Stock market complacency has never been greater.

One of my favorite films is Animal House. The mayhem depicting the Tri-Delt sabotage of a college town parade in the film’s final scenes is truly astounding.

Animal House introduced a very young Kevin Bacon to movie audiences. In its finale, he plays a member of an ROTC squad providing parade security. He plants himself on a sidewalk with outstretched arms to calm panicked townsfolk as they flee the carnage wrought by a crew of misfit frat boys. “ALL IS WELL!” he shouts. But all is NOT well. He’s literally flattened by the stampeding citizens.

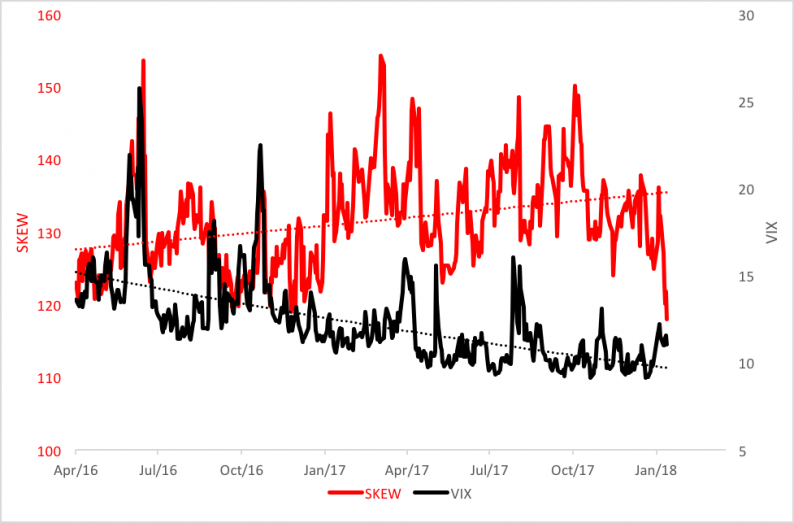

So what’s all this got to do with investments? Just this: The option market is shouting “ALL IS WELL!” and the outcry’s coming from the Cboe Skew Index (SKEW).

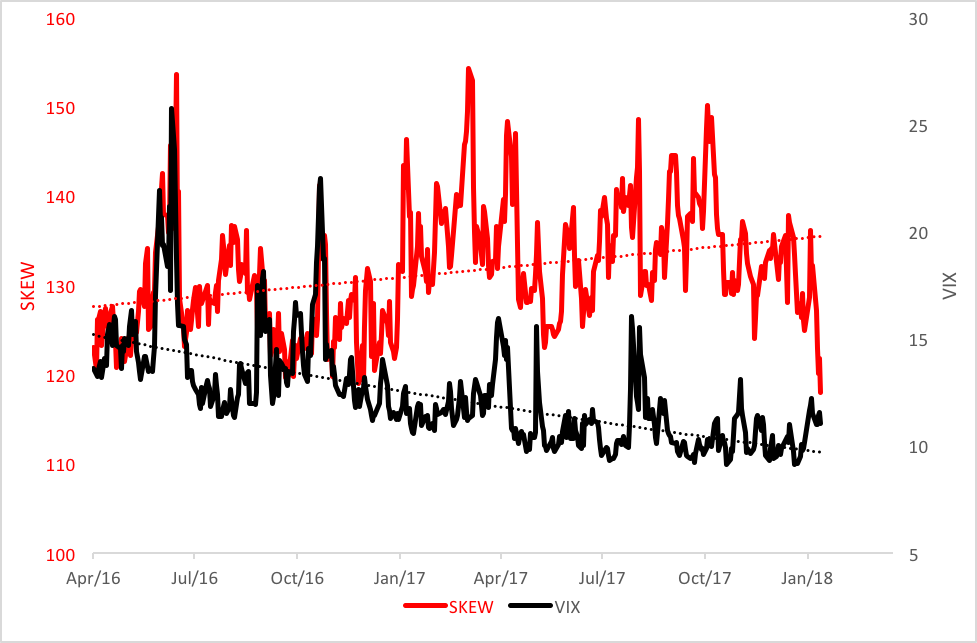

The Skew index, like the better-known Cboe Volatility Index (VIX), is a measure of potential risk. Both VIX and SKEW are used by traders and investors to meter market sentiment.

Both VIX and SKEW are derived from option prices, specifically contracts on the S&P 500 Index. While VIX measures volatility expectations over a 30-day forward horizon, SKEW views perceptions of “tail risk.”

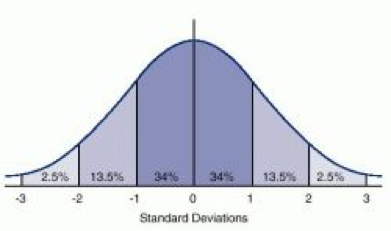

Tail risk is the probability of an outsized decline—two standard deviations or more—in the S&P 500 over the coming month. The tail in this case is on the left, or negative, side of a return distribution. Below you can see a “normal” distribution, known as a bell-shaped curve, where most investment returns snuggle within one standard deviation of the mean, or average.

The tails—two or three standard deviations to the left and right, are skinny in a normal distribution meaning the likelihood of a return that size grows evermore remote as you move away from the mean or “0” line.

SKEW describes traders’ expectations of the left tail fattening.

Leave A Comment