Well damned if this wasn’t a good news type of day.

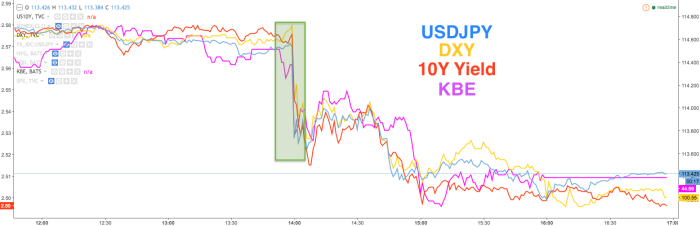

We’d wager the only people unhappy with how Wednesday turned out are Treasury shorts (and there are a lot of them) who got burned badly by a Fed that managed to sprinkle just enough dovish pixie dust into today’s hike to send yields plunging. Oh, and bank stocks were understandably unhappy…

“Treasuries surged after the Fed raised rates as expected and maintained forecasts for additional increases for the next two years, dashing expectations it might signal a quicker pace of hikes,” Bloomberg wrote on Wednesday afternoon, adding that “traders who were speculating on a more hawkish slant from the Fed were left disappointed that the central bank didn’t signal it was shifting to a more aggressive tightening path.” The dollar fell against all of its major peers.

“This is broadly negative for the U.S. dollar,” Mark McCormick, North American head of foreign-exchange strategy at Toronto-Dominion Bank in Toronto, said. “The market was looking for a definite shift in the dots and more clear signals toward a more restrictive stance over the next few years.”

As for risk: it was off to the races…

Everything that fell last week amid the deflationary plunge in crude rallied, with the slumping USD underpinning commodities.

And as if we hadn’t gotten enough good news for one day, this hit the wires one minute (literally) after the close:

Here’s the breakdown:

Prime Minister Mark Rutte’s Liberal Party took 31 seats in elections on Monday, according to an exit poll by Ipsos published as voting booths closed.

- Compares with 41 seats in 2012 elections

- Labor took 38 seats in 2012 elections

- Party is current government partner with Liberal Party

- Compares with 15 seats in 2012 elections

- Compares with 15 seats in 2012 elections

- Compares with 13 seats in 2012 elections

- Compares with 12 seats in 2012 elections

- Compares with 5 seats in 2012 elections

- Compares with 4 seats in 2012 elections

Leave A Comment