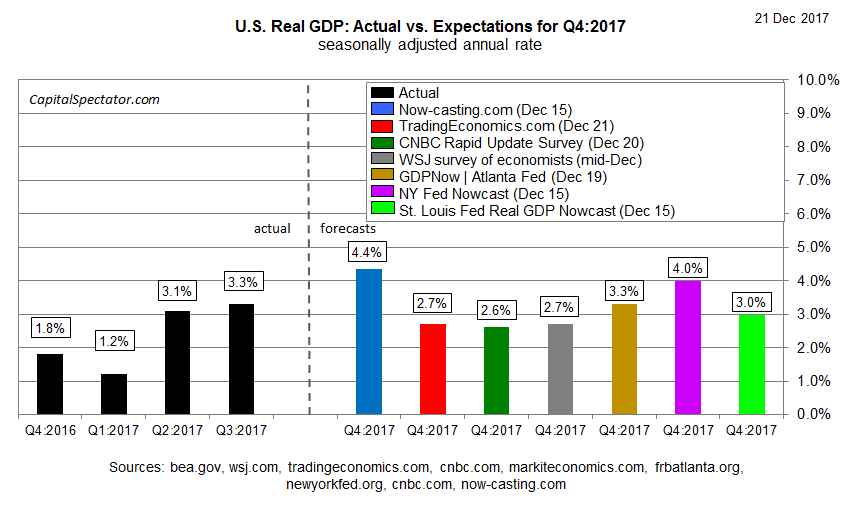

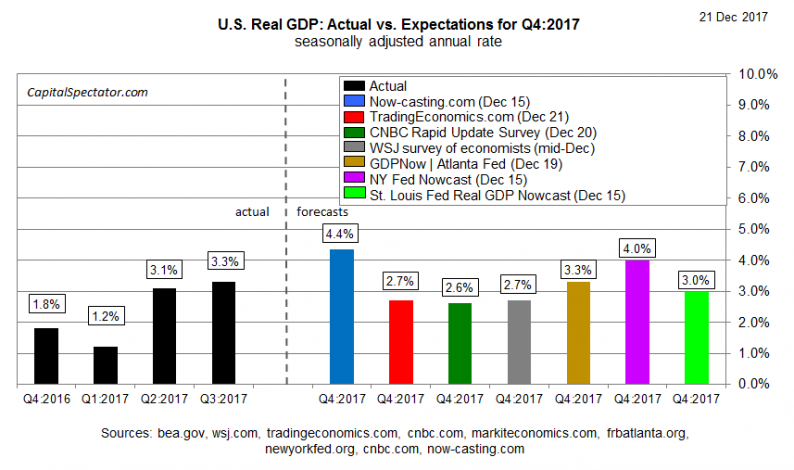

The preliminary fourth-quarter GDP report that’s due in late-January is still on track to post a healthy gain, but the latest forecasts reflect a wide set of projections, ranging from a modest slowdown to a strong acceleration in output vs. Q3’s pace.

On the low end of estimates are two surveys of economists. The median for CNBC’s Dec. 20 poll anticipates a 2.6% rise for Q4, a moderate downshift from Q3’s solid 3.3% advance. In line with that outlook is the average 2.7% forecast via The Wall Street Journal’s mid-December survey of dismal scientists. (Note: revised Q3 GDP data is due later today, at 8:30 am Eastern, and the consensus forecast sees output unchanged at 3.3%, according to Econoday.com.)

A pair of econometric nowcasts offer a substantially stronger outlook for this year’s final quarter. Now-casting.com’s Dec. 15 projection reflects a strong acceleration in growth to 4.4%. A New York Fed nowcast published on the same day is only slightly lower with a 4.0% estimate.

Note, however, that the median estimate of the Q4 forecasts in the chart above is a solid 3.0%. That marks a slowdown in growth from Q3, but the estimate suggests that the recent improvement in US economic activity will continue in 2017’s final quarter, albeit at a slower rate.

Yet survey data suggests that the risk of a downside surprise isn’t trivial. Last week’s PMI data for the manufacturing and services sectors, for example, highlight the possibility for deceleration. “Measured overall, the surveys point to the economy growing at a modest annualized rate of just over 2% in the fourth quarter,” said Chris Williamson, a chief business economist at IHS Markit.

In contrast with relatively muted survey numbers for Q4, the new tax-cut bill that President Trump is expected to sign is cited by the administration as the catalyst for dramatically stronger growth in 2018. “We’re going to easily see 4% growth next year,” advises Gary Cohn, director of the White House National Economic Council.

Leave A Comment