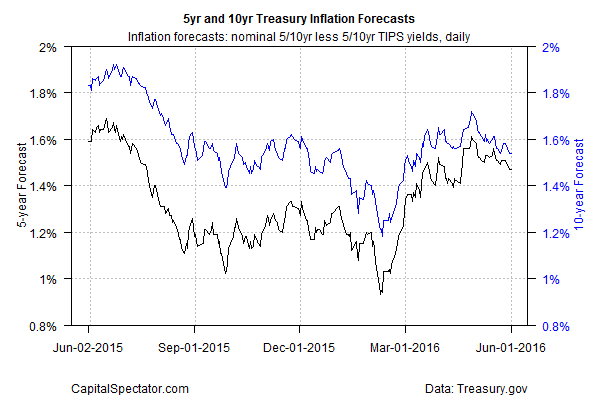

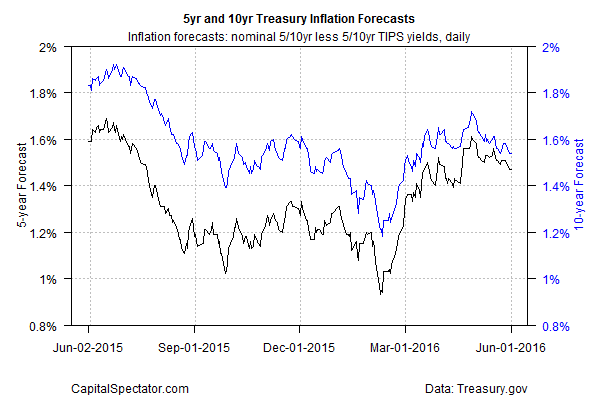

The Federal Reserve is considering another rate hike, perhaps as early as this month, but the Treasury market’s estimate of future inflation signals skepticism from the vantage of government bond traders. The implied forecast, based on the yield spread between nominal and inflation-indexed Treasury yields, is inching lower again. The recent decline suggests that the odds for squeezing monetary policy at the central bank’s June 14-15 FOMC meeting may be lower than hawkish Fed comments of late imply.

Anything’s possible, of course, but is the Fed going to roll out another rate hike in the face of sliding inflation expectations–when pricing pressures are already low and well below the bank’s 2% target? Perhaps the answer awaits in Friday’s employment report for May. But the crowd’s looking for another dip in job creation. Econoday.com’s consensus forecast calls for a softer gain in headline payrolls of just 158,000 for May—down slightly from April’s disappointing increase of 160,000.

The optimists are prepared to argue that the Verizon strike, which ended this week, is to blame. Maybe, but by this logic we’ll have to wait until next month’s employment update for a reliable signal to learn if the labor market is firming up—or not.

Meantime, the Treasury market’s inflation outlook is stumbling again. After rebounding from February’s lows, when pessimism was running deep and wide about the US economic outlook, the 10-year Treasury inflation estimate has been sliding in recent weeks. Based on daily yield data via Treasury.gov, the implied forecast for the 10-year spread dipped to 1.54% yesterday (June 1)—well below the recent high of 1.72% as of late-April.

The US stock market, however, is holding on to most of its recent rebound, but the S&P 500 can’t seem to break through the ceiling and post new highs. A convincing run of economic releases in the summer could spark a rally that declares in no uncertain terms that the bull is back. Meantime, the bear-market bias that’s been lurking since late last year lingers on (see here and here, for instance).

Leave A Comment