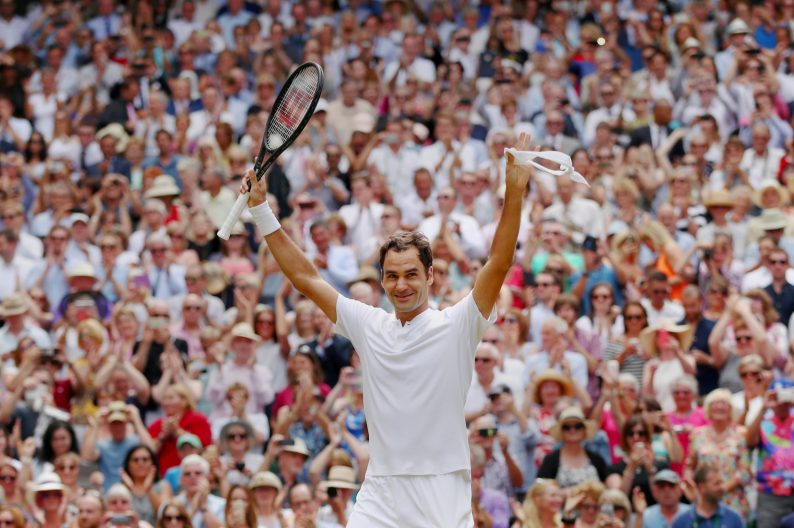

Congrats to Roger Federer on his 8th career Wimbledon title and 18th Grand Slam title! The man is simply the best player to ever play the game. At 35 years old, he is aging like fine wine. I remember that there were rumors that he’d retire on top many years ago but he just keeps on playing and winning majors. This year he cruised through the Wimbledon championship without dropping a set. He manages his playing schedule so his body doesn’t break down. I’d say he is doing a pretty good job of that. In 2017, he has won both Grand Slams that he entered and carries a 31-2 record on the year, including an 8-0 mark against the top 10 players. What investing lessons can we take away from the greatness of Roger Federer?

Ride the winners to higher highs

Federer has been a consistent force on the tennis circuit since joining the tour in 1998. He climbed to be the #1 ranker player in 2004 and has stayed in the top 10 ever since. Here is a chart of his player ranking.

Seeing that rise in his player rank in the early years (1998-2004) is what you want to see in your stock prices. A steady ascent up and to the right. At Runnymede, we believe in sticking with Federer-like stocks – ones with proven track records of success and a long runway of growth ahead. If you can find companies with the ability to grow their earnings and sales at 10-15% per year, your investment portfolio will be a winner in the long-run.

Highs and Lows of Investing

In the New York Times, I found this wonderful quote from Federer at Wimbledon.

“You go through these waves of highs and lows, and navigate through, and it’s not always simple.”

I feel like this quote could be directly applied to the stock market. If you look at a long-term chart of the US stock market, the decision to buy and hold looks easy because we know that the end result is positive and the market seems to always recover. However, like Federer says, “It’s not always simple.” During bear markets, it is painful to ride out a huge downdraft. Ask anyone that suffered in 2000 or 2008. We know too many people that came to us having already lost 50% of their savings and then ended up ill due to the extreme stress and worry. At Runnymede, we spend large amounts of research hours on studying the business cycle to make the decision for our clients on when to take money off the table and move to safe assets like cash or Treasuries. This isn’t always an easy decision like in 2000 when Internet stocks are flying high but valuations make no sense. But you have to stick with your discipline even if it takes time for the market to follow logic and not euphoria. Even 2008 wasn’t easy to navigate through. We moved client accounts to defensive positioning, out of stocks and into US Treasuries; but even then, watching the carnage that Fall wasn’t easy. We hope to never see another near systemic collapse of the financial system again.

Leave A Comment