In its February decision on interest rates, the Reserve Bank of Australia (RBA) issued a surprisingly upbeat and rosy assessment of economic conditions in Australia. Outside of mining, I daresay economic conditions look particularly promising:

“In Australia, the available information suggests that the expansion in the non-mining parts of the economy strengthened during 2015 even as the contraction in spending in mining investment continued. Surveys of business conditions moved to above average levels, employment growth picked up and the unemployment rate declined in the second half of the year, even though measured GDP growth was below average. The pace of lending to businesses also picked up.”

Yet, the reality remains that overall inflation is too low (1.7% for 2015) and there is still too much turbulence in China’s economic transition for the RBA to sit comfortably. The Australian dollar (FXA) is finally doing some of the heavylifting for the RBA, so it does not need to cut rates. The RBA can get away with threatening to maybe, possibly, perhaps cut rates if absolutely necessary. So for now, the RBA’s conclusion is sufficient to keep markets on notice. It also keeps the Australian dollar from getting caught in some mild policy divergence away from all the other major central banks that are still in retreat on policy:

“Over the period ahead, new information should allow the Board to judge whether the recent improvement in labour market conditions is continuing and whether the recent financial turbulence portends weaker global and domestic demand. Continued low inflation may provide scope for easier policy, should that be appropriate to lend support to demand.”

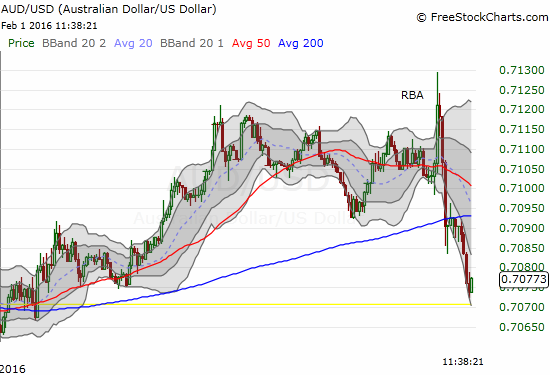

The reaction in currency markets reflects the dual nature of the statement. Traders first bought and then sold the Australian dollar.

The market rocks up and then down in response the RBA’s mixed messages.

On a daily scale, this quick churn reinforces a struggle at important resistance. Against both the U.S. dollar and the Japanese yen, the Australian dollar is struggling at critical resistance from 50-day moving averages (DMAs). If current trends persist, the test should resolve to the downside. If resolution occurs to the upside, then the move could represent a brand new wave of optimism that chooses to latch onto the good news over the same old bad news in the RBA’s report.

Leave A Comment