Spending and wage growth disappointed in September, particularly as incomes continue to register barely any growth. The fact that this stagnation has continued for several years allows commentary such as this:

U.S. consumer spending in September recorded its smallest gain in eight months as income barely rose, suggesting some cooling in domestic demand after recent hefty increases.

The Commerce Department said on Friday consumer spending edged up 0.1 percent after an unrevised 0.4 percent rise in August. Consumer spending accounts for more than two-thirds of U.S. economic activity.

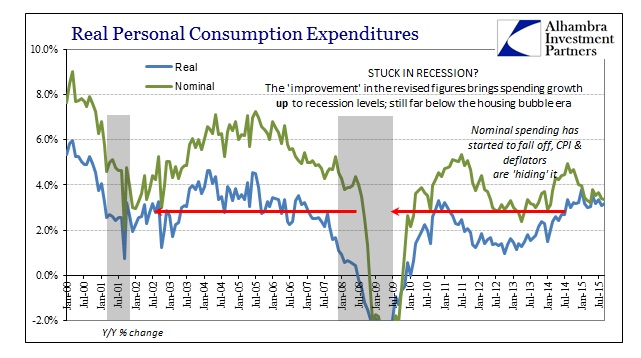

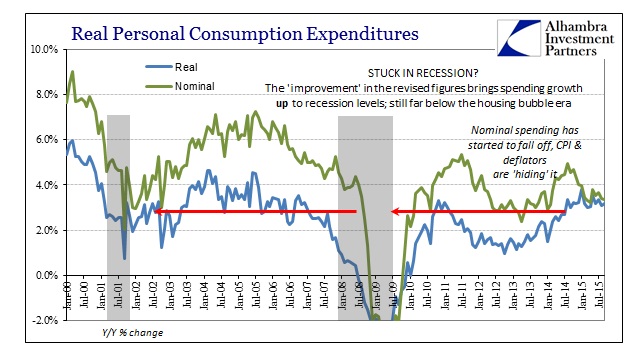

There is no way to reconcile the use of the qualifier “hefty” about spending in the summer with anything other than relative imprecision. In other words, like GDP, it only looks “hefty” if you stick within the deficiency of the current cycle. By any useful, historical standards, both spending and income remain stuck in what may amount to positive numbers but nothing even close to healthy.

Nominal spending has, in 2015, resorted to its lackluster post-2012 slowdown baseline while the decline in the official “inflation” measures all the way to zero mathematically sort out real spending seemingly upward. Neither nominal nor real spending growth comes out anywhere close to a healthy advance, despite continued reference in that direction.

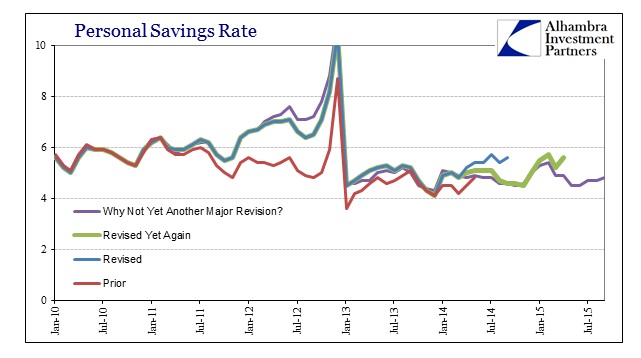

This infirmity starts with the overwrought tendency lately toward huge and altering revisions, particularly where it comes to consumer spending. I believe that is as the unstable and volatile GDP figures (which is not surprising given the statistical relationship there) which more than suggests the difficulty reconciling subjective settings (like trend-cycle) with downside disappointment time and again. It is, as noted earlier, a signal of at least an unstable economy still departed from anything like a recovery track.

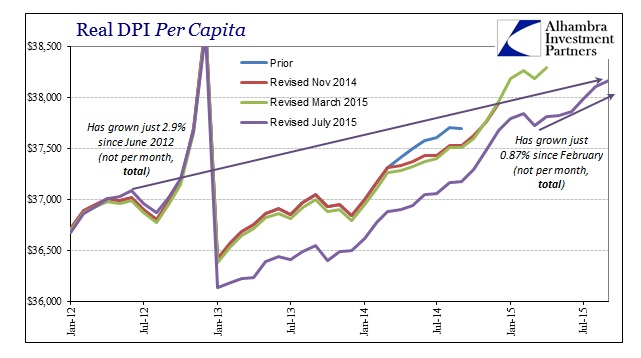

It all starts with incomes, where, despite the purported “best jobs market in decades”, wage growth refuses to relent from economic “slack.” Yellen and the FOMC may see the end to that drain, but it just isn’t anywhere close and the lid on wage and income gains is the major element of economic danger in 2015. Dating back to June 2012, real DPI per capita is up less than 3% total (and just 0.9% since February, which would include those “hefty” gains). That insufficiency is further bothered by the drastic downward revisions that removed a great deal out of 2013 (and thus calls into question what truly happened in later 2014). In contrast to comparable prior periods, none of this adds up to anything other than the same devilish economic inertia.

Leave A Comment