AT40 = 47.0% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 54.4% of stocks are trading above their respective 200DMAs

VIX = 10.4 (volatility index)

Short-term Trading Call: cautiously bullish

Commentary

At the time of typing, financial markets are carefully stepping into “Trifecta Thursday” – or maybe not so carefully if measured by the volatility index. The VIX remained amazingly calm ahead of what has been heralded as a key meeting on monetary policy form the European Central Bank (ECB), testimony from former FBI Director James Comey on Russian election meddling and President Trump’s potential connections to it, and a national election in the United Kingdom that is serving as yet another referendum on Brexit.

What worries? The volatility index, the VIX, is comfortably stuck near 14-year lows.

Contrary to the market’s remarkable calm, I decided to buy a handful of call options on ProShares Ultra VIX Short-Term Futures (UVXY) expiring next week. I did not bother hedging with put options since my stock positioning is heavily skewed to the long side. If volatility does manage to wake up, I plan to close out the UVXY call options quickly given my assumption the current period of extremely low volatility likely presages an overall calm summer.

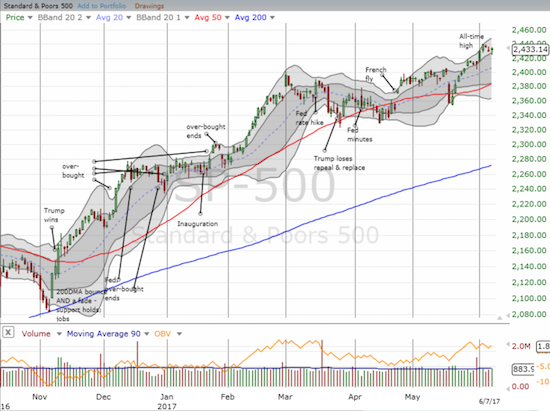

The calm is of course reflected in an S&P 500 (SPY) that is just off another set of all-time highs. Although this week started with an immediate reversal of the gains following last Friday’s U.S. jobs report, the index neatly bounced off the bottom of the upper Bollinger Band (BB) channel that defines the latest short-term uptrend.

Despite small setbacks to start the week, the S&P 500 is still in the middle of a robust bounceback from the one-day sell-off that broke 50DMA support three weeks ago.

While AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), brought fresh credibility to the rally with the gains following last Friday’s U.S. jobs report, my favorite technical indicator returned quickly to its over-arching theme of wavering. AT40 closed last week at 55.3% and has lost ground for three straight trading days. It closed Wednesday at 47.0%. The downtrending energy sector is likely a culprit once again. Fresh weakness also appeared in retail stocks with Macy’s (M) taking a shellacking on Tuesday after reporting guidance tainted by weaker margins. The storied retailer is approaching a 7-year closing low. Over the last two years, Macy’s has lost a whopping 68%. Macy’s helped drag the SPDR S&P Retail ETF (XRT) right back to its low of the year and a near 52-week low.

Leave A Comment