This firm moved to bolster its position within its market by acquiring a competitor in 2016, but it paid too high a price. In addition, the expected synergies from the deal have not come to fruition and the profitability of the combined firm has fallen instead of rising. Despite the struggles, the expectations baked into the stock price remain overly optimistic and leave shares significantly overvalued. For these reasons and more, Diebold Nixdorf Inc. (DBD: $18/share) is in the Danger Zone.

DBD Struggled to Grow Profits Before the Acquisition

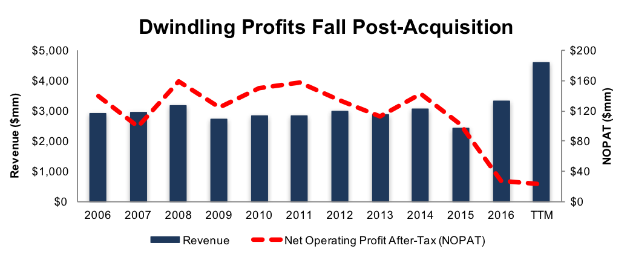

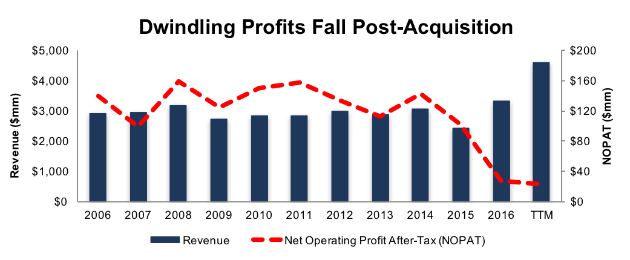

During the 10-year period prior to the acquisition (2005-2015), DBD’s revenues and after-tax profit (NOPAT) declined 1% compounded annually. The company’s NOPAT margin fell from 6% in 2011 to 4% in 2015 while its ROIC fell from 11% in 2011 to 6% in 2015. DBD’s balance sheet efficiency, or invested capital turns, fell from 1.9 in 2011 to 1.5 in 2015.

Post-Acquisition Results Have Been Even Worse

Management indulged in the common imprudent capital allocation mistake to purchase artificial growth in revenue and earnings by acquiring German competitor Wincor Nixdorf for $1.8 billion. The combined company created the largest maker of automated teller machines (ATM) and surpassed competitor NCR Inc. (NCR) in terms of installed ATMs (though revenues are still much lower $4.6 billion vs $6.5 billion for NCR). Based on the purchase price, and DBD’s 5.1% WACC at the time, the deal would need to generate $92 million in additional NOPAT just to ensure the purchase price was value-neutral, and not destructive to shareholders. Unfortunately, the required NOPAT failed to materialize. While DBD bought significant increases in revenue, the bottom line profits actually dropped as integration costs outpaced any synergies by a wide margin.

Per Figure 1, DBD’s NOPAT fell 73% in 2016 to $28 million, and further, to $23 million over the last twelve months. The company’s NOPAT margin fell to 0.8% in 2016 and 0.5% TTM while average invested capital turns fell to 1.2 TTM (down from 1.5 pre-acquisition). As a result, ROIC fell to 1% in 2016 and 0.6% TTM.

Meanwhile, the company’s revenue soared 37% in 2016 to $3.3 billion and $4.6 billion TTM.

Figure 1: DBD’s Profit Collapse After Acquiring Wincor Nixdorf

Sources: New Constructs, LLC and company filings

Compensation Plan Failed to Stop Damaging Acquisition

Diebold’s executive compensation plan fails to properly align executives’ interests with shareholders’ interests. The misalignment helps drive poor decisions that destroy shareholder value while executives are eligible for large bonuses. Executives’ annual cash bonuses are tied to non-GAAP operating profit, free cash flow, and “key initiatives.” Performance based shares, which make up 50% of long-term equity incentives are tied to cumulative three-year total shareholder return.

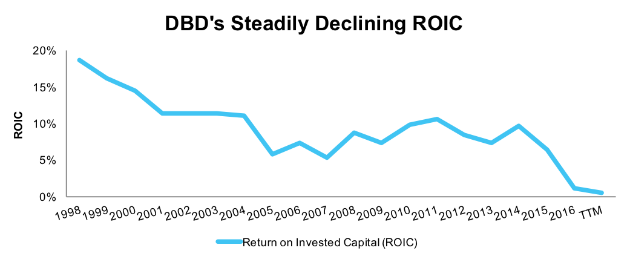

Unfortunately for investors, non-GAAP operating profit excludes key operating expenses such as legal/acquisition expenses, acquisition integration charges, and Wincor Nixdorf purchase accounting adjustments. Essentially, executives receive bonuses on a metric that removes much of the cost of acquiring Wincor Nixdorf, while shareholder value is destroyed. Not surprisingly, DBD’s economic earnings fell from $0 million in 2015 to -$95 million in 2016, and -$187 million TTM. Such poor allocation of capital is not new, either. Per Figure 2, DBD’s ROIC has been in long-term decline. What else should we expect from a firm that allows executives to get big payouts while shareholder value is destroyed?

Figure 2: DBD’s ROIC Since 1998

Sources: New Constructs, LLC and company filings

We’ve demonstrated through numerous case studies that ROIC, not total shareholder return, non-GAAP operating profit, key initiatives, or free cash flow, is the primary driver of shareholder value creation. A recent white paper published by Ernst & Young also validates the importance of ROIC (see here: Getting ROIC Right) and the superiority of our data analytics. Without major changes to this compensation plan (e.g. emphasizing ROIC), investors should expect further value destruction.

Non-GAAP Metrics Show Misleading Profit Growth

Diebold is among a long list of firms that use non-GAAP metrics, such as EBITDA and non-GAAP operating income, to mask the severity of declining profits. Our research digs deeper so our clients see through the illusory numbers. Below are some of the items Diebold removes to calculate its non-GAAP net income:

These adjustments have a large impact on the disparity between DBD’s reported GAAP operating profit, non-GAAP operating profit, and economic earnings. In fact, DBD’s non-GAAP metrics have shown operating profit improving while the true economics of the business are in decline. In 2016, DBD removed over $59 million in restructuring charges, $118 million in acquisition expenses, and $128 million in purchase accounting adjustments (combined 9% of revenue). Combined with other adjustments, DBD reported non-GAAP operating profit of $159 million, compared to -$160 million in GAAP operating profit and -$95 million in economic earnings. In the TTM period, DBD reported $233 million in non-GAAP operating profit, -$164 million in GAAP operating profit, and -$187 million in economic earnings, per Figure 3.

Leave A Comment