Disaster in precious metals land has been averted (for now) as the market unwinds what appears to be sudden excessive bearish sentiment. Surveys such as the daily sentiment index reached single digit levels for Gold and Silver (the previous week) while the net speculative position in Gold and Silver has declined dramatically in recent weeks. This is encouraging for precious metals bulls as it portends to a rally but negative sentiment by itself cannot change the broader trend.

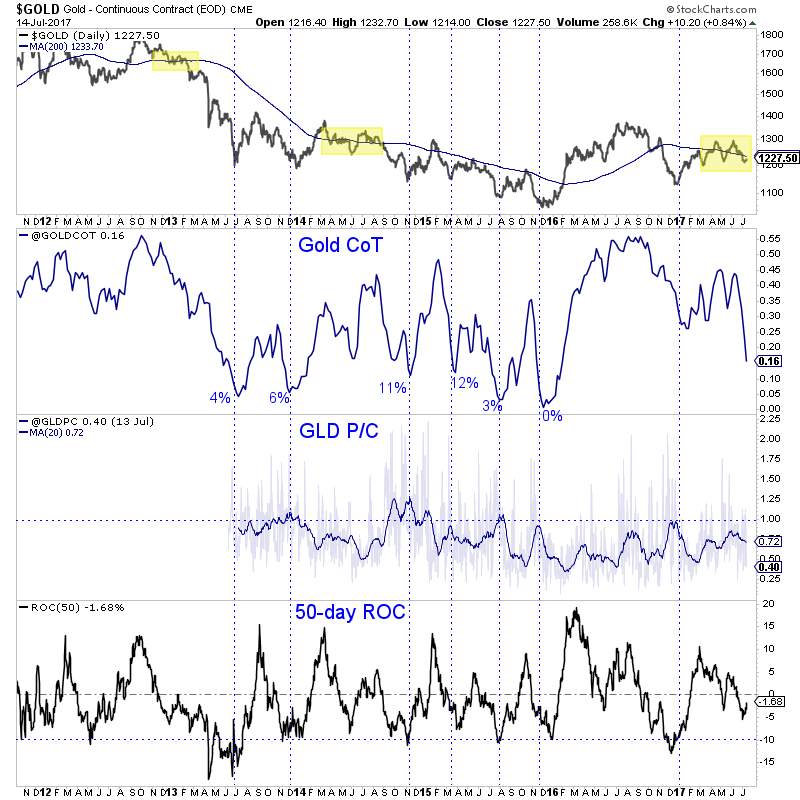

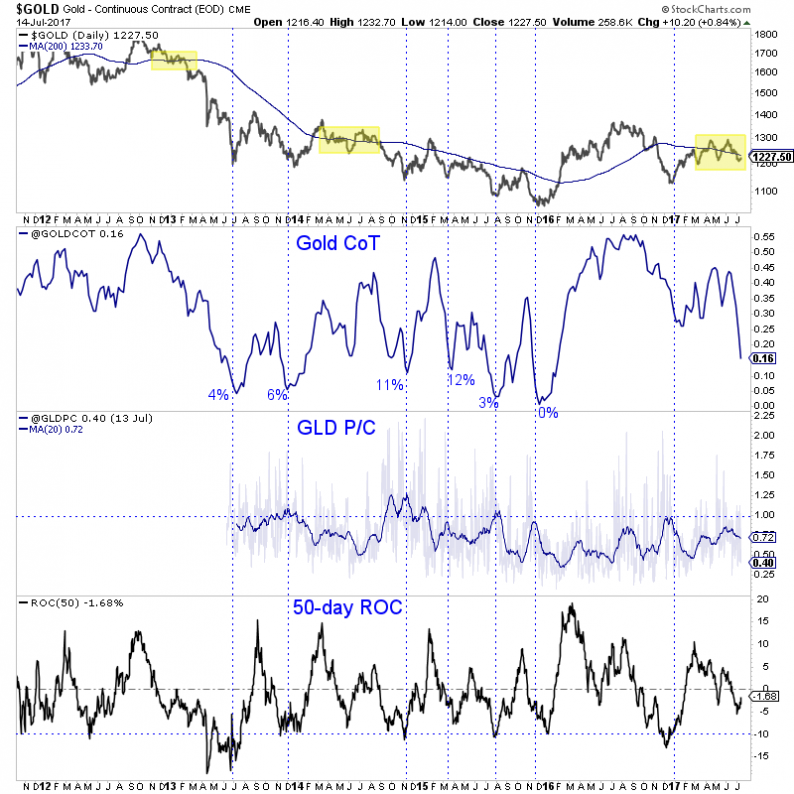

In the chart below we plot Gold with its 200-day moving average along with Gold’s net speculative position (as a percentage of open interest), the GLD put-call ratio and Gold’s rolling 50-day rate of change. The vertical lines mark Gold at its most oversold points based on the three indicators.

Gold’s best rallies have occurred with the CoT (net speculative position) at 0% to 4%, the put-call ratio 20-day moving average near 1.00 and the 50-day ROC at -10%. Gold rallied strongly in November 2014 with the CoT at 11% but note the put-call ratio was at its highest on the chart. While the current CoT is at 16% and at its lowest level in 16 months the other indicators did not reach extremes. In terms of Gold’s price action and the three indicators, the comparison to summer 2014 makes the most sense.

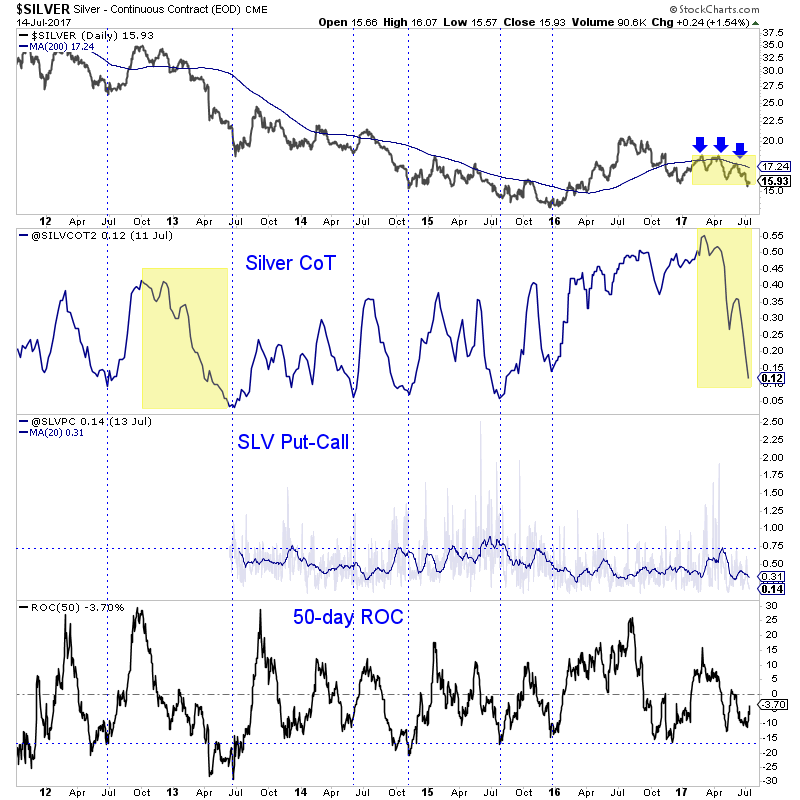

Moving to Silver, we plot the same data and what stands out is the massive liquidation in the net speculative position. In just the past several months it has decreased from 55% of open interest to now 12% of open interest.

The recent price action and massive liquidation is best compared to early 2013. Then, Silver formed three declining peaks and the net speculative position plunged. In fact, in early April 2013, Silver was trading at $27 with a net speculative position of roughly 11% of open interest. Within the next three months Silver plunged to $18, despite the previous massive liquidation in the net speculative position. So the speculators were actually correct.

Leave A Comment