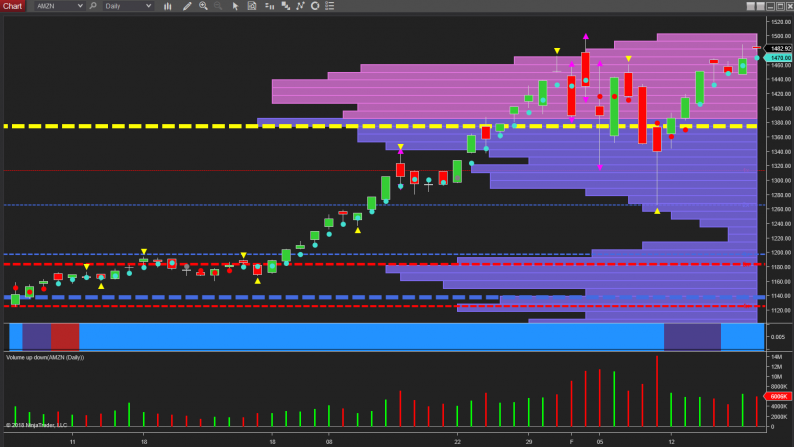

Whilst the longer term outlook for McDonald’s (MCD) stock price may look rather bearish at present, the picture for Amazon (AMZN) could not be more different, with the stock continuing to rise, and now testing the dizzy heights of $1500, which was touched briefly in today’s trading session, before coming off these levels as US indices turned lower after an initial move higher following the release of the FOMC minutes.

For Amazon, the recent market volatility has proved to be no more than a minor interruption in the longer term bullish trend for the stock. And whilst it did indeed sell off sharply on the 9th February, along with many other blue chip stocks, its recovery has been immediate and strong, and clearly evidenced by the extreme volume associated with that day’s price action. The depth of the wick to the lower body of the candle, coupled with the ultra high volume simply signaled the strength of buying, with the strong recovery duly following.

The $1500 per share price is now tantalizingly close, and once this is taken out on good volume, the price of Amazon stock will then be set to continue its journey higher, and further extend the current longer term bullish trend.

Leave A Comment