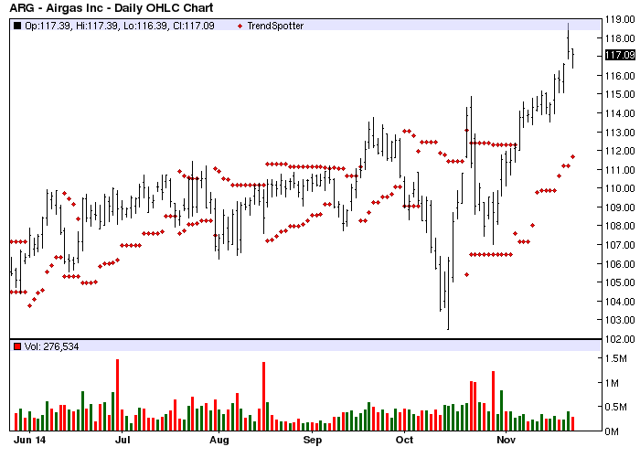

The Chart of the Day belongs to Airgas (NYSE:ARG). I found the stock by sorting the All Time High List for the stocks with the most frequent new highs In the last month then used the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 10/21 the stock gained 2.85%.

Airgas, Inc., through its subsidiaries, is the largest U.S. distributor of industrial, medical, and specialty gases, and hardgoods, such as welding equipment and supplies. Airgas is also the third-largest U.S. distributor of safety products, the largest U.S. producer of nitrous oxide and dry ice, the largest liquid carbon dioxide producer in the Southeast, and a leading distributor of process chemicals, refrigerants, and ammonia products. More than eleven thousand employees work in about nine hundred locations including branches, retail stores, gas fill plants, specialty gas labs, production facilities and distribution centers. Airgas also distributes its products and services through eBusiness, catalog and telesales channels. Its national scale and strong local presence offer a competitive edge to its diversified customer base.

(click to enlarge)

Barchart’s Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

Fundamental factors:

Leave A Comment