AT40 = 32.8% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 49.5% of stocks are trading above their respective 200DMAs

VIX = 19.5

Short-term Trading Call: cautiously bullish (downgrade from bullish – see below for more details)

Commentary

The trading contours in the aftermath of an oversold episode can move quickly. Another important juncture arrived on Friday in the form of a potentially bearish pattern.

The bulls were fully in control again on Friday as the S&P 500 (SPY) looked like it was going to print an important confirmation of a breakout above its 50-day moving average (DMA). However, once headlines blazed with news about indictments of 13 Russian nationals over meddling in U.S. elections, the party came to an abrupt halt. The result was a fade sharp enough off the highs to create bearish signals across many stocks and even indices: the dreaded evening star. An evening star is a sign of potential reversal at the end of an uptrend that has exhausted buyers.

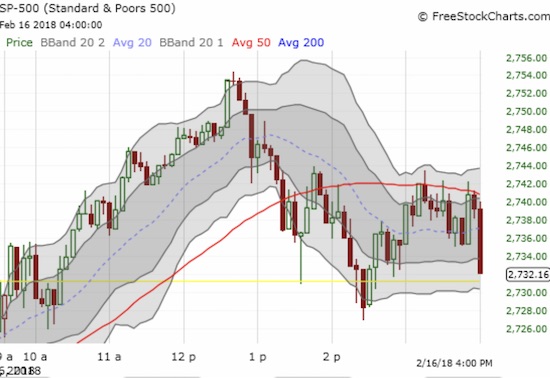

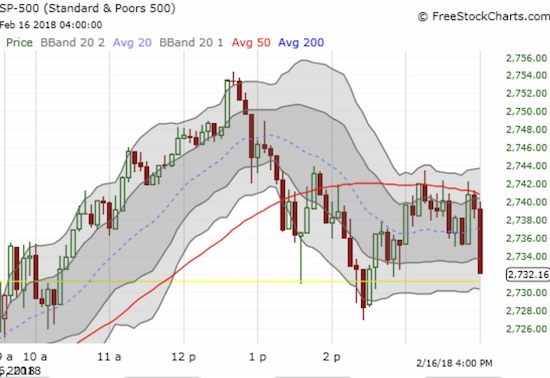

This 5-minute chart of the S&P 500 (SPY) shows how strong the buyers were until the lunch hour. Sellers took over from there and for good measure sold hard into the last 5 minutes.

The fade from the high of the day stopped just short of the 50DMA for the S&P 500 (SPY)

The fade pushed the Nasdaq into a marginally negative close on the day right at its 20DMA.

The fade pushed the PowerShares QQQ ETF (QQQ) into a 0.5% loss on the day just above its 20DMA.

The bearish evening star pattern needs confirmation with a down day. A close above the intraday high invalidates the pattern. Given the precarious state of the oversold bounce, I decided to downgrade my short-term trading call to “cautiously bullish.” I will be even more aggressive on the bullish side if/when the bearish pattern gets invalidated. As a reminder, I switch to bearish if/when the S&P 500 breaks and closes below 2649. If AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, drops into oversold conditions at the same time, I will have to keep the trading call at cautiously bullish but be prepared for a much more extended churn through the oversold period.

Leave A Comment