With each passing day, both the technical price action and the news flow are getting more positive for gold.

(Click on image to enlarge

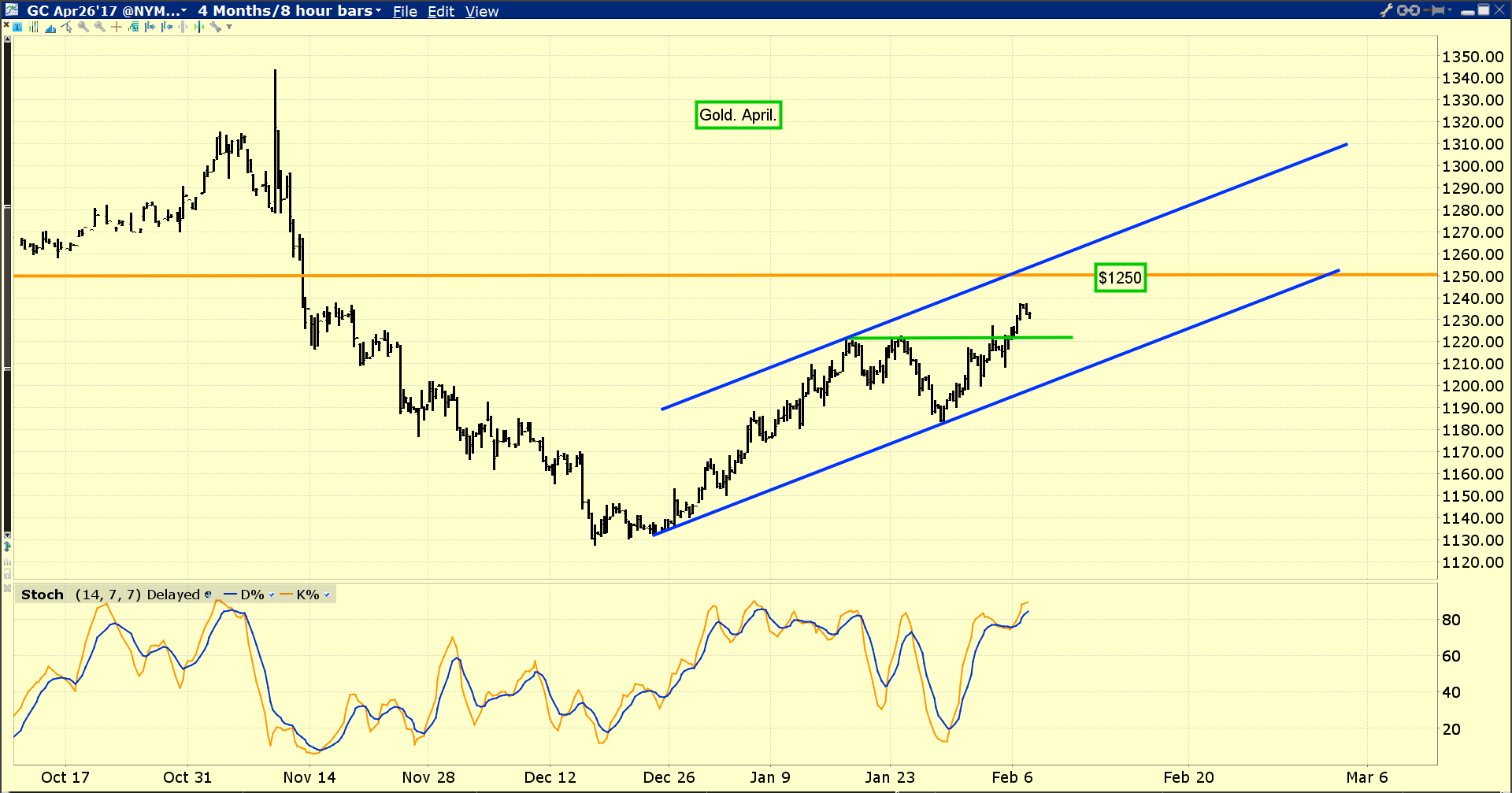

Another great week for the world’s ultimate asset is clearly underway. A beautiful technical uptrend is now in play.

Gold has also surged through resistance at $1220 and is making a beeline towards my $1250 target zone.

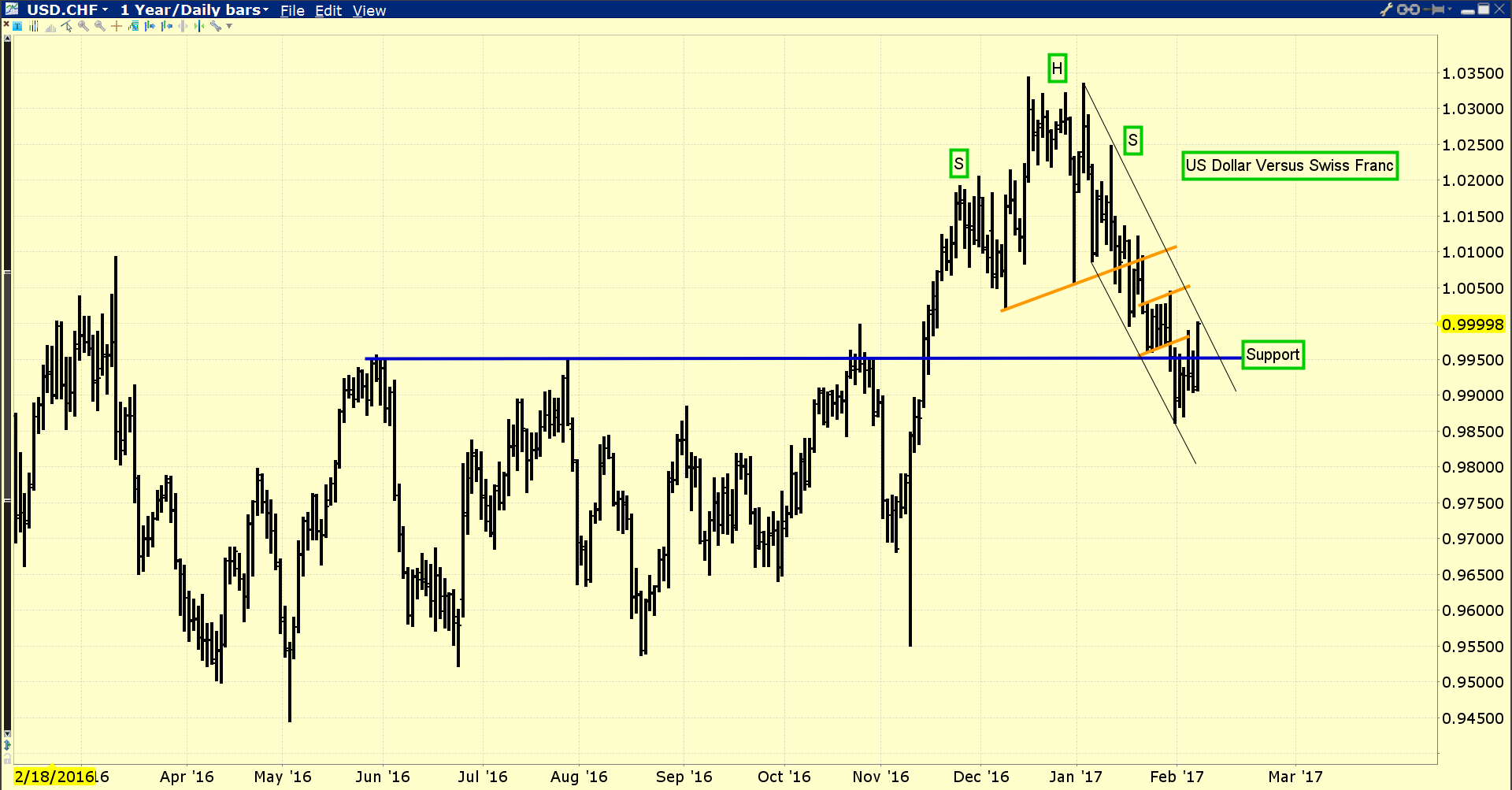

The US dollar has broken down from a substantial head and shoulders top formation against the Swiss franc.

A small rally back towards the neckline of the pattern is likely, but the overall technical picture for the dollar is very negative.

Both the yen and the franc are safe haven fiat currencies, and the “risk-on” dollar’s price action against both of them is truly horrific.

That’s great news for gold, which is the ultimate safe haven.

Will President Trump order Janet Yellen to engage in outright money printing to devalue the dollar?

I think he’ll do it, and here’s why: America’s demographics are drastically different from the demographics that were in place when Ronald Reagan got elected with a similar “Make America Great” mantra.

America is now an ageing society, and both the citizens and the government are maniacally obsessed with debt.

Also, the business up cycle is nearing an end, and while immigration changes make most citizens happy, that’s not going to re-create a 1950’s society with a 15% GDP growth rate.

Sadly, Trump’s only practical tools to reduce the huge debt burden on the backs of both citizens and government are money printing and gold revaluation.

FOREX reserves in China may be about to become a very powerful gold price driver.

To combat the disintegration of its FOREX reserves, China may have to float the yuan, or engage in significant money printing.

Leave A Comment