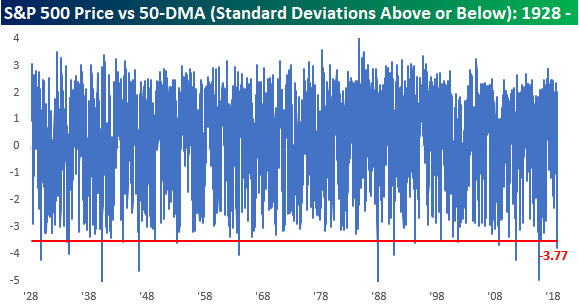

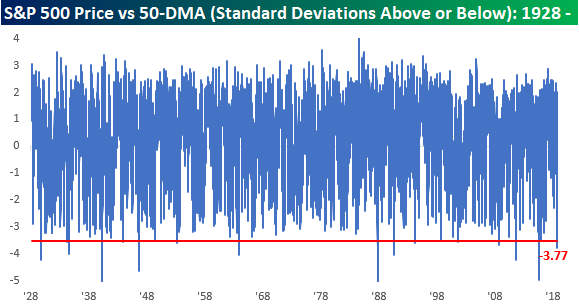

Wow! That was pretty extreme. After the most severe sell program in the market since the ‘flash crash’ of 2010 sent US equities plunging for a second straight day, the S&P 500 finished at what can only be considered a ridiculously oversold level on Thursday at more than 3.7 standard deviations below its 50-day moving average. For reference, we consider 1-standard deviation below the 50-DMA to be oversold, and two standard deviations to be an ‘extreme’ oversold reading. We’ll let you use your own adjectives to describe a level nearly twice that. To put some perspective on that oversold reading, the last time the S&P 500 was more oversold was August 2015.

So, what now? There’s some good and bad news here, but only time will tell which one plays out.

Leave A Comment