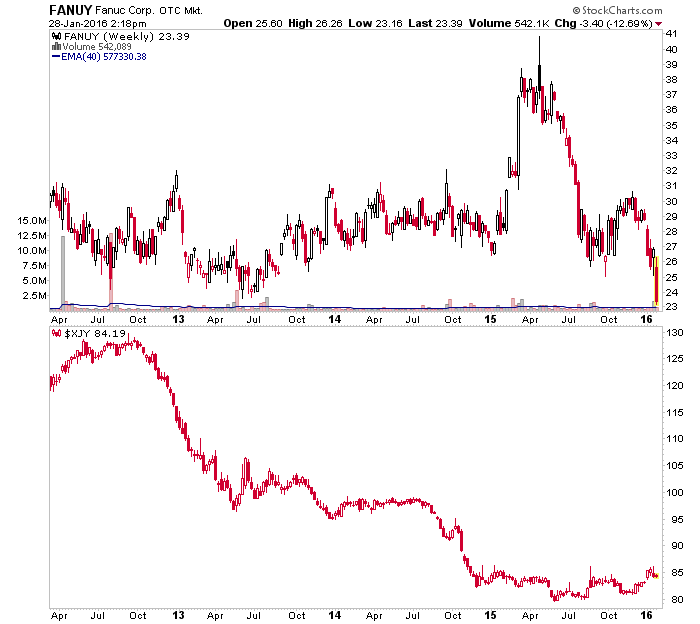

I used to get freely distributed emails (i.e. non-premium) from a well regarded service based in the UK. They struck me as very smart and very buttoned down. What they didn’t strike me as was guys who have worked on a manufacturing floor. When I saw their narrative remaining bullish the likes of Fanuc due to its Robotics component (in the face of what I knew was a near meltdown about to take place in Machine Tools) I quit their email list because I felt their analysis itself was too robotic.

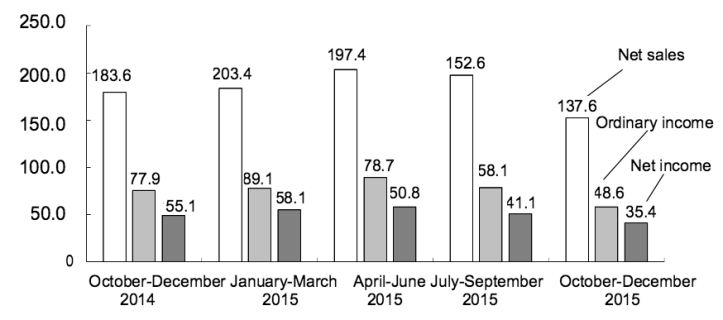

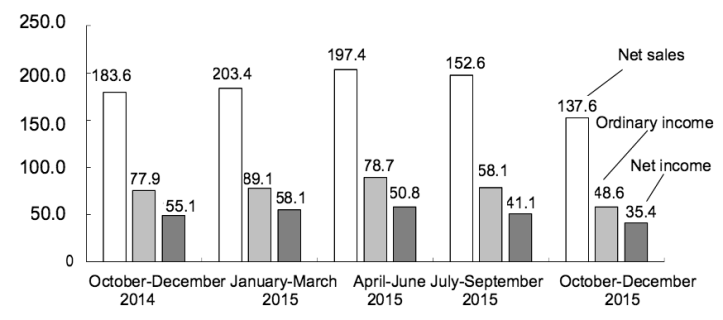

As noted before, Fanuc is a Machine Tool builder (and a damn good one) with a cool Robotics angle; not the other way around. Here is Fanuc’s latest quarterly release for anyone interested. It’s not pretty, but it is right in line with the Machine Tool industry.

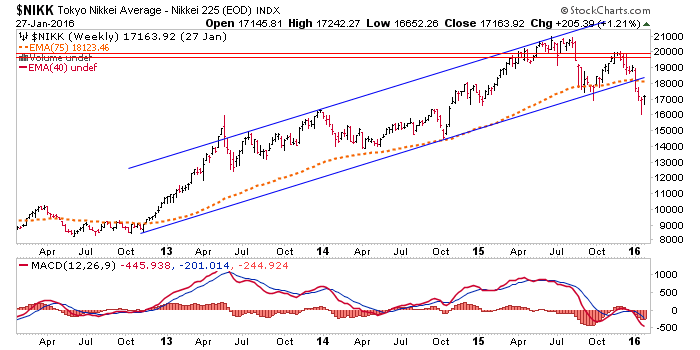

I think the problem is only partially due to the recent firming of the Yen, but that hasn’t helped. Fanuc is on radar for when Japan becomes a buy, but that day is in question right now after the Nikkei lost an intermediate-term uptrend channel (2nd chart below, reviewed most weeks in NFTRH).

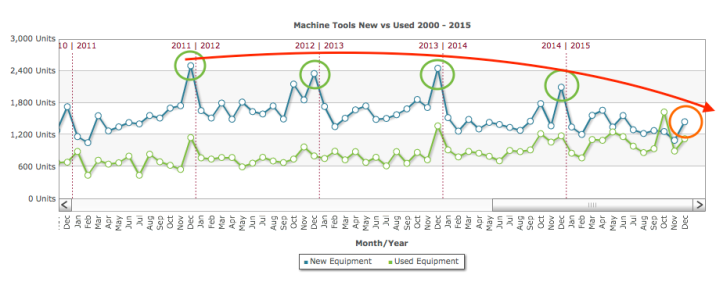

Here again is the terrible Machine Tools trend per a post from yesterday.

Leave A Comment