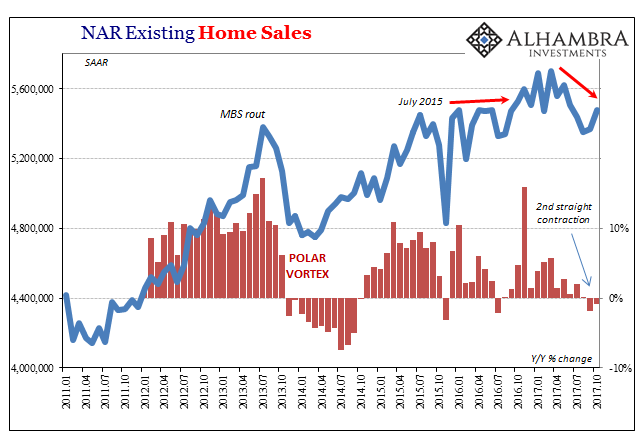

The National Association of Realtors (NAR) estimates sales of existing homes rose 2% in October 2017 from a downwardly revised September estimate. The trade group tries its best to put recent results in the best possible terms, claiming in its press release that at 5.48 million (SAAR) the number of resales is “their strongest pace since June.”

That’s technically true and also meaningless. Year-over-year, home sales fell for the second straight month. At a level of 5.48 million in October 2017, it’s not meaningfully different than the 5.45 million registered in July 2015 more than two years ago. The housing market has not fallen in danger of another historic bust, but importantly it’s not growing, either.

The reason appears to be inventory. Even the NAR cannot deny the lack of sellers and the impact on what might/would otherwise be a robust market. And it can’t make sense of it, either.

NAR Chief Economist Larry Yun:

Job growth in most of the country continues to carry on at a robust level and is starting to slowly push up wages, which is in turn giving households added assurance that now is a good time to buy a home. While the housing market gained a little more momentum last month, sales are still below year ago levels because low inventory is limiting choices for prospective buyers and keeping price growth elevated.

If the economy is as robust as he claims, especially wages rising in a healthy labor market, then why is it not registering as “added assurance that now is a good time to” sell a home, too? What counts for buyers also counts for sellers. The latter just aren’t showing up, serious reluctance despite rising prices and several years of being this way already.

Reported inventory levels were down another 10% year-over-year in October, which were down last year almost 5% from October 2015, already down nearly 6% compared to October 2014. Inventory is off by 20% over three years with prices rising and all throughout what was uniformly described as “robust” “job growth” pushing up wages. Yet, the housing market isn’t buying it, or at least selling off of it.

Leave A Comment