike was primarily driven by the EIA announcing that only 46 bcf of natural gas was injected into storage versus estimates that were much higher.

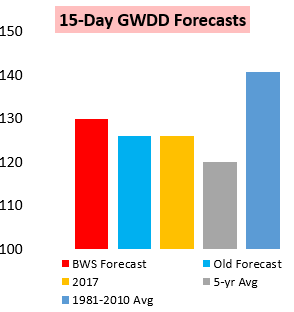

This came far below our estimate of 60 bcf as well, though in our Morning Update we noted, “…with risks for a lower EIA print than our estimate we actually see risk briefly skewed higher this morning.” Slight GWDD additions overnight helped as well.

This print is bullish enough to emphasize storage shortages and keep a bid under prices; a reversal off $3.07-$3.1 seems most likely. This verified well with the November contract briefly breaching this range before quickly reversing lower below it into the settle, even with a tighter EIA print.

Leave A Comment