After a decent rally in equities last week, this week has on the docket several potentially market-moving events – from FOMC meeting to mid-term elections to China trade. Longs can think of selling some covered calls.

Last week, two separate US data points showed a slight pickup in employee wages. Wage growth has been a consistent disappointment throughout this recovery/expansion, which is into its 10th year now.

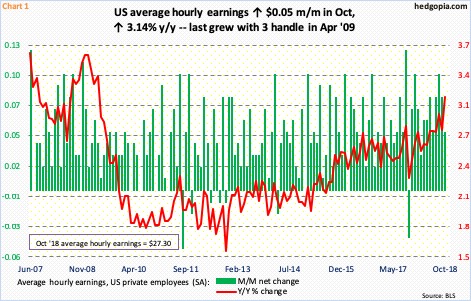

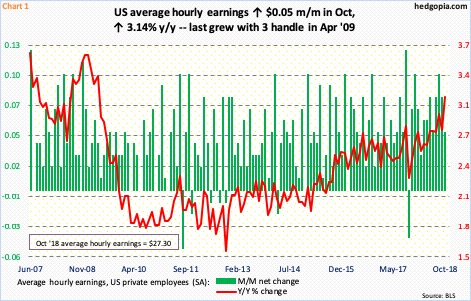

Average hourly earnings of private employees in October rose 3.1 percent year-over-year to $27.30. This was the first time since April 2009 that this metric grew with a three handle. In the big scheme of things, wages are still suppressed, particularly considering how mature the expansion is and considering inflation is at/near the Fed’s two-percent goal.

In the 12 months to September, core PCE (personal consumption expenditures) – the Fed’s favorite measure of consumer inflation – rose 1.97 percent, with growth of 2.03 percent in July, which was the first reading with a two handle since April 2012. Core CPI (consumer price index) has risen with a two handle since March this year.

That said, the y/y trend has been up since bottoming in October 2012 (Chart 1).

That is also the case with the employment cost index. Total compensation – comprised of wages and salaries plus benefits – for private-industry workers bottomed at increase of 1.2 percent y/y in 4Q09. In 3Q18, it grew 2.9 percent. This was the fastest pace since 2Q08 (Chart 2).

This in all likelihood gives FOMC hawks more reason to maintain their bias. After three 25-basis-point hikes this year, markets expect one more in December (18-19), with 79-percent odds in the futures market. Since December 2015, the fed funds rate has gone up by 200 basis points to a range of 200 to 225 basis points. Next year, the dot plot expects three more 25-basis-point increases. Markets are not as hawkish. So whenever data like last Friday’s come out, indigestion follows. Apart from the pickup in wages, non-farm payroll went up 250,000 in October. In the first 10 months this year, the economy created a monthly average of 213,000 non-farm jobs. In 2017, the monthly average was 182,000, versus 195,000 in 2016, 226,000 in 2015 and 250,000 in 2014.

Leave A Comment