Amazon Beats Revenue Estimates

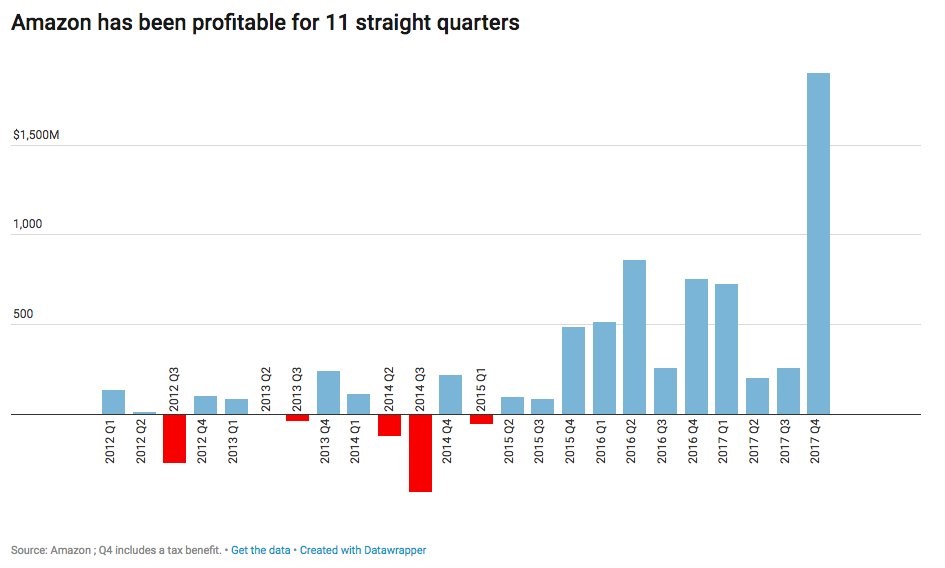

In the midst of the negative news during the market sell off on Friday, AMZN stock was rallying because it beat estimates. The stock was up 2.87% on Friday and fell with the market on Monday. The firm reported $3.75 in Q4 2017 EPS which wasn’t comparable to estimates because of the tax benefits the firm saw which weren’t in the estimates. The company reported $1.9 billion in net income; the tax benefit was $789 million. Many companies are seeing one time changes because of the tax law which is making Q4 confusing if you don’t look at results closely. As you can see from the chart below, Amazon has now been profitable 11 quarters in a row. The investors who stuck with the company when it was reporting losses have been rewarded mightily. They believed the company was making the necessary future investments; those investments have paid off. Patient investors have allowed CEO Jeff Bezos to look to the next 2 years instead of the next quarter. Although it looks obvious in hindsight, 5 years ago, it wasn’t clear that Amazon Web Services and Amazon’s Alexa assistant were going to be this dominant.

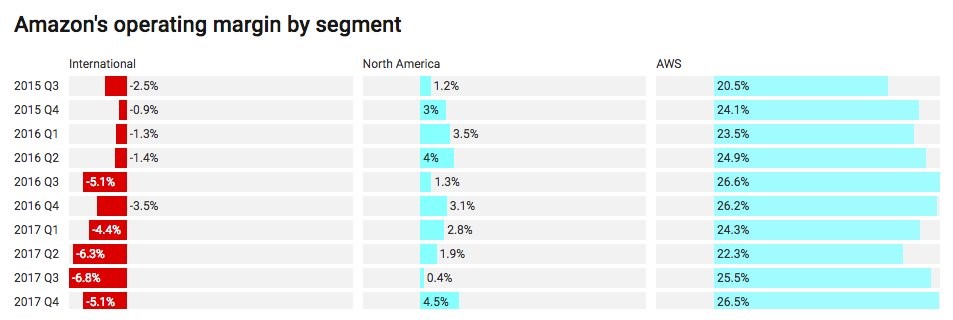

Revenues were $60.5 billion which beat estimates for $59.83 billion. That was a 38% increase from last year. That breaks down to $37 billion in North American sales which was 42% growth and $18 billion in international sales which was 29% growth. The Amazon Web Services revenues were $5.11 billion which beat estimates for $4.97 billion. AWS had 45% sales growth and accounts for 64% of operating income. You can see this break down in the chart below. As you can see, the international segment has negative margins, North America has razor thin margins, and AWS has very high operating margins.

The revenue guidance for Q1 2018 was $47.75 billion to $50.75 billion. This beat estimates for $48.6 billion. The operating income estimates were way below the consensus the street had which is normal for Amazon. Operating earnings guidance was for between $300 million to $1 billion. That was way below the estimates for $1.5 billion. The company makes it clear that it isn’t concerned with near term results, but it sometimes beats its own estimates by a wide margin. It’s an excessive use of under promising and over delivering. The very wide company guidance is a farce because it tells you nothing about the current quarter.

Leave A Comment