The Global Sustainable Investment Alliance, a collaboration of green investment-oriented entities, has released its latest Global Sustainable Investment Review, looking at the state of SRI investments.

This is the third in a series of reports “presenting results from Europe, the United States, Canada, Asia, Japan, and Australia and New Zealand.”

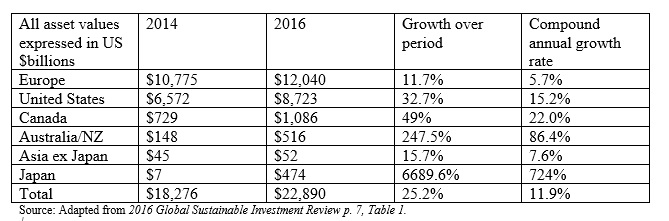

The report tells us that there are now $22.89 trillion of assets around the globe “being professionally managed under responsible investment strategies,” one-quarter more than the $18.28 trillion in 2014. Further, the 2016 AUM represents roughly 26% of all professionally managed assets. SRI has become a major force

In emerging markets, including importantly the People’s Republic of China, “regional and local investors are the main investors in sustainable assets,” although GSIA says that this may change in the near future as China opens itself up to operations of foreign-owned fund managers.

A Broad Umbrella

The GSIA understands the broad umbrella of sustainable investing to cover all of the following practices:

The sixth item on that list, “impact investing,” is defined by the GSIA as the targeting of investments, typically within private markets, that are aimed at solving social or environmental problems – which one might colloquially paraphrase as “trying to do well by doing good.” The GSIA says that this is “a small but vibrant sector” of the broader SRI universe.

Nearly all regions saw increases in the AUM. This table indicates as much.

Europe clearly retains a leading role in this field: more than half of the SRI assets included in this report are European. Japan has exaggerated percentage numbers because this two year period saw the industry take off from nearly ground level there, and as a consequence of changes in reporting/classification of assets in Japan.

Leave A Comment