While crude and copper have been christened the great economic forecasters of our time, the data shows that there is another, more highly correlated, commodity to the economic cycle. Lumber prices are the most correlated with ISM and GDP of all industrial commodities and that is a problem…

First, Lumber prices have collapsed to 4 year lows. The 33% Year-over-year plunge is the biggest since the financial crisis and is flashing a big red recession alarm…

Click on picture to enlarge

Second, Lumber prices have historically led stocks and are pointing to significant downside from here…

Click on picture to enlarge

and finally, Third, it appears lumber’s decline points to notable downside for manufacturing…

Click on picture to enlarge

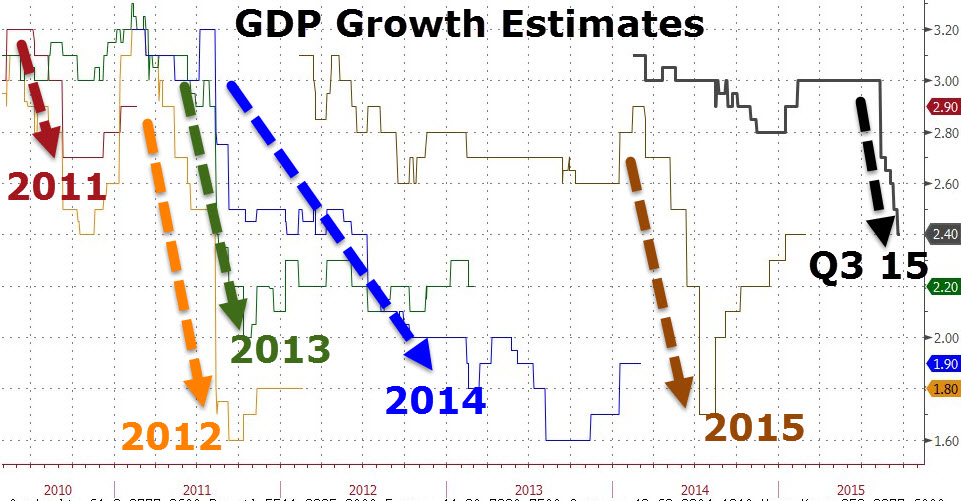

But apart from that, everything is fine… Oh wait…

Click on picture to enlarge

Charts: Bloomberg and @Not_Jim_Cramer

Leave A Comment