AT40 = 46.9% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 62.0% of stocks are trading above their respective 200DMAs

VIX = 12.9 (volatility index)

Short-term Trading Call: cautiously bullish (notable caveats explained below)

Commentary

The timetable for a May end to this period of extremely low volatility looks like it is right on schedule.

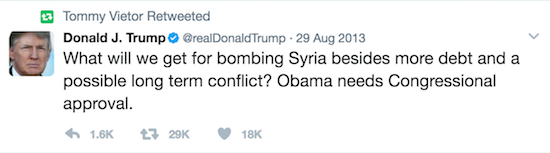

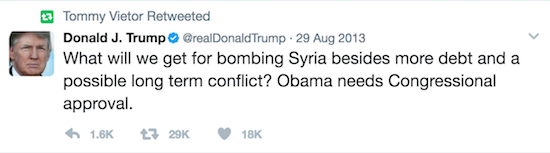

Times and circumstances can change in an instant…

Source: Twitter

This historical Trump tweet is a handy reminder that times and circumstances can change in an instant. Bombing Syria does not make sense until it does. Similarly for the stock market, geo-political dangers and economic risks do not matter until they do. I daresay last week’s events brought us incrementally closer to a moment when the market will suddenly care. For now, the sellers STILL lack the firepower and follow-through even as buyers and bulls fail to to reignite lost momentum.

The S&P 500 (SPY) rallied right to its downtrend before the Fed minutes brought the index right back down toward a subtle test of 50DMA support.

The most salient feature of this chart of the S&P 500 (SPY) is the triangle or wedge pattern developing between the uptrending 50DMA and the downtrend from the all-time high. I redrew the line from previous posts to more closely match the closes instead of the highs of the day. This change brings Wednesday’s trading around the release of the Fed minutes into high relief. This change also demonstrates that the market’s response to the U.S. bombing of Syria barely registered a blip. The downtrend in the 20DMA now runs almost exactly parallel to the downtrend from the all-time high. As long as the index closes above its 50DMA, my bullish call, albeit cautious, stays golden. The bullish call gets confirmation with a breakout above the downtrend.

My trading plan for a close below 50DMA support is a bit more involved. My previous plan was to stay cautiously bullish and look for a true oversold reading to trigger an aggressive bullish positioning. After sellers folded on March 27th, I noted how AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, had achieved “oversold enough” status. The bounce from “oversold enough” is still active given AT40 has not yet hit overbought status. So, if the S&P 500 takes a tumble from here, AT40 will likely very quickly fall back to the low 30s. I will be very hesitant to flip bearish at that point. As a compromise deference to the current short-term downtrend and increased market risks, I plan to switch to a neutral status if 50DMA support gives way for the S&P 500. Such a trading call will mean that I will abstain from making additional bullish trades until an oversold reading. I will also be extremely selective in making bearish trades – like reaching for put options on Caterpillar (CAT).

AT40 and volatility

Speaking of AT40, my favorite technical indicator twisted wildly in the wind last week. AT40 closed the month of March at 49.8%, got as low as 39.7% after the Fed minutes, rallied vigorously on Thursday in a move that was almost another bullish divergence (the S&P 500 barely managed to close flat on that day), and then closed the week at 46.9%. Most importantly, AT40 failed to hold the previous high from mid-March. So while sellers lack follow-through firepower, buyers are acting like they may be getting a bit exhausted.

The wild swings in AT40 translated into upward pressure (albeit subtle) on the volatility index, the VIX. Volatility ended March at 12.4. On Monday, the VIX briefly broke through its so far tough-to-crack 200DMA. The VIX has failed to close above this trendline since the election. Yet, the pressure is building and hinting to anyone watching of an incrementally more dangerous market. Ahead of the Fed minutes on Wednesday, the market got quite comfortable with volatility tumbling on Tuesday to 11.8 and then as low as 10.9 right before the minutes. That move MAY have been the final flush of complacency as volatility closed the week at 12.9. If my read is correct, this period of extremely low volatility will come to an end on schedule.

Leave A Comment