I was right to be bearish last week…until the very last day when all at once the market reversed almost all its accumulated worries.

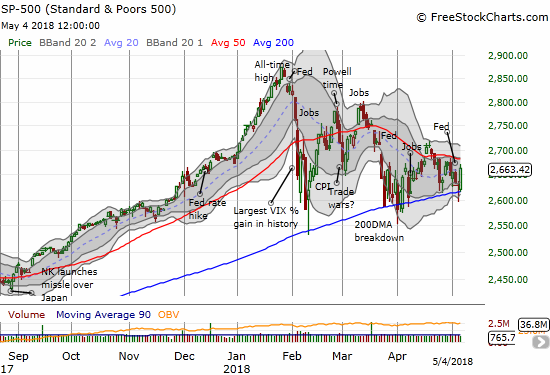

The S&P 500 (SPY) bounced back from yet another test of still uptrending 200DMA support. Friday’s 1.3% gain put it within yet another encounter with downtrending resistance from its 50DMA.

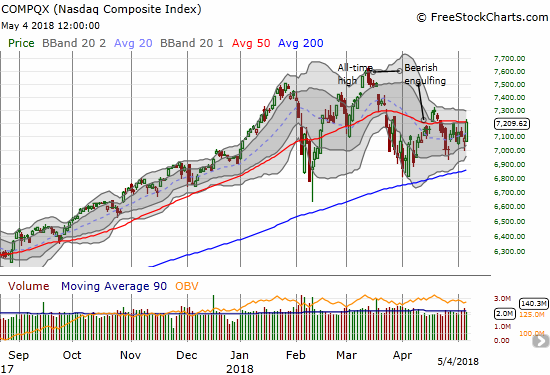

The 1.7% gain in the NASDAQ was enough to nick 50DMA resistance.

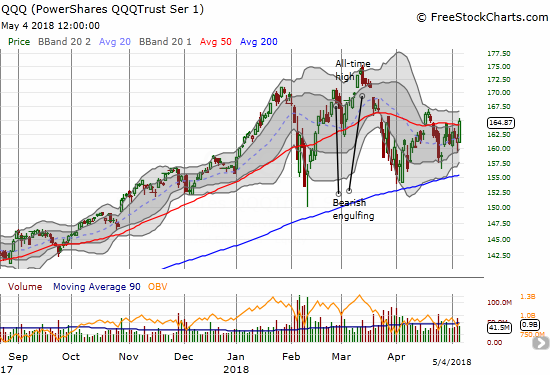

The 1.9% gain for the PowerShares QQQ ETF (QQQ) was enough to break through 50DMA resistance.

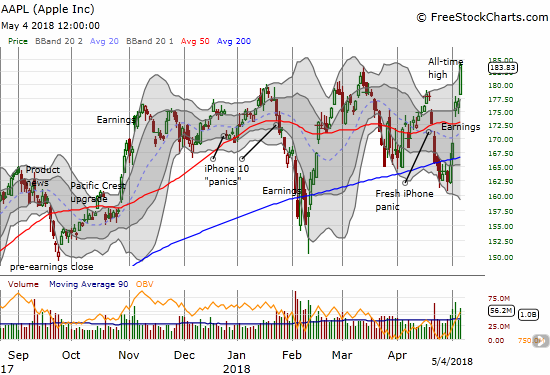

As usual, there are a host of catalysts to cherry pick to explain what happened: a) a benign jobs report showing strong growth but wage growth “weaker than expected,” b) China approved a joint-venture between Qualcomm (QCOM) and China’s state-owned Datang Telecom Technology Co. in a hopeful sign of thawing trade tensions between the U.S. and China, and/or c) news that Warren Buffett added another 75 millions shares to his investment in Apple (AAPL) bringing his share of Apple’s stocks to a notable 5%. I could be missing some catalysts (and conveniently ignoring something the market also ignored on the day), but I will focus in on AAPL since in my last Above the 40 postI noted how AAPL’s repeated pre-earnings failure to break through 200DMA resistance was a sentiment killer. I even, gasp, flipped puts several times and used this behavior as part of my argument to remain cautiously bearish on the market.

The story with AAPL is simple now. The stock made a new all-time high. It completely reversed the last iPhone panic. It is one of the few big cap tech stocks which sustained a positive post-earnings response. It has major backing from a major investor of influence. The company is pumping a literal tidal wave of cash into the hands of shareholders through another $100B in its buyback and another dividend hike. These are not the tailwinds to fight! They are the tailwinds to ride.

Apple ended an incredible week with a 3.9% gain on Friday alone. The week that finally produced a new all-time high also delivered a whopping 13.3% gain.

At this point, pretty much only fresh news of China vs. U.S. trade tensions could stand in AAPL’s way in the coming weeks and months. Yet, while AAPL’s stellar performance tempts me, I am not yet ready to declare the all-clear for the stock market.

I have a few stubborn reasons left for staying cautiously bearish the market in general. The S&P 500 remains firmly stuck in a triangle pattern. I need to see the index close above the peak from the last 50DMA breakout AND show follow through buying. My favorite technical indicator, AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, was very weak until Friday. Even with the S&P 500 making another amazing 200DMA comeback on Thursday, AT40 closed at a 3 week low. At 53.5%, AT40 has more upside, but it is still in “show me” mode after a bearish rejection from the 70% overbought threshold on April 19th. Finally, the S&P 500 has now responded poorly to the last three meetings from the Federal Reserve. In other words, I think it is very possible AAPL powers higher without dragging much of the general market with it as investors and traders seeking “safety” in equities bias their money toward AAPL and away from a lot of other options.

The volatility index, the VIX, is at a critical juncture. It jumped around the 15.35 pivot all week only to close at 14.8. If downward momentum continues, I will have to assume bullish sentiment is similarly growing. I was fortunate during the week to sell my last tranche of call options in ProShares Ultra VIX Short-Term Futures (UVXY) for a small profit and then quickly flip through a short position in iPath S&P 500 VIX ST Futures ETN (VXX). I bought a new tranche of UVXY calls near Friday’s close.

Leave A Comment