Investors tend to buy large pharmaceutical companies because of their safety.

But during the Great Recession, shareholders of Pfizer (NYSE: PFE) not only suffered a haircut in stock price, along with shareholders of most companies but also got stung with a dividend cut.

In 2009, the company slashed its quarterly dividend in half to $0.16.

The dividend has since recovered to $0.34 and a respectable 3% yield. Additionally, Pfizer has raised its dividend every year since 2010.

SafetyNet Pro and I both don’t like dividend cuts. When a company lowers its dividend, it shows that the dividend is not untouchable. A company that has reduced the dividend once is more likely to do it again than a company that has never done so.

That being said, SafetyNet Pro and I are benevolent dividend safety graders. Like a sympathetic parole board, we believe in second chances once the price has been paid. That’s why, even after a dividend cut, if a company doesn’t shrink the dividend again for 10 years, we stop penalizing the company on its dividend safety grade.

2018 is the ninth year that Pfizer’s dividend has been stable. After 2019 is over, its 10-year probation will be over and assuming it has not had any more violations, it will lose the current one-level penalty for the 2009 cut.

But Pfizer has another chance to boost its rating even before the end of 2019.

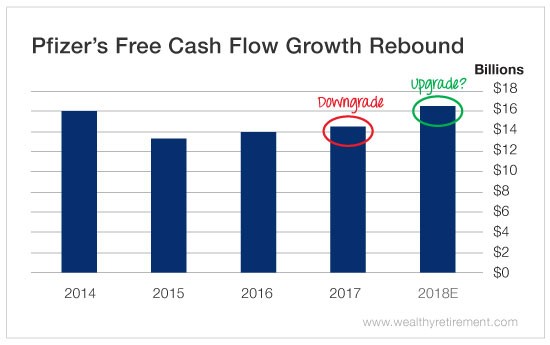

Another area where Pfizer’s rating has suffered has been three-year cash flow growth. In 2014, Pfizer’s free cash flow totaled $15.9 billion. In each of the next three years, free cash flow was below 2014’s level. However, this year, free cash flow is forecast to be $16.6 billion, which will give the company a positive free cash flow growth over a three-year period and will result in an upgrade.

So you have a company that cut its dividend in the last 10 years with negative three-year free cash flow growth. Typically, that signifies that there is some risk to the dividend. But as long as free cash flow growth is anywhere close to expectations this year, Pfizer will get an upgrade next year. Then, after the dividend cut penalty ages out, the stock will likely be “A” rated in 2020.

Leave A Comment