Three economic reports arrived this morning, presenting the last round of numbers ahead of this afternoon’s policy statement from the Federal Reserve that’s expected to roll out the first interest-rate hike in nine years. How do the latest figures stack up? Overall, it’s a mixed bag. Housing starts rebounded nicely in November, but industrial output continued to weaken last month. Meantime, the flash December data for Markit’s purchasing managers’ index for manufacturing is still pointing to growth, but the trend is stumbling. Will the numbers du jour convince the Fed to delay a rate hike yet again? Hard to say. In any case, let’s quickly review the latest data dump ahead of the Fed announcement.

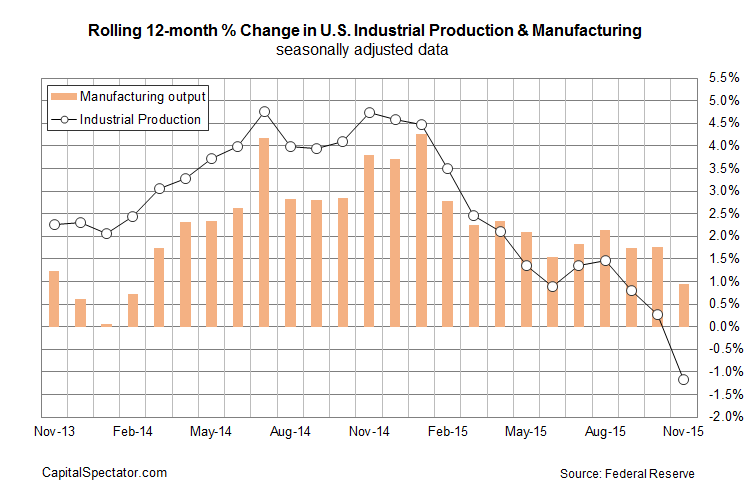

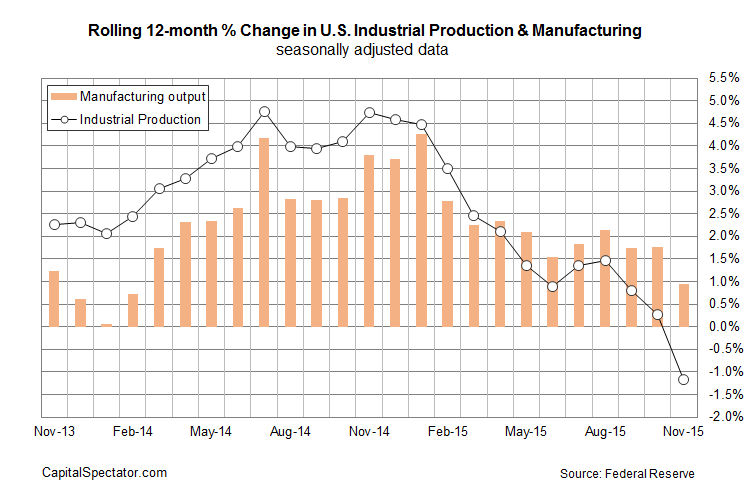

Let’s start with industrial production, which dispensed a bigger-than-expected slide. Output fell 0.6% last month, marking the third straight monthly decline. The longer-run trend is even weaker: the annual pace stumbled to a negative 1.2% reading—the deepest slide for the year-over-year change in nearly six years. It’s a bearish profile, although one reason for reserving judgment: manufacturing. Although manufacturing output was flat last month in the Fed’s report, the year-over-year change was still positive, rising 0.9% in November vs. the year-earlier period. But that’s the slowest growth rate in over a year and the directional bias doesn’t look encouraging.

Markit’s survey data for manufacturing looks a bit firmer. Nonetheless, the preliminary PMI reading for this month slipped to its lowest level in three years. The 51.3 estimate for December is still above the neutral 50.0 mark, but the margin of comfort is getting thin. “Just as the Fed looks set to hike interest rates for the first time since 2006, the manufacturing sector shows signs of stalling,”purchasing managers’ index for manufacturing Markit’s chief economist, Chris Williamson. “The flash PMI results show factories ending the year with the weakest inflow of new orders since the global financial crisis.”

Leave A Comment