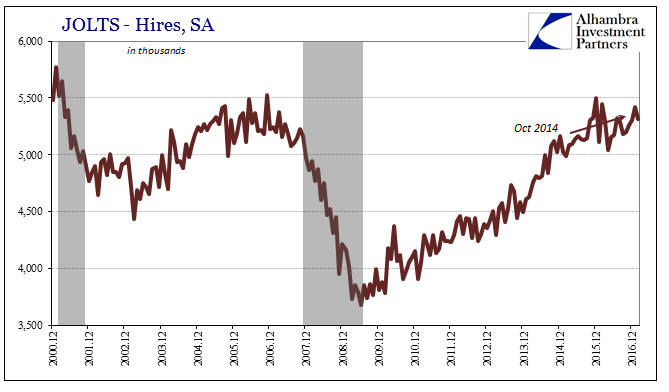

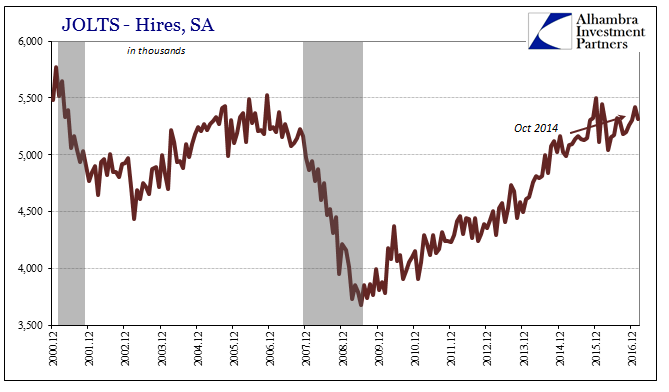

Since there isn’t any detectable acceleration in wages or earnings, the plateau across the JOLTS data dating back to various points in 2015 is therefore not likely to be related to the presumed end of labor market slack. Even if the unemployment rate were a valid and relevant interpretation of “full employment”, there would be no reason why businesses might not keep on hiring and advertising for hire anyway. Instead, the slowdown in JOLTS mirrors the wider slowdown across the economy.

This additional BLS data is statistically related by an internal benchmark to the CES, where the “implied” monthly employment change (Hires minus Separations) of JOLTS is fitted to some degree with the Establishment Survey estimate. Even so, there is variation in this data that may not, and often does not, appear in the CES survey.

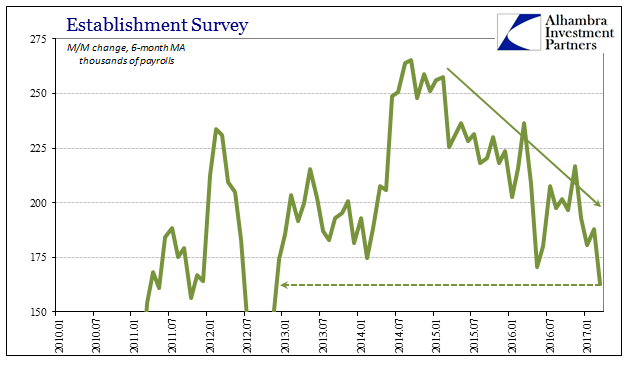

What that means for any given monthly figure is that it does not necessarily match the mainstream payroll numbers. For February, the headline Establishment Survey estimate was relatively robust (revised down subsequently), a meaningless number on its own, while the JOLTS series particularly in terms of Hires was not. Though the Establishment Survey was reported as weak in March, that doesn’t immediately propose JOLTS estimates produced next month will show the same thing.

Instead, we can rely on averages for both which do show some small level of harmony, at least as far as the same direction. Since the two series are benchmarked to each other, it doesn’t necessarily amount to corroboration given that degree of self-reference. Still, the same shortcomings as seen by the payroll data are found in JOLTS, too.

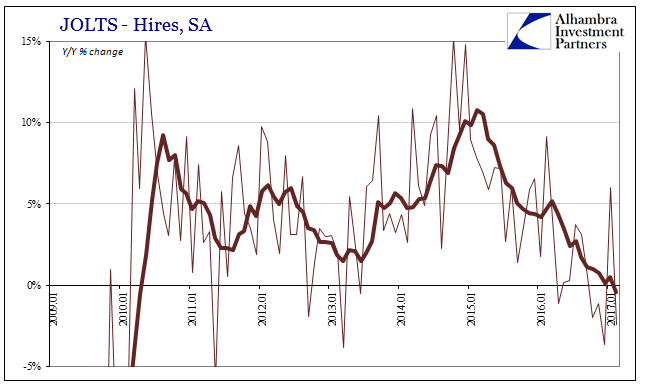

Year-over-year, the change in monthly HIRES was negative again for the fourth time in the past five months. The 6-month average is now for the first time since 2010 also negative. Thus, while we don’t know the full extent to which the labor market has slowed down there is (still) every indication that it has to some considerable degree. This is a troubling indication because for JOLTS a year has passed (and for the Establishment Survey, a year plus a month) since the bottom of “global turmoil.” That should have been more than enough time for a meaningful turnaround to develop, even considering how the labor market often lags inflections.

Leave A Comment