QUESTION: Mr. Armstrong, have you ever heard of a short lived Wörgl Experiment in Austria? It was shut down by the Austrian Central Bank they say because it was successful. Have you looked into this experiment they claim defied deflation and inflation?

ANSWER: Yes. This was by no means an isolated instance. True, it was touted as the “Miracle of Wörgl” during the Great Depression. The very similar “experiment” took place in the United States with over 200 cities also issuing their own currency. You have to understand the dynamics of the period. This was the very age of AUSTERITY where the assumption was the collapse was a lack of confidence in government so they increased tax collection and cut spending unleashing both deflation and a dwindling money supply. This led many cities to create their own money due to the lack of money in circulation also impacted by hoarding.

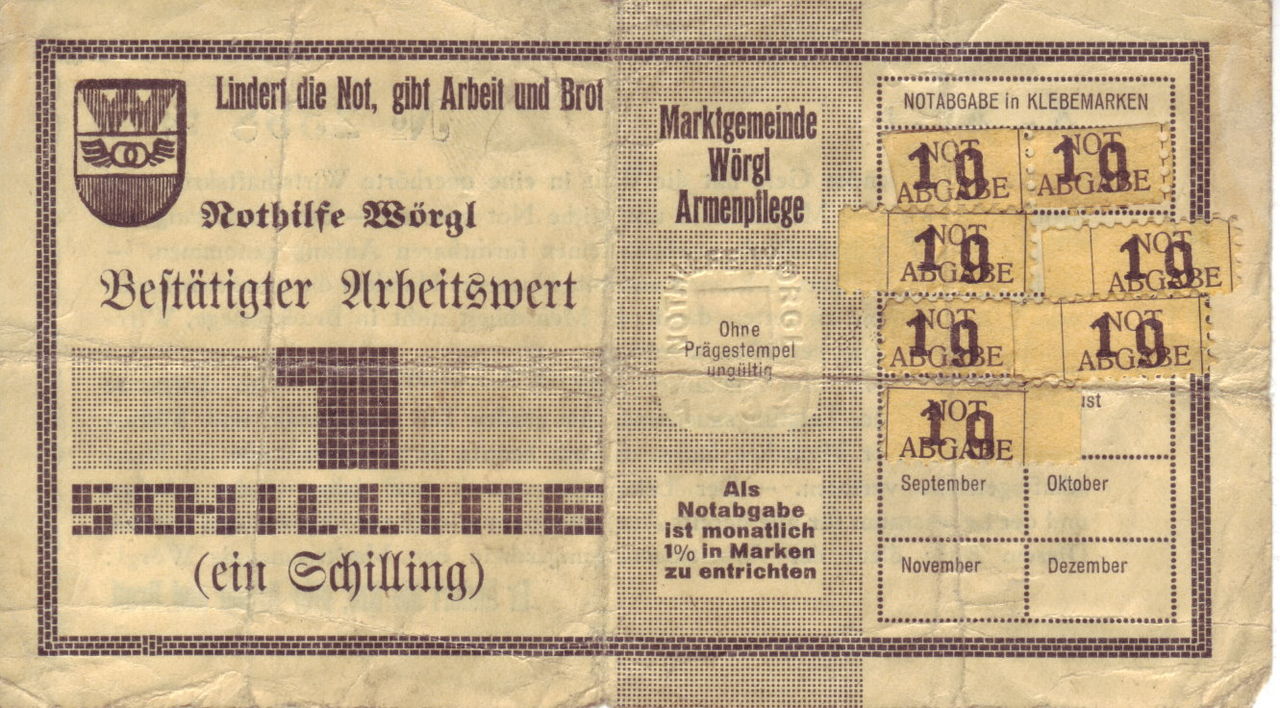

The Wörgl Experiment began on July 31, 1932, the very month that the Dow Jones bottomed. The experiment involved issuing of “Certified Compensation Bills”, which was a form of local currency known as Scrip generally, or Freigeld. The monetary theories of the economist Silvio Gesell were applied by the town’s then-mayor, Michael Unterguggenberger. What differed with Gesell’s idea was that the currency would expire. Believe it or not, there are some government’s looking into currency which expires. Europe since World War II issued currency which expired roughly every 10 years. This forced people to bring out the old currency to be swapped and thus prevent hoarding.

The central part of Gesell’s idea was how to stop HOARDING of money. This is why FDR also confiscated gold. He too saw the problem of people hoarding money and not spending it. This is part of every economic decline. If there is no CONFIDENCE in the future, people save more. This is simply human.

Leave A Comment