Of all the indicators that the Fed has presented to justify its rate hike mentality and to validate that the US economy remains on a growth path despite clear recessionary signals from both the manufacturing sector and the dramatic tightening in financial conditions in recent months, Yellen’s preferred metric also happens to be the most lagging one: nonfarm payrolls and the unemployment rate, both of which supposedly signal the collapsing slack in the labor market and a jump in wages that has been “just around the corner” for years.

The problem is that when shifting away from lagging indicators of the labor market, to coincident ones, a starkly different picture emerges. The best example of this is when looking at the growth of federal income and employment tax withholdings, the broadest and most timely read on the health of the job market, which as Jed Graham writes, “has been sinking at an alarming rate.”

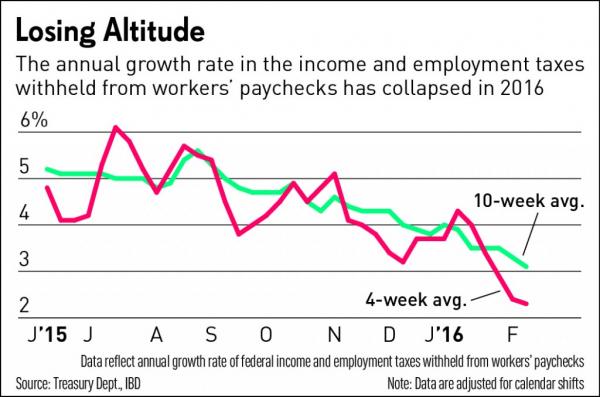

While for most of 2015, tax withholdings rose at a rate of 5% or more from a year ago, on the back of job growth and gains in wages, commissions and other incentive pay, in recent months there has been a substantial dropoff in this key indicator.

As shown in the chart below, revenue inflows to the Treasury Department steadily slowed through the fall, bringing the annual growth rate down to just below 4% by the start of 2016. That’s when growth seemingly collapsed — to just 1.8% over the past five-plus weeks, from Jan. 11 through Feb. 16.

The problem with the jobs report is that it relies on statistically interpolated, and seasonally adjusted data from the Bureau of Labor Statistics, which not only has a significant revisionist history aspect being materially revised after a given period, but is also subject to clear political bias and huge “birth/death” assumptions, which correlate the growth in labor with the net creation of new U.S. businesses despite clear indications over the past several years that there should be no net additions as a result of collapsing “dynamism” as the Brookings institute itself calculated some time ago and as we chronicled in August of 2014 in “4 Million Fewer Jobs: How The BLS Massively Overestimated US Job Creation”

Leave A Comment