AbbVie Inc. (ABBV) discovers, develops, manufactures, and sells pharmaceutical products worldwide. The company was created in 2013 when Abbott Laboratories split into two companies – Abbvie and Abbott. Abbvie continued raising dividends to shareholders for the five years since becoming a separate publicly traded company. The company is a dividend aristocrat., with a 45-year track record of annual dividend increases.

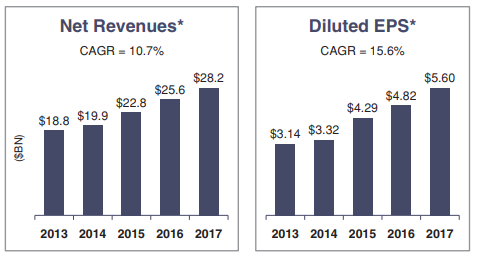

GAAP Earnings per share have been largely flat since 2013. The company does provide a reconciliation between GAAP and non-GAAP earnings, however. The non-GAAP earnings have been increasing.

However, Abbvie is expecting GAAP adjusted earnings per share of $6.47 – $6.57/share in 2018. Based on those forward earnings, the stock seems attractively valued today.

The downside with Abbvie is that the company generates 60% of its sales and a larger share of profits from a rheumatoid arthritis drug called Humira. The drug’s patent expired in 2016 in the US and is expiring in 2018 in the European Union. However, due to the drug being a bio-similar, there are over 70 patents that provide some intellectual property protection until sometime in 2022 according to Abbvie.

Humira sales have been growing rapidly, and will likely continue going strong until competitors catch up to it. Abbvie projects that Humira sales will peak at $21 billion in 2020, up from $ 18.50 billion in 2017. It is possible that sales can continue growing at a healthy clip until 2022, after which they will start decreasing as competitors nibble at Humira’s market share. If the market it serves expands, or there are new uses for the drug, it is possible that sales can actually be maintained, even if we have increased competition.

I do not like the huge reliance on a single product, because it decreases the margin of the safety factor. I also do not like the fact that this product will certainly face higher competition in the years to come. The third fact I do not like is that I do not see another blockbuster drug that will replace Humira’s sales after 2022. While there are many compounds in different stages of clinical trials, it would take several new drugs to compensate for the eventual loss of Humira’s sales.

Leave A Comment