Tesla shares have continued their plunge this morning, down nearly 13% from the Thursday close in the aftermath of the SEC securities fraud lawsuit aimed at Elon Musk directly, as investors realize that in addition to seeking unspecified monetary penalties, the regulator will ask a judge to bar Musk from serving as an officer or director of a public company.

Predictably, the Tesla Board doubled down in its defense of the embattled CEO, saying that it is “fully confident in Elon, his integrity, and his leadership of the company”, however, doubt is creeping that Musk may soon no longer be part of the company that made him a household name, and with it come estimates of just what Musk’s value is to Tesla.

In a note titled “Lawsuit Secured”, Barclays tries to calculate precisely what the Musk “premium” is, which it calculates at $130, and writes that “should the SEC be successful in barring Mr. Musk from serving as an officer or director, investors would focus back on the value of Tesla as a niche automaker, rather than a founder-led likely disrupter of multiple industries.”

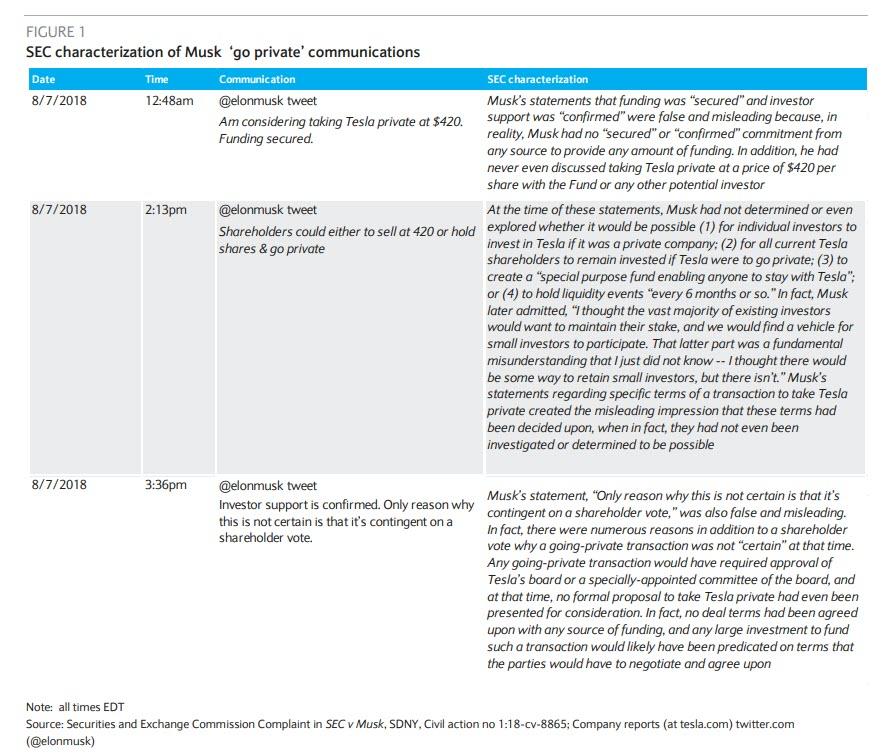

In the sarcastically-titled note from analyst Brian Johnson, Barclays first breaks down the key aspects of the the lengthy SEC complaint, which appears to have been based on Tesla emails, texts, and perhaps interviews with Mr. Musk and board members, and which alleges that Mr. Musk’s tweets on Aug. 7 were “false and misleading.”

Explaining how the lawsuit will likely play out, Barclays writes that Musk, who reportedly declined a settlement with the SEC, is entitled to a jury trial, plans a vigorous defense around his claim that he acted, as his statement later on Thursday noted “in the best interests of truth, transparency and investors”. As such, and based on Musk’s comments before and after the notice, a defense along the lines that he didn’t intend to deceive investors as he ‘believed” that his contacts with the unnamed sovereign wealth fund meant that funding was indeed likely to be secured. Indeed, Musk issued a statement Thursday that:

Leave A Comment