The EUR/USD currency pairTechnical indicators of the currency pair:

The dollar index gained 0.11% on Thursday. Bullish factors were generally strong economic news from the US and safe-haven demand amid a sharp sell-off in equities, as well as due to the escalating conflict in the Middle East. In turn, the euro was unable to counter the dollar’s rise as the European Central Bank (ECB) left its key rate unchanged at 4.5% on Thursday, in line with market expectations. At the moment, the probability of the ECB rate hike at the December meeting is only 5%, as there has been weak economic data from Eurozone countries lately, with core inflation gradually declining.Trading recommendations

The trend on the EUR/USD currency pair on the hourly time frame is a downtrend. Yesterday, the price tested the support level of 1.0522, which was followed by the reaction of buyers. The MACD indicator has become inactive, while there is buying pressure inside the day. Sell deals can be looked for from the resistance level of 1.0565 or 1.0564, subject to the sellers’ reaction. Buying can be looked for from the support level at 1.0522, subject to liquidity testing below the level.Alternative scenario: if the price breaks the resistance level of 1.0590 and consolidates above it, the uptrend will likely resume.  News feed for 2023.10.27:

News feed for 2023.10.27:

The GBP/USD currency pairTechnical indicators of the currency pair:

The Pound Sterling lost ground against the US Dollar in the recent trading sessions after the UK wage growth rate was lower than expected, and the labor market situation improved marginally. UK wage growth is attracting close attention from the central bank as it tries to avoid unwinding the wage-price spiral. UK wages grew slower than expected in August, reinforcing market expectations that the Bank of England (BoE) will not raise rates any further and thus is at the end of its tightening policy. Given the lack of bullish factors for the pound, there is a high probability of further decline in the pair in the medium term.Trading recommendations

From the point of view of technical analysis, the trend on the GBP/USD currency pair on the hourly time frame is a downtrend. Similar to the euro, the pound sterling found support yesterday at 1.2081, followed by a buyers’ reaction. The MACD indicator turned positive. Under these market conditions, buy deals can be sought intraday with a target of 1.2152 or 1.2176. Selling can be looked for after testing these resistance levels but with confirmation in the form of sellers’ reactions.Alternative scenario: if the price breaks the resistance level at 1.2189 and consolidates above it, the uptrend will likely resume.  There is no news feed for today. The USD/JPY currency pairTechnical indicators of the currency pair:

There is no news feed for today. The USD/JPY currency pairTechnical indicators of the currency pair:

Yesterday, the Bank of Japan conducted another intervention to support the exchange rate. Despite the absence of official statements, it is clear that the policymakers are trying to prevent the price from fixing above 150 yen per dollar. There is a high probability that next week, the Bank of Japan will again change the policy of yield curve management with the adjustment of the forecast. Otherwise, it will be necessary to intervene again in the pricing of the yen.Trading recommendations

From the technical point of view, the medium-term trend on the currency pair USD/JPY is bullish. After the intervention of the Bank of Japan, the price bounced sharply from the resistance level of 150.78, but the buyers recovered some of their losses quite quickly. Buy trades are best considered after testing liquidity below 149.98. For sales, the resistance level of 150.23 can be considered, but with short targets.Alternative scenario: if the price consolidates below the support level at 149.33, the downtrend will likely resume.  News feed for 2023.10.27:

News feed for 2023.10.27:

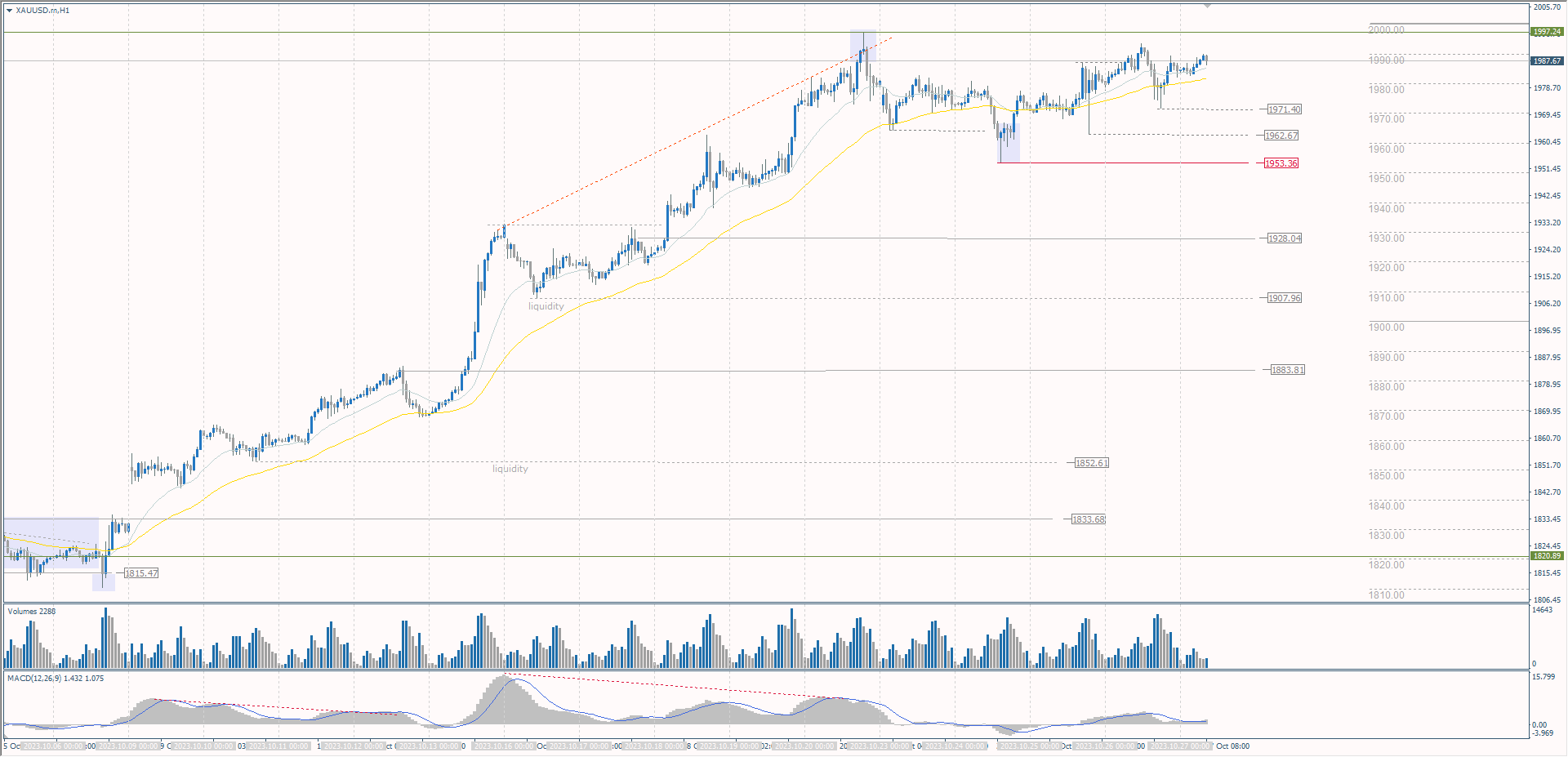

The XAU/USD currency pair (gold)Technical indicators of the currency pair:Yesterday, gold prices were boosted by demand for the “safe-haven” asset due to a sharp decline in US stocks and news of a brief raid by Israeli troops using tanks in the Gaza Strip. Precious metals prices were also supported by a sharp 11 bps decline in 10-year T-note yields and lower expectations of a Fed and ECB rate hike in December. At the moment, gold has no serious limiting factors.Trading recommendationsFrom the point of view of technical analysis, the trend on the XAU/USD has changed to an upward trend. At the moment, the price is trading above the moving averages and is aiming at the psychological level of 2000. The MACD indicator is positive, and there is weak buying pressure intraday. Under such market conditions, buying is better from moving averages with confirmation of buyers’ reaction on intraday time frames. Selling can be sought from the resistance level of 1997.24 but on the condition of testing liquidity above the level with confirmation in the form of a change of structure on the lower time frames.Alternative scenario: if the price breaks and consolidates below the support level of 1953.29, the downtrend will likely resume.  News feed for 2023.10.27:

News feed for 2023.10.27:

More By This Author:Japan Is Setting The Stage For A Monetary Policy Review. Falling Tech Companies Are Dragging The Broad Market Analytical Overview Of The Main Currency Pairs – Thursday, October 26Weak Corporate Reports From Tech Companies Weigh On Stock Indices. Japan’s Nikkei 225 Is Falling As The Yen Rises Above 150

Leave A Comment