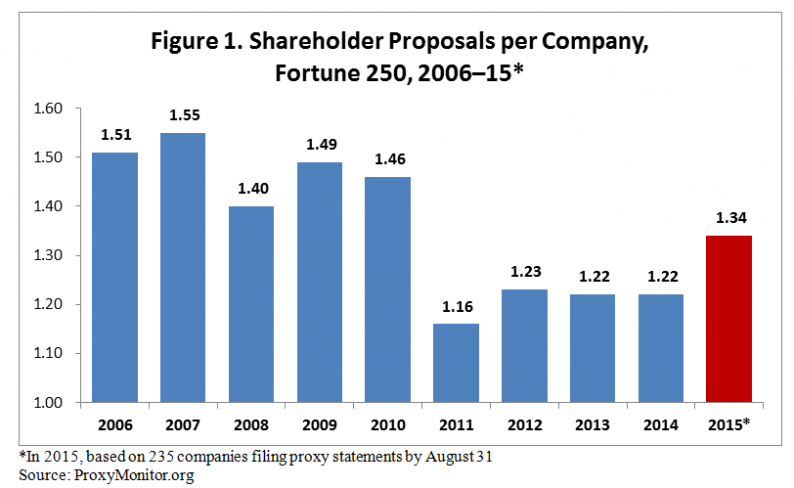

Activism has become a hot topic on Wall Street, with every major study showing that it’s on the rise. So far this trend is continuing this year, as measured by the number of shareholder proposals that made it to big companies’ proxy ballots. There’s also another trend right now, which is that shareholders are becoming more successful in getting their proposals passed.

Shareholder activism on the rise

The Manhattan Institute has just published the latest edition of its Proxy Monitor report. They’ve found that so far, the average big company has faced 1.34 proposals from shareholders so far this year, compared to 1.22 last year. That’s the highest level the Proxy Monitor has measured in the last five years.

Why more proposals are getting on corporate ballots

The firm reports that the main driver of this increase is proxy access demands from New York City pension funds. If passed, those demands would enable large, long-term shareholders to nominate their own candidates for the board of directors ballot.

The Proxy Monitor also reports that the Securities and Exchange Commission has become more lenient with shareholder proposals, allowing more of them to get on the ballot. The reason for this is because the SEC adopted a wider stance in terms of assessing whether shareholder proposals are appropriate to include on companies’ ballots.

Regulators letting more proposals pass

In January, the SEC stopped enforcing the conflicting proposals rule, which has resulted in some activism campaigns which managed to get shareholder proposals that conflicted with management proposals on the same ballot.

According to the Proxy Monitor, so far this year, the agency has issued 82 letters telling companies that it wouldn’t move against them if they chose to exclude a shareholder proposal from their ballot. That’s a decline from 116 last year. Also this year, the SEC refused to send no-action letters on 68 petitions. That’s an increase from 50 last year.

Leave A Comment