The data dates back to 2004, when the Dallas Fed data was introduced. Today, with the release of the Richmond Fed’s manufacturing data, we now have all five March releases. There are some interesting trends. For instance, the current composite (a simple average of all categories except for prices, workweek, and capex) declined on the month, driven by lower employment, shipments, and new orders in February. The outlook composite (asking manufacturers what they think is in store 6 months ahead) declined due to lower inventory, new orders, shipments, and unfilled orders.

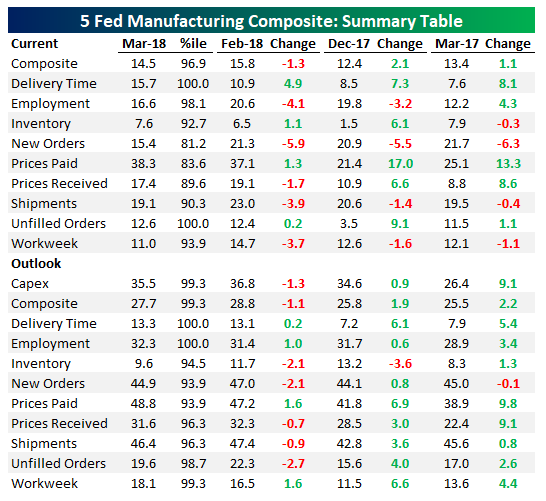

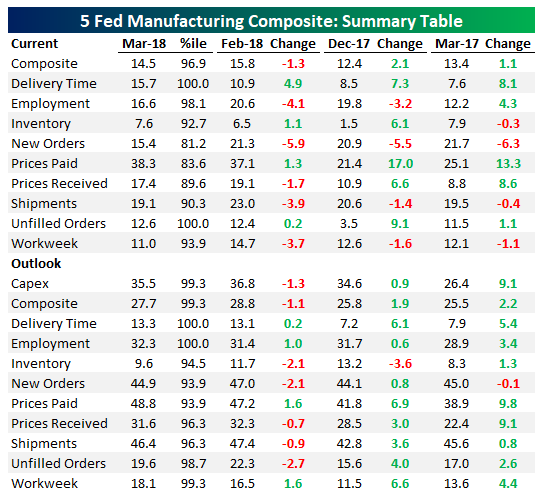

Prices paid continue to accelerate, while prices received have started to decline on both a current and forward basis. Capex expectations also may have peaked. We summarize the readings in the table below, showing from left to right the current reading, its percentile versus the historical range, the reading from last month, sequential change, the reading from 3 months ago, 3m change, the reading from a year ago, and YoY change. All components are seasonally-adjusted, with readings above 0 indicating expansion and readings below 0 indicating contraction.

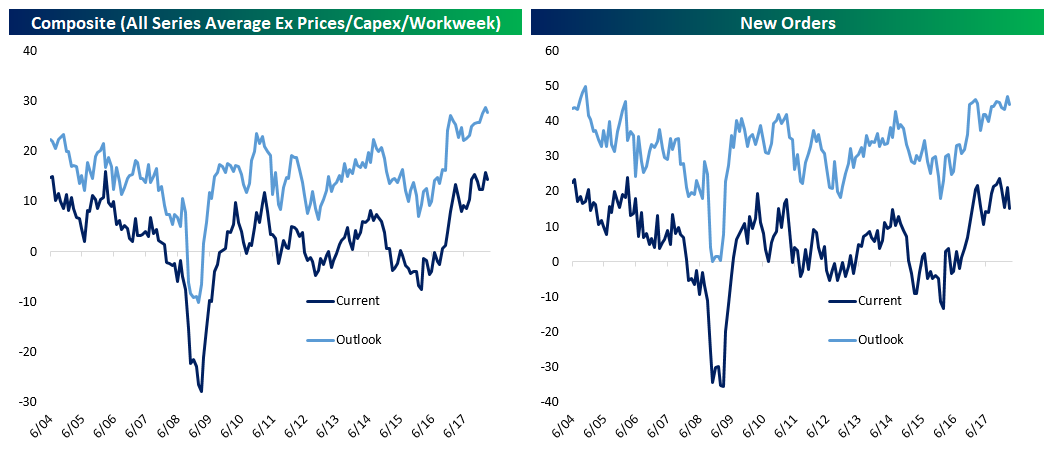

We can also chart the data to show its evolution over time. As shown in the first chart at left below, our composite is just off record levels established last month on an outlook basis and near-record levels on a current basis. The New Orders readings look much less impressive. While the outlook for new orders is right near a record from last month, current readings have pulled back materially.

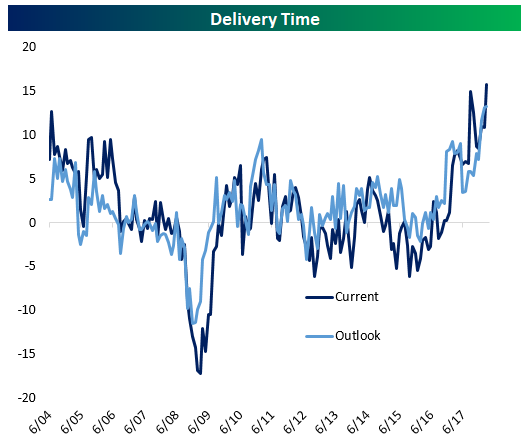

While some indices are retreating, one series that is still at a record on both a current and expected basis is the delivery time series. As shown below, manufacturers are seeing rapidly rising wait times for supplier deliveries, an indication of capacity constraints.

Prices are also indicating capacity constraints as they’ve accelerated rapidly from early 2016 lows through today. We do note prices received edged slightly lower in March but are still very high relative to history.

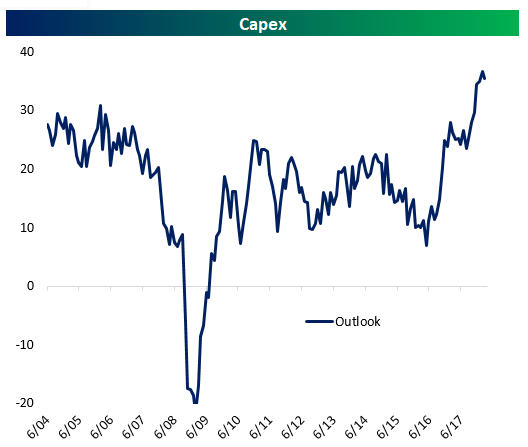

Finally, expected outlays on capital expenditures took a breather after posting a record for several consecutive months.

Leave A Comment