The distressed Abercrombie & Fitch Co. (ANF – Free Report) came up with a solid quarterly performance in a long time as it reported top and bottom-line beat in second-quarter fiscal 2017. Further, the company’s results compared favorably from the prior-year period. Notably, this was the company’s first positive bottom-line surprise in the last six quarters, following in-line results in first-quarter fiscal 2017. Moreover, revenues beat estimates for the second straight quarter.

Though the company delivered a loss in the reported quarter, results clearly reflected a significant progress on its strategic initiatives and strength in Hollister as well as direct-to-customer business, amid a highly promotional retail backdrop.

Consequently, shares of this Zacks Rank #3 (Hold) company surged a solid 17.1%% yesterday. Additionally, significant progress on strategic capital investments, cost saving efforts, loyalty and marketing programs have aided Abercrombie to outperform the broader industry on a year-to-date basis. The stock declined 6.2%, against the industry’s slump of 32.7%.

Q2 Synopsis

The company posted second-quarter adjusted loss of 16 cents per share, substantially narrower than the Zacks Consensus Estimate of a loss of 34 cents. Bottom-line result also compared favorably with the loss of 25 cents per share reported in the year-ago quarter. The company notes that currency headwinds had minimal impact on bottom-line results in the quarter.

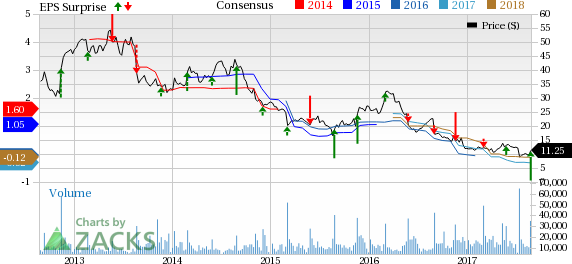

Abercrombie & Fitch Company Price, Consensus and EPS Surprise

Abercrombie & Fitch Company Price, Consensus and EPS Surprise | Abercrombie & Fitch Company Quote

Leave A Comment