ABM Industries (ABM) has an amazing track record when it comes to paying dividends to shareholders. ABM is part of the Dividend Kings, a group of stocks that have raised their payouts for at least 50 consecutive years.

Dividend Kings are the best of the best when it comes to rewarding shareholders with cash and this article will discuss ABM’s dividend, as well as its valuation and outlook.

Business Overview

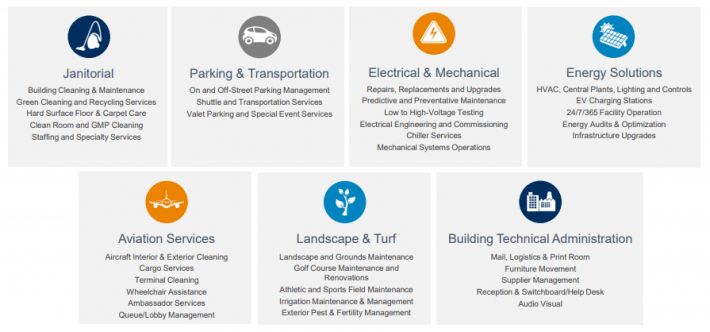

ABM was founded back in 1909 and since that time, it has grown into a powerhouse of facility solutions with more than 130,000 employees, virtually all of which are in the US. The company competes in a wide variety of activities for its clients but it is most heavily involved in janitorial work. Below we can see the major categories ABM competes in and it is diverse; basically, if there is something a landlord or tenant needs, ABM can probably do it.

Source: FQ1 Earnings presentation, page 5

ABM counts hospitals, universities, public schools, data centers, manufacturing plants, airports and others among its long and impressive client list. The company’s expertise and many decades of experience in facility management has earned it a terrific reputation and it is a true industry leader.

Source: Investor day presentation, page 22

ABM’s strategy is to compete in industries where it can win and that selection of customer bases is what you see above; ABM has learned through the decades where it can compete successfully and where it cannot and has focused its efforts accordingly.

ABM is a serial acquirer and the below image shows recent acquisitions and divestitures that have molded ABM into what it is today.

Source: Investor day presentation, page 22

In 2007 ABM’s revenue was about $3B and today, it is more than double that amount. ABM has grown some organically but the vast majority of its growth has been purchased. And given strategic direction from ABM in terms of future cash usage, we can expect more acquisitions as the years go on.

One source of potential growth going forward is international expansion as ABM entered the UK market in earnest with the GBM and Westway acquisitions in the past few years. Going forward, continue to look for lots of transactions from ABM in terms of both acquisitions and divestitures as it shifts its mix around further.

ABM’s market cap is $2.4B today it is on track to do about $6.5B in revenue this year. It is split into six segments that provide a wide array of facility solutions to its customers: Business & Industry, Education, Aviation, Technology & Manufacturing, Healthcare, and Technical Solutions. The company’s revenue streams are highly diversified and as I mentioned, janitorial services are the biggest single piece of the pie for ABM.

Leave A Comment