Hot on the heels of the biggest collapse in Australian Capex ever, and just as we predicted back in 2012, we thought it about time to once again re-visit – Godot-like – the never-ending wait for ‘recovery’ (or ongoing crash) in Capital Expenditure around the world.

Back in as we predicted back in 2012that in the Brave New Normal World, where zero cost debt-issuance is used to immediately fund stock buybacks instead of being reinvested in growth and expansion, in the process boosting management pay through equity-performance linked option payout structures, that with every passing year CapEx spending would decline first in relative then in absolute terms, even as free cash flow use of funds is spent on other “here-and-now” shareholder-friendly activities such as buybacks and dividends would grow exponentially.

And yet companies which have no choice but to continue their existence, even if they are forced to pay out all incremental cash to their loud-mouthed shareholders simply because there really is no global economic growth which can soak up the incremental growth spending, they still spend money on (mostly) maintenance and (to a tiny extent) growth capital spending.

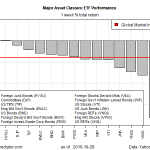

So for those curious where this spending ends up (because everyone knows where dividends and buybacks go), here is a global heatmap of all capex spending broken down by region and segment:

As Goldman so succinctly explains, this is not about to turn around anytime soon…

Our long-held bearish view on capex hinges on several overlapping factors:

- the aftermath of China’s huge investment phase and the resultant overcapacity;

- global growth becoming less capital-intensive;

- the ubiquity of technology (substituting hardware capex for software opex, digitisation of widgets, optimising utilising and rousing dormant capacity); and

- persistent uncertainty (around regulation, obsolescence risk and new competitors, both cross-border and cross-sector).

Leave A Comment