Markets flew around all over the place today. Precious metals down in pre, stocks up. Stocks down post-Draghi, PM’s up. I remain positioned for balance in the miners (reestablishing some hedging at the end of the day) and in stocks. Cash is the best balancer and I have a lot of that, but insofar as I am in… I am balanced. It’s been a good year so far and I intend for it to stay that way.

As to the outside day…

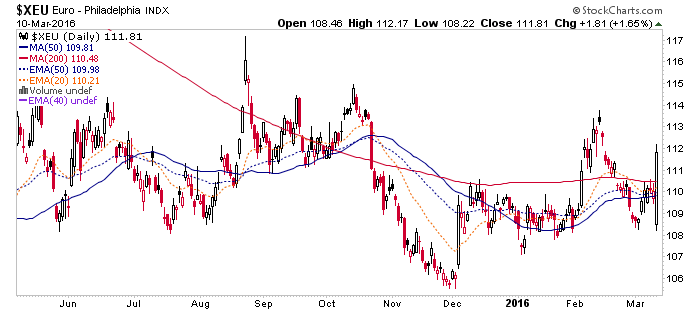

First, looking at ground zero we find the Euro flipping Draghi the bird. Outside day? Today’s candle was outside the whole month so far.

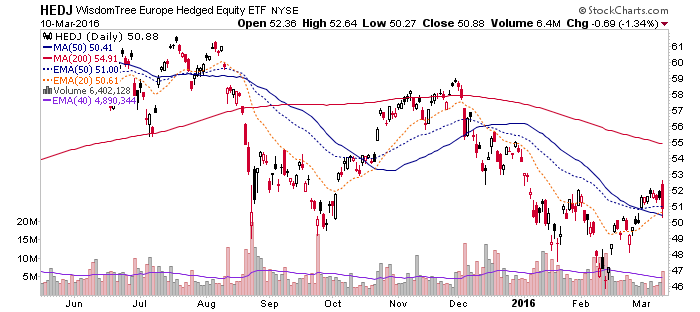

The Euro hedged European ETF was also outside all the activity for March. This is twice now that the market has dumped on a Draghi announcement.

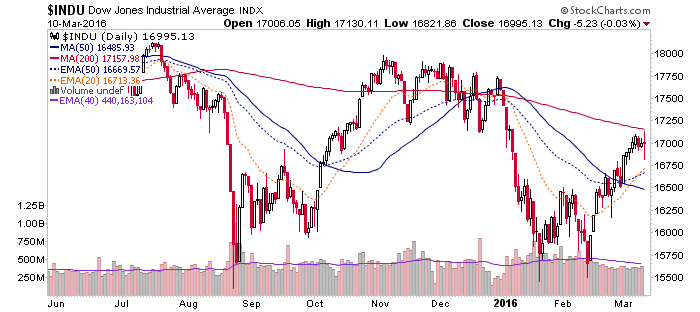

The Dow swung wildly outside of its recent activity.

While SPX and NDX were outside of just the last few days. Here is NDX at a lateral support level and the 50 day averages. It actually looks like a (short-term) buy to me. That’s what the chart looks like. I am not going to paint a post to a predetermined theme.

Anyway, just an end of day view as the dust settles.

Leave A Comment