By Bajikar Tech Investor

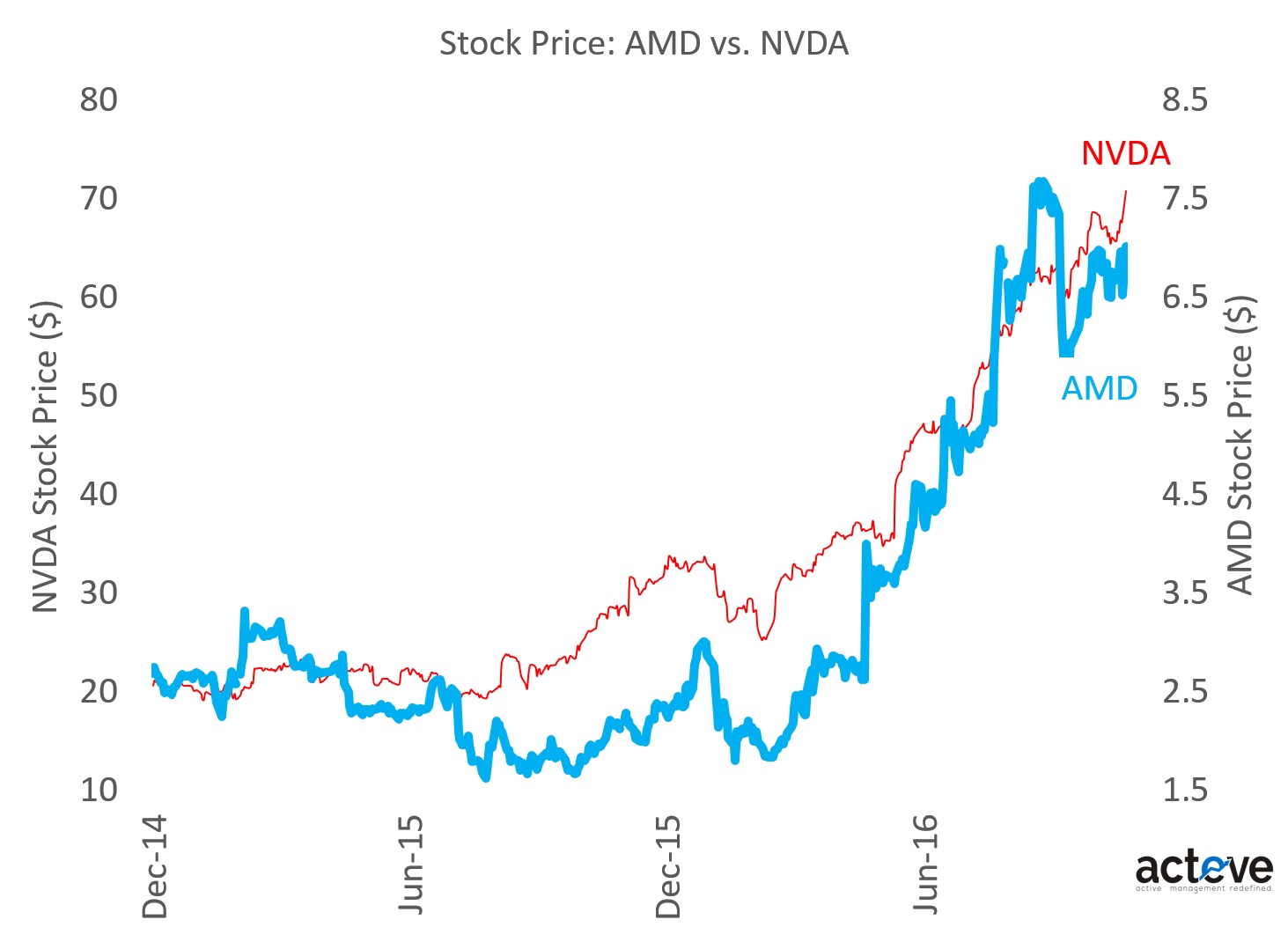

Both Advanced Micro Devices, Inc. (AMD) and NVIDIA Corporation (NVDA) offer exposure to GPU Compute, arguably a very desirable capability with growing applications in artificial intelligence, AR/VR and self-driving cars. Both AMD and NVDA stocks have approximately tripled over the last couple of years, so it’s probably safe to assume that the average investor in either of these stocks directly or indirectly understands the benefits and value of GPU Compute. The question is how much are investors paying for each of these stocks, and on what basis?

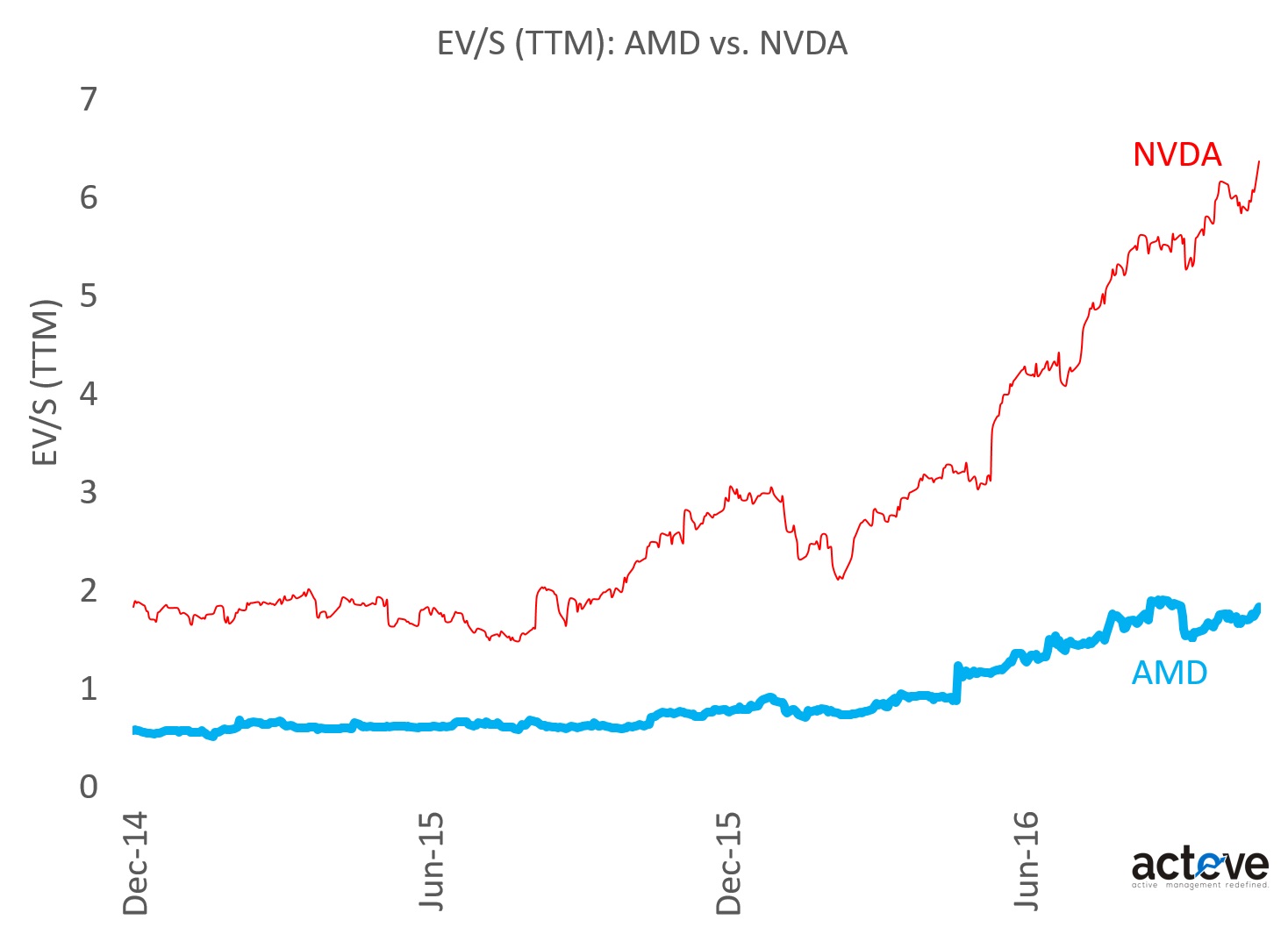

Since AMD is just getting back to having non-negative earnings, comparing P/Es is unlikely to give us a reasonable clue. The chart below compares EV/S (TTM) for the two stocks, and the difference is worth exploring. NVDA is trading at (EV of) 6x TTM sales, while AMD is trading at nearly 2x. Semiconductor peers on average trade at ~3x.

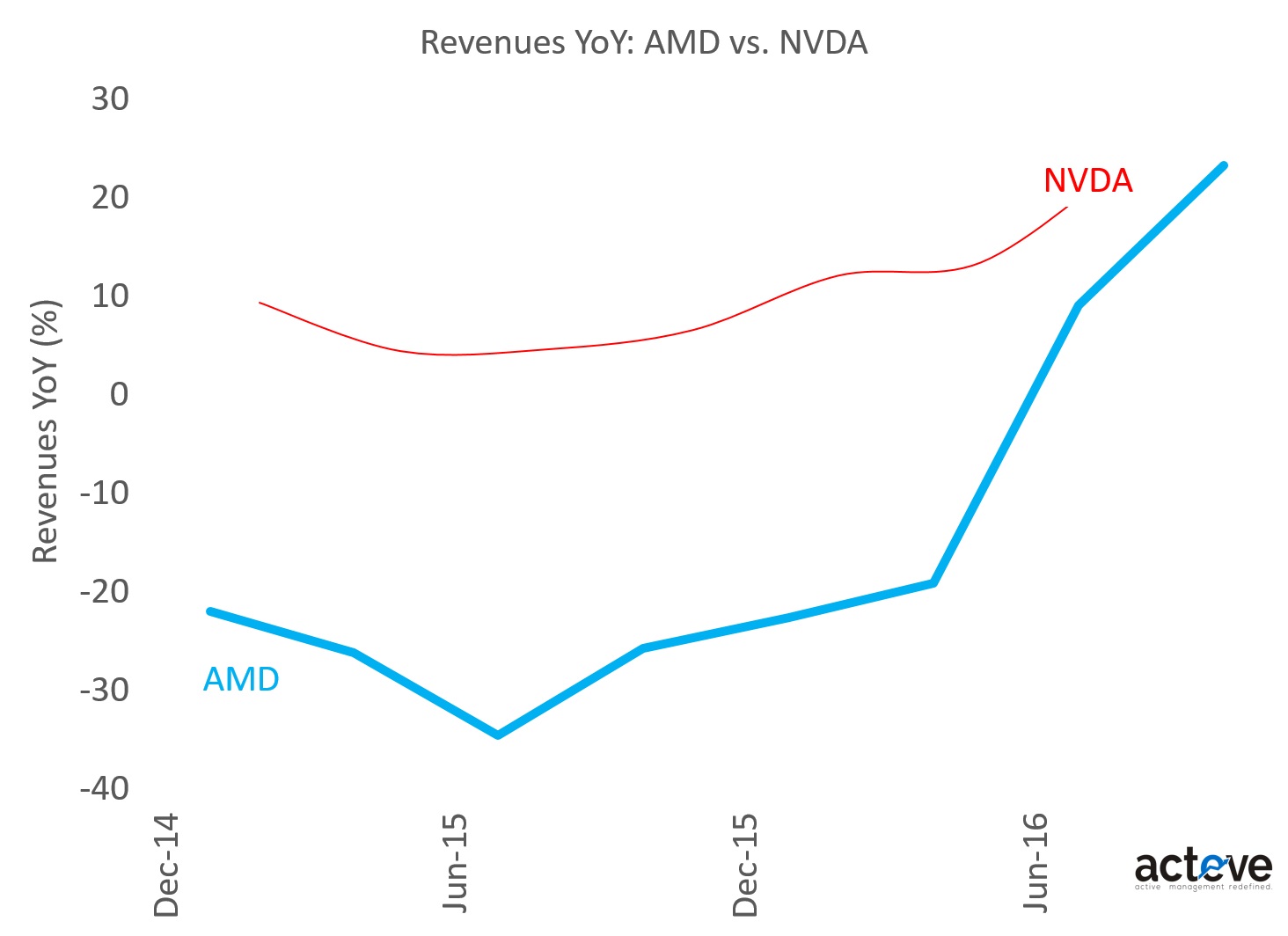

The chart below compares AMD and NVDA on YoY revenue growth. While both are currently sporting solid double digit growth numbers, they arrived here from vastly different places 2 years ago, with AMD having achieved the bigger improvement. YoY revenue does not explain why NVDA is trading at a 3x premium relative to AMD.

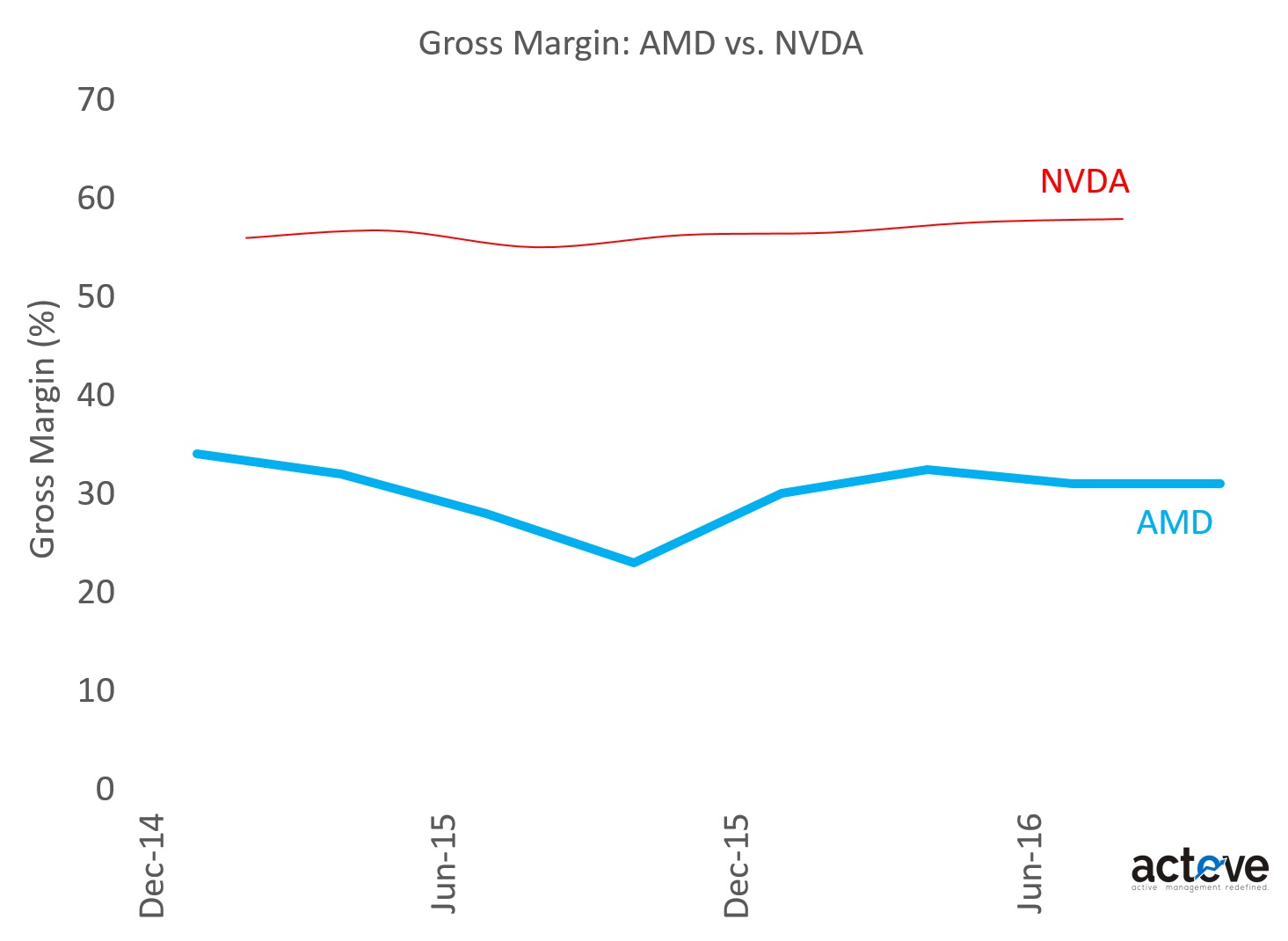

The next chart compares AMD and NVDA gross margins. NVDA’s gross margins are approaching 60%, with some improvement over the last couple of years. AMD on the other hand sports gross margins of little over 30%, without a major improvement over the same period.

These charts suggest that if AMD is able to match or exceed NVDA’s YoY revenue growth, and raise gross margins, it could see an improvement in its valuation multiple. Here are a few items the sellside has contemplated as potential drivers of higher gross margins for AMD:

1. share gains of higher-ASP desktop discrete GPU (from NVDA)

2. share gains of Cloud/Server CPU (from Intel) and GPU (from NVDA)

3. additional IP licensing deals

Beyond gross margin improvements, investors could also decide to reward AMD with a higher valuation multiple based on other catalysts such as:

1. progress in AR/VR and self-driving car (AMD is notably missing in action in the latter at the moment while NVDA enjoys the spotlight)

2. custom silicon deals in China

3. consistent improvement in execution

Leave A Comment