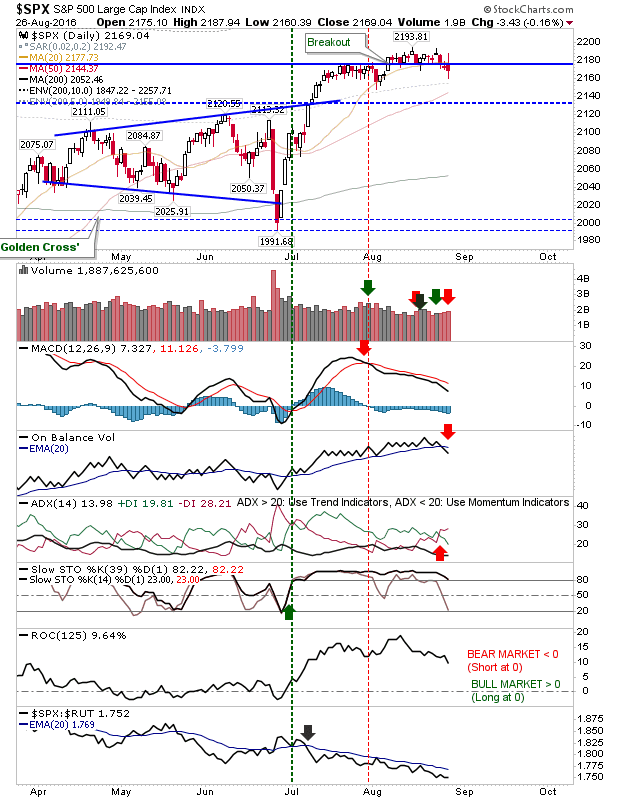

Yellen’s speech pushed markets both up and down, but probably left more minds stuck in indecision than offered a clear path forward. Markets don’t like indecision, which gives bears and weak longs an opportunity to sell. There are still key support levels to break, but recent weeks of tight action could lead to an unraveling.

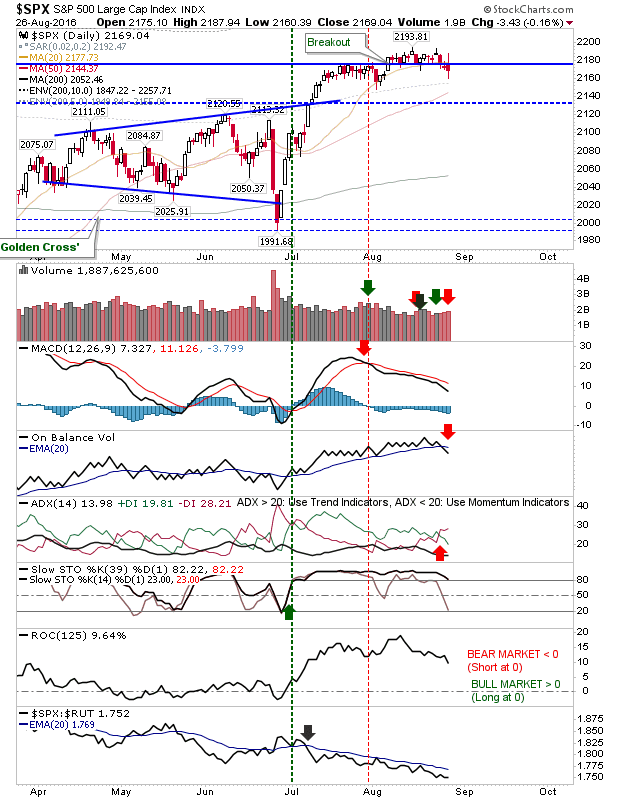

The S&P finished as registered distribution with new ‘sell’ triggers in On-Balance-Volume and Directional Indicator. The index has been stuck in a relative downward turn since July (against Small Caps). This index is offering the clearest ‘sell’ signal.

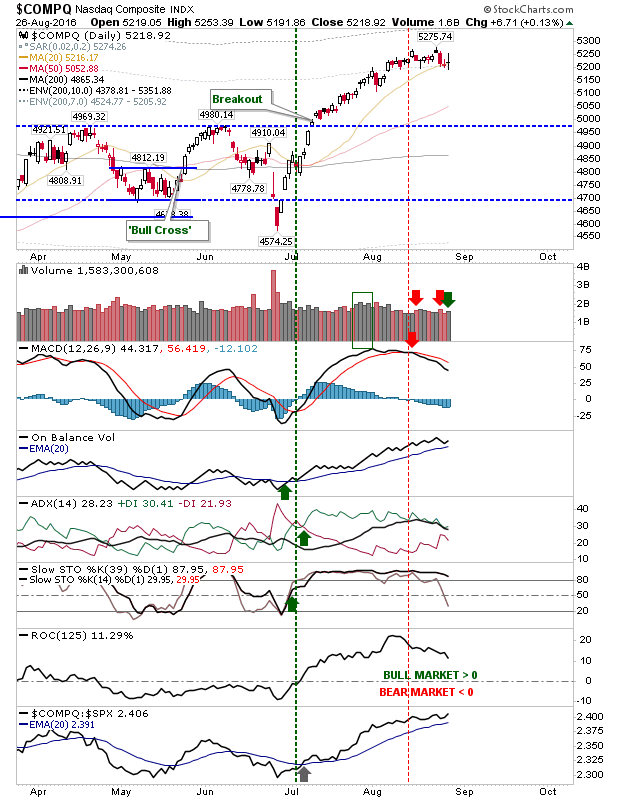

The Nasdaq also finished with a indecisive ‘doji’ at the 20-day MA. Technicals only have a ‘sell’ trigger in the MACD to deal with. However, where the S&P looks to be siding with bears, the Nasdaq is edging in bulls’ favor. So if buyers are to take control on Monday, then the Nasdaq may be the big winner.

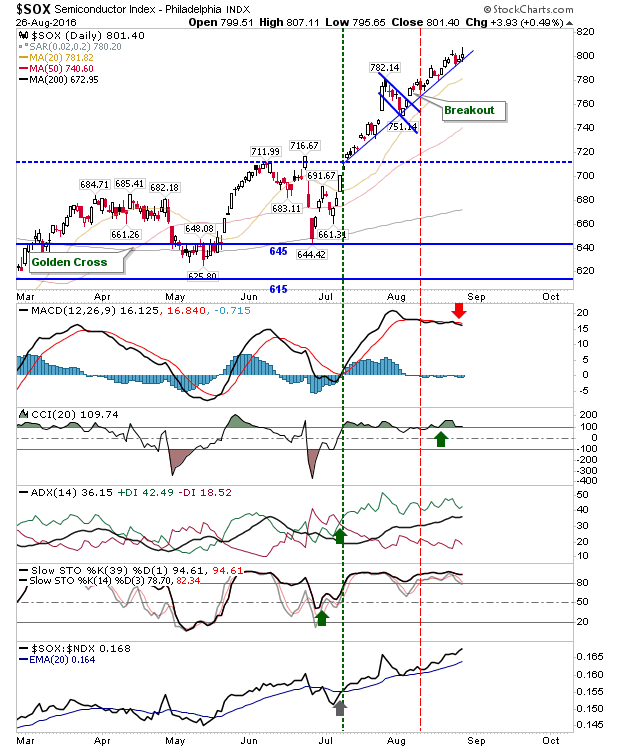

The Semiconductor Index is another index set up for bulls. The tight line of support has been held since July and Friday’s action didn’t change that. It’s looking extended, so it isn’t a buying opportunity, but there isn’t a reason to sell until this rising support line is breached.

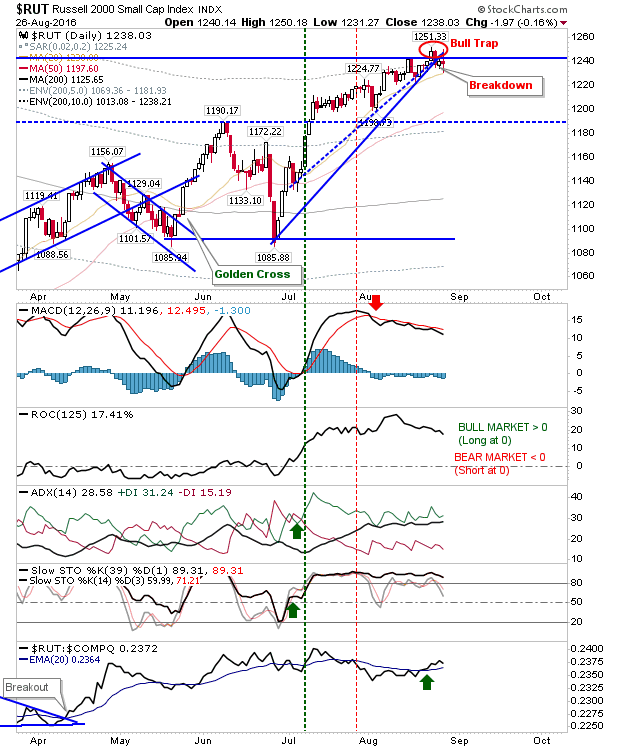

While the S&P is set up for profit taking and the Nasdaq to ‘dip’ buying, the Russell 2000 may give shorts something to work with. There is a ‘bear’ trap and a break of trendline support to work with. The one thing going against the short position is the relatively strong performance of this index against the Nasdaq and S&P.

For Monday, look for premarket action as a guide. Gaps lower set up for compound selling in the S&P and Russell 2000, but a flat to higher gap would give bulls reason for optimism in the Nasdaq and Nasdaq 100 and a good chance for new highs.

Leave A Comment