So… how’s that border wall coming?

Errr, never mind. I’m eventually going to learn that politics isn’t worth discussing. As I’ve said before, I’m not the kind that sucks at the government teat, so I don’t get worked up (or really care that much) about the goings-on in D.C. I find it amusing, yes, but the notion of making some individual an avatar for myself and getting all riled when he is attacked… no, I’ll leave that for dim minds. Some people consider themselves superior to others based on their beliefs, but humans are innately self-interested, and their politics reflect that.

So let’s talk about religion instead!

No, no, no. Almost as bad. Let’s look at a chart or two.

It’s heartening, of course, to see the stuffing being knocked out of the NQ. Friday and Monday morning started it all, and we had our Gartman “shall take courage to purchase, and we shall” rally, and then the “Trump is hosed” resumption. The real question, of course, will be whether we take out recent lows. I’ll let you guess which side I’m cheering for.

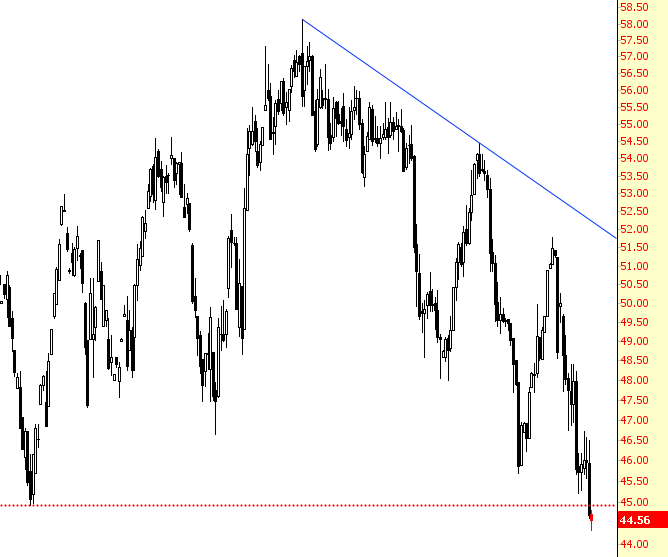

Crude oil is where my heart belongs, of course, and I’ve been wringing my hands the entire way down, worried about a bounce. We’re terribly deep at this point, and my hand-wringing is worse than ever, but it’s quite obvious what the trend is. We’ve broken through principal support (at last), and as I’ve said so often, being short energy stocks could be the trade of the year.

Oil isn’t the only thing that’s weak, though. Freakishly, gold continues to suck out loud as well. If, a couple of days ago, you received a visit from an emissary of the future telling you that (a) interest rates were going up (b) there would be a massively bad piece of news for the administration in D.C., you would have logically rushed out to buy gold. Nope! Gold continues to totally stink, as it has, more or less, since autumn 2011.

Leave A Comment