Look, I don’t know. Maybe tech will rebound on Wednesday and manage to close green, but the first couple of hours were a continuation of Tuesday’s bloodbath and what I would say to anyone who thinks this is somehow surprising is that maybe common sense took a backseat to “FOMO” sometime in 2017.

And when I say “common sense”, I don’t necessarily mean that folks were willing to overlook valuations and fundamentals in some of these “story” stocks because they were eager to invest in the ongoing evolution of technology and thereby the continued advancement of humankind. Rather, I mean that the “story” itself is more than a little absurd to the extent it assumed there wouldn’t be stumbling blocks along the way.

Technology has a habit of running out ahead of regulation and eventually, the chickens come home to roost on that. It’s never clear what the catalyst will be, but it always happens. For Facebook, the Cambridge Analytica scandal was the straw that broke the camel’s back, colliding as it did with an exceptionally polarized political environment. The shares have seemingly stabilized following the announcement of an update to privacy “tools”, but it goes without saying that this is far from over.

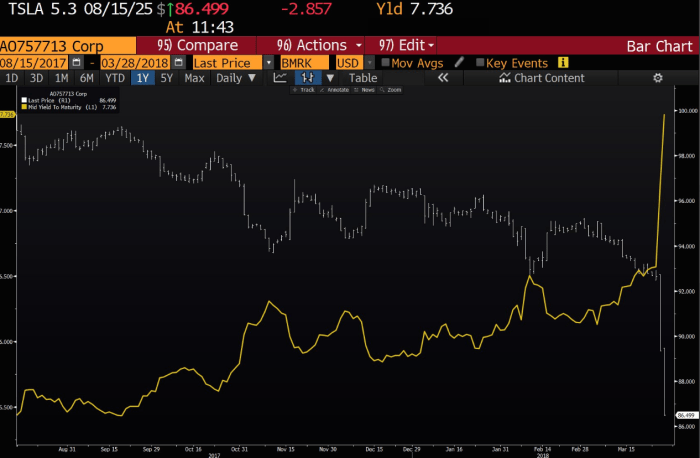

For Tesla, the turmoil comes amid further scrutiny on the safety of the company’s Autopilot system. The stock is down another 7% on Wednesday and the bonds are collapsing following the Moody’s downgrade.

For Amazon on Wednesday, the problem is Trump. According to sources who spoke to Axios, he’s “obsessed” with the company and wants to “go after it”. Although he’d pitch that effort as something that’s designed to help “everyday” small business owners avoid falling into the Bezos black hole, his motivation is first and foremost tied to his personal vendetta against “the AmazonWashingtonPost” (as he calls it when he’s ranting on Twitter) and secondarily related to complaints from rich people. Here’s Axios:

Leave A Comment