AT40 = 47.2% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 60.1% of stocks are trading above their respective 200DMAs

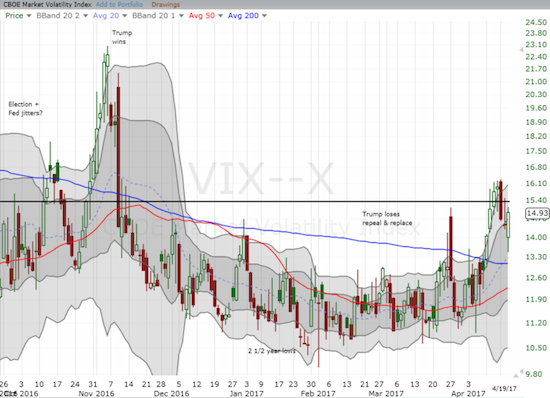

VIX = 14.9 (volatility index)

Short-term Trading Call: cautiously bullish)

Commentary

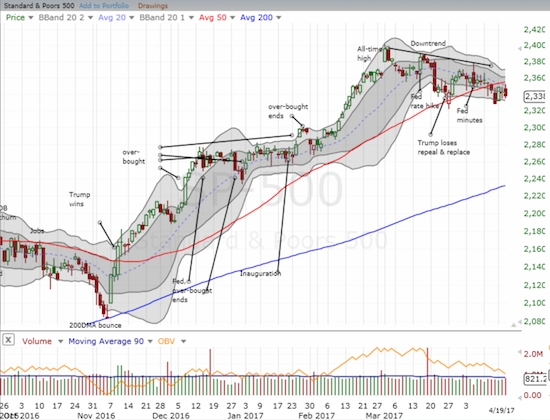

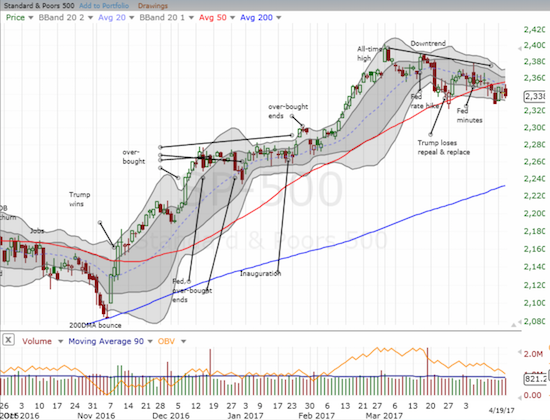

The S&P 500 (SPY) ended last week on a sour note. The index hit its first 42 trading day low since the days going into last year’s U.S. Presidential election and confirmed a breakdown below support at its 50-day moving average (DMA) – something the market had not experienced since last September and October. The setup appeared perfect for sellers to finally make a serious point, but, as usual these days, they failed to deliver. While the S&P 500 continues to trade below its 50DMA, each day this week has featured a higher intraday low.

Yet, the sellers have clearly not given up as easily as prior market setbacks. Yesterday, the downtrending 20DMA held as resistance at the intraday high. The 50DMA is holding as resistance.

The S&P 500 is in a position of stasis, a stalemate.

Perhaps most importantly, the volatility index, the VIX, made a sharp and rapid comeback and closed just under the 15.35 pivot.

The S&P 500 hangs in stasis waiting for the catalyst that further confirms the short-term downtrend or freshly frustrates the sellers.

The volatility index, the VIX, made a rare comeback trading as low as 13.5 before closing with a gain of 3.5%.

AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, is adding to the sense of stasis. My favorite technical indicator closed the day at 47.2%. Since March 6th, AT40 has bounced widely between 31% and 55%. Now that earnings season is in full swing, I have no reason to expect a change in this churning behavior – the kind of change required to nudge the S&P 500 to a breakout or breakdown.

Stock market stasis does not cap the drama for individual stocks of course.

Netflix (NFLX) reported earnings on Monday evening and sellers went to work from the open the next day. Buyers were able to bounce the stock back to its 50DMA, but sellers refreshed the downward push with a 2.5% loss. I interpreted these two days of selling and the 50DMA breakdown as bearish enough to warrant a small short position. The easy stop loss is a close above the 50DMA. I have no immediate downward price target just yet.

Leave A Comment