We all hear about the massive move away from active to passive in the US market. We also hear arguments that passive may eat the world and that active management is a zero sum game (seems like a reasonable hypothesis, but I’m not so sure).

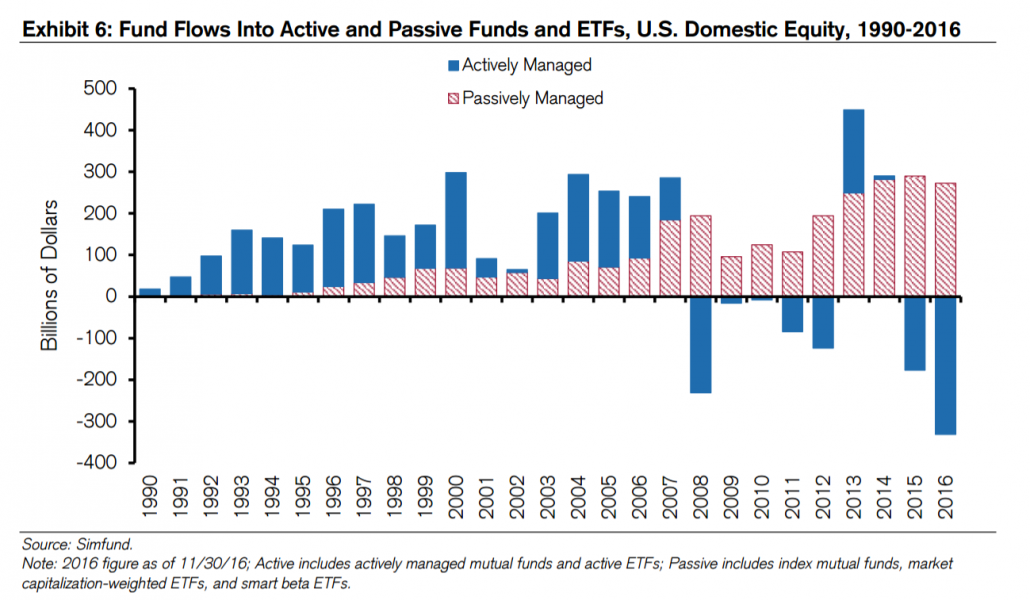

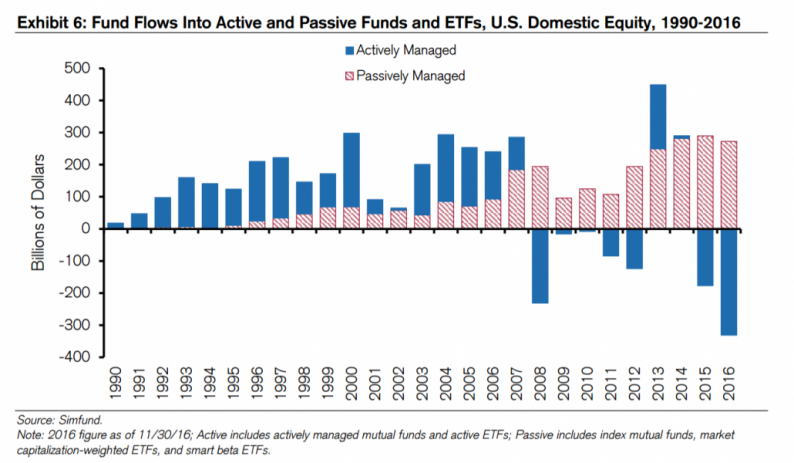

Here is a figure from a recent CS report that highlights the US activity and the clear move away from active and into passive:

Source: CS, “Looking for Easy Games”

All of this chatter seems viable from a US-based perspective.

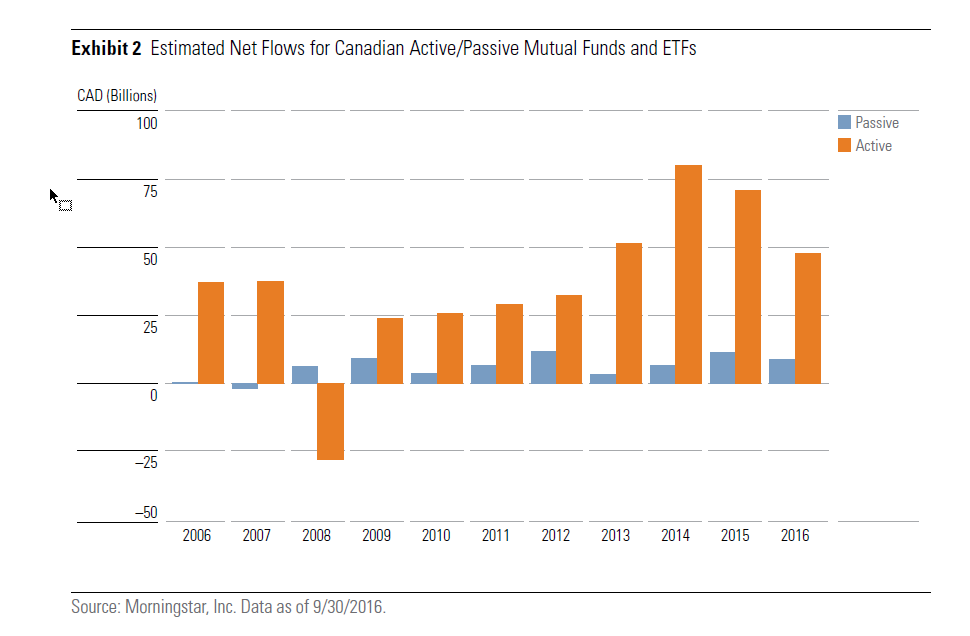

Interestingly enough, you don’t have to look that far to see a completely different narrative playing out. When we look North to Canada and we see an entirely different game playing out:

Source: Morningstar. Thanks to Ben Johnson for highlighting this research report and thanks to Art Johnson for bringing this to our attention!

The Canadian market highlights a completely different story — a move towards more active and a move away from the tiny amount of passive already in place.

Wild!

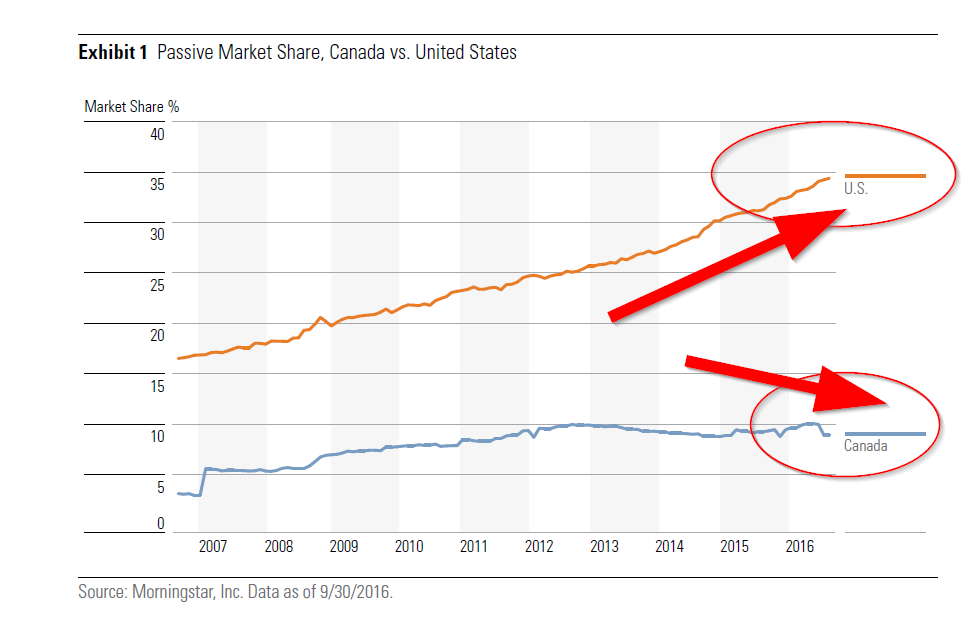

Here is a comparison chart of the move to passive between the US and Canadian markets:

Source: Morningstar

What is going on?

The real answer is “who knows,” but the Morningstar Canadian crew has an answer:

Big banks, incentives, and backward self-regulation are to blame.

Incentives certainly play a role. Perhaps recent past performance also plays role? Maybe even culture?

My takeaway is that the narrative claiming that passive is going to destroy and/or eat the financial world is too simplistic. There are a lot of mechanisms at work in the financial marketplace and their interaction effects are extremely hard to predict. I don’t have the answers and I can’t predict the future, but it will sure be fun to see how it all plays out!

Leave A Comment