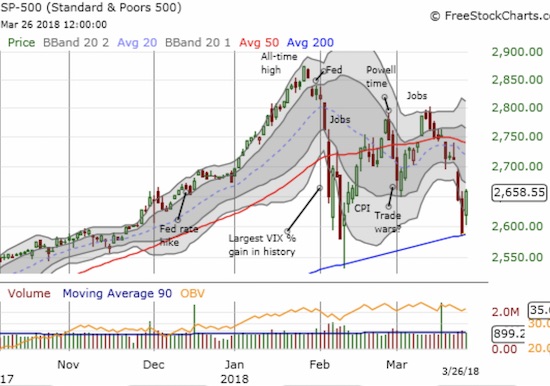

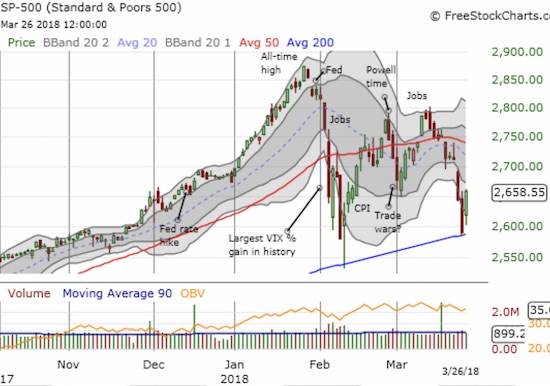

AT40 = 35.9% of stocks are trading above their respective 40-day moving averages (DMAs) (jumped from 25.6%)

AT200 = 43.0% of stocks are trading above their respective 200DMAs (up from 2-year closing low at 37.5%)

VIX = 21.0

Short-term Trading Call: neutral

Commentary

This is truly a market that is from another planet.

In a market that is from another planet, I went through the good, the bad, and the ugly of the stock market. I was biased toward buying into the looming oversold conditions and particularly targeted the S&P 500 (SPY) which was stretched well below its lower-Bollinger Band (BB). I bolstered my confidence with some key hedges. While I was optimistically looking forward to the index popping back up like a buoy pushed underwater, nowhere in my scenario planning did I even think about a day like this one!

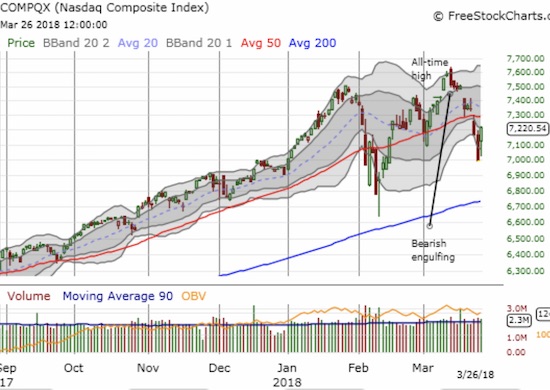

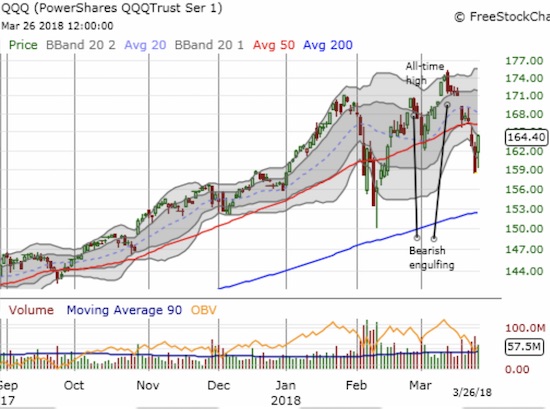

The S&P 500 (SPY) soared 2.7%. The Financial Select Sector SPDR ETF (XLF) gained 3.2%. The NASDAQ gained 3.3%. The PowerShares QQQ ETF (QQQ) popped 3.7%. The iShares Russell 2000 ETF (IWM) under-performed the crew with a 2.2% gain. Even the waning iShares US Home Construction ETF (ITB) popped 2.4%.

The S&P 500 (SPY) gapped up to confirm another picture-perfect test of support at its 200DMA.

It was a very wild day for the NASDAQ. It almost gapped up enough to wipe out all of Friday’s loss. Next sellers took the NASDAQ close to Friday’s low. Finally, buyers won the day by closing the tech-laden index out with a 3.3% gain.

Like the NASDAQ, the PowerShares QQQ ETF (QQQ) had a wild day. It’s 3.7% gain almost matched *Thursday’s* open!

The 5-minute intraday chart on the S&P 500 is very instructive. The strong open only lasted 10 minutes before sellers stepped in. No doubt, this crowd was relieved to get the prices it felt it missed on Thursday and Friday. Sellers dominated the action for about 90 minutes. At that point buyers finally mounted a successful counter which took price above the previous down candle. Once the intraday downtrend broke, the buyers were off to the races.

Leave A Comment