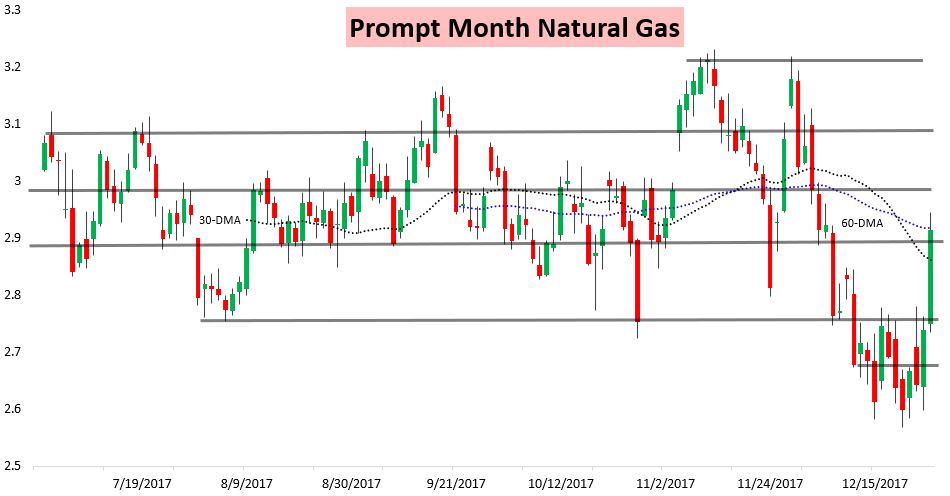

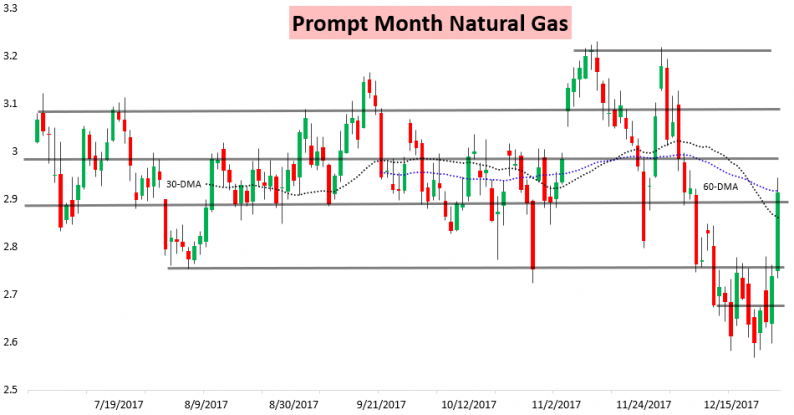

It was the first day having the February natural gas contract as the prompt month after the January expiry yesterday, and the February contract was met with a short squeeze on colder forecasts, with prices spiking to settle right at the prompt month 60-DMA.

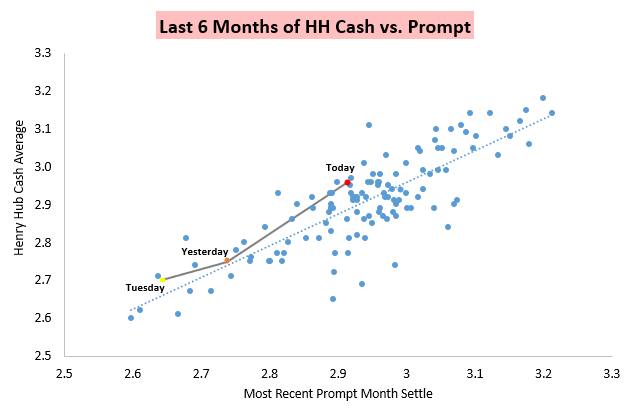

Cash prices rallied even further, with cash prices and futures both moving far higher on the week. Yet cash prices settled just above futures as they reacted more to short-term cold and the February natural gas contract continued to price in uncertainty lingering in weather later in January.

The rally was significant enough for natural gas to again be centered front and center on CNBC, where our Chief Weather Analyst Jacob Meisel was featured breaking down today’s rally,

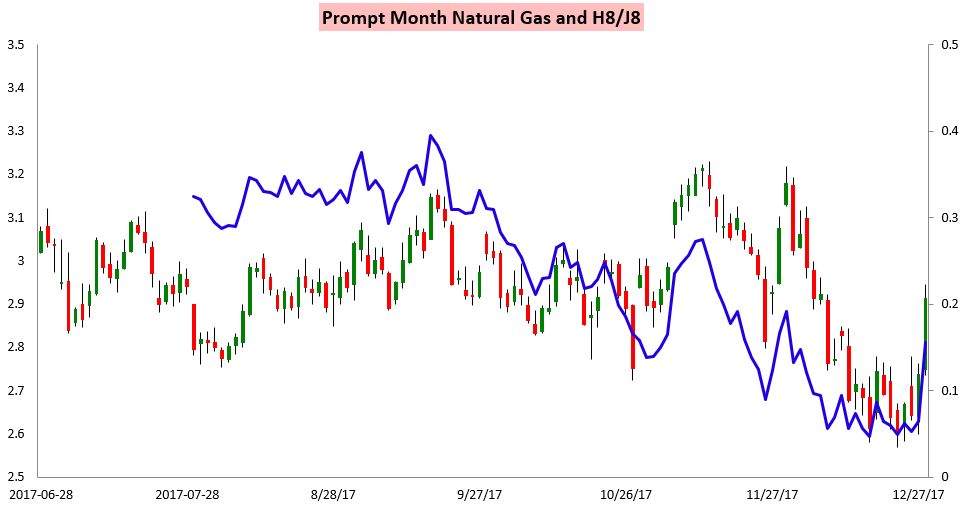

And after a period where weather was not driving price action, it was clear that weather and short-term demand expectations were behind this rally as H/J blew out significantly.

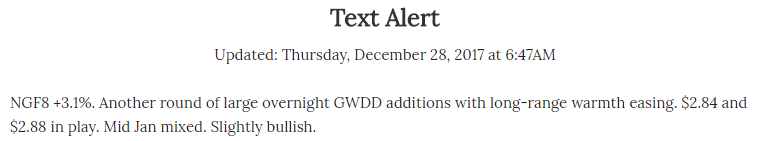

This move did not come entirely as a surprise, though it was a bit larger than we had expected. Our Morning Text Message Alert picked up the resistance we encountered around $2.88, though a supportive EIA print helped us move through even that.

We warned clients about this too; we saw the EIA print as slightly bullish even though it hit our estimate perfectly, with just slight week-over-week loosening.

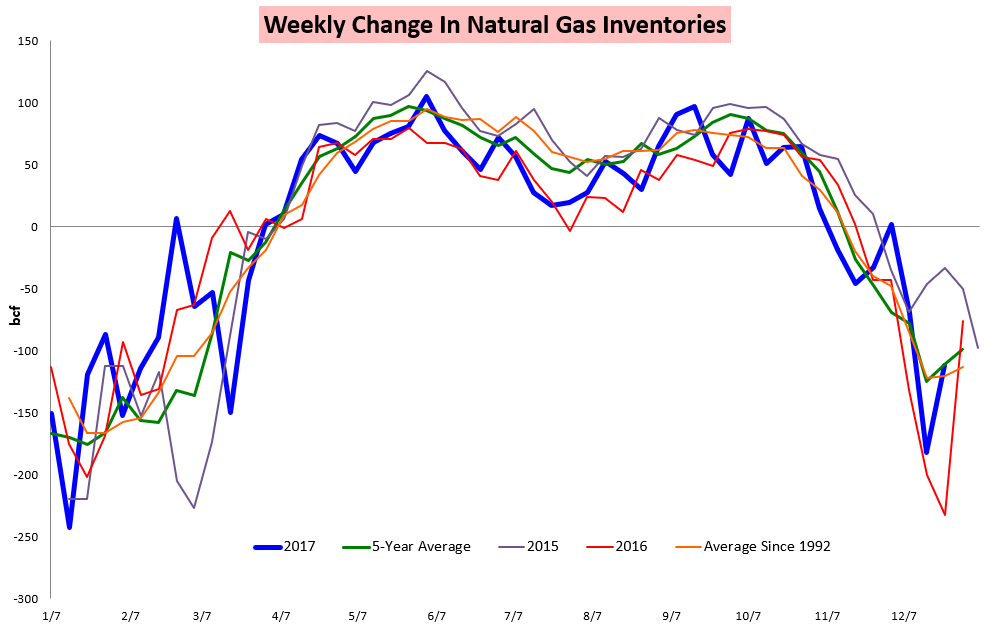

We can see that even though the storage withdrawal was far smaller than last week’s, it still came in right around the 5-year average.

Now attention turns to what are expected to be very large storage withdrawals to be announced by the EIA over the next few weeks. With enough sustained cold, the natural gas market could be dealing with a storage shortage, which is clearly what spiked prices today. This is something we had warned about back in our November 21st Seasonal Trader report, that though the market appeared well-supplied at the time any sustained cold could have a disproportionate bullish impact, as inventory levels remained far below where they were last year.

Leave A Comment