A decade ago I believed annuities were for rich people, the average person probably doesn’t need them. Investing through an insurance company is generally expensive.

What do retirees need from their retirement plan?

Whether you have a pension, 401k, IRA or a combination, most people say they want “guaranteed income” for the rest of their life. When you unpack that statement, it has several components.

- “Income certainty” – You know the money will be there on schedule. You don’t have to worry about the economy, stock market or other economic conditions affecting your monthly income. It’s guaranteed and safe!

- “Enough income” – The ability to pay your bills for the rest of your (and your spouse’s) life. You never want to run out of “enough” money to cover your expenses or worry about inflation.

- “Enjoy your current lifestyle” – The ability to not have to change your lifestyle, downsize, or depend on others for financial support

Retirees could supplement their pensions or social security by investing a small portion in the market to offset inflation, and the major portion in safe bonds or FDIC insured certificates of deposit paying good interest rates – and be comfortable they could meet those goals.

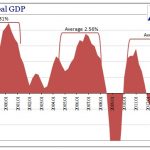

If you planned well, saved, met your retirement targets and invested conservatively, you were in good shape. There was no need for annuities because the three goals were met. That worked well until the government bailed out the banks and interest rates dropped to historic lows.

Those who primarily relied on safe, juicy (probably government) pensions were generally OK. Retirees who depended on a retirement nest egg to supplement their social security faced a bigger challenge. Interest rates for safe bonds and CDs were a fraction of what they were prior to the bailout. My wife and I saw our interest income cut by 66%.

Millions of retirees and baby boomers were frantically looking for ways to make up the shortfall in safe, guaranteed income. A combination of lower interest rates, a stock market crash and 10,000 baby boomers retiring daily caused a significant increase in annuity sales.

What is an annuity?

Researching annuities became a real challenge. Most everything I found was written by those who sell them – promotional material disguised as educational.

A friend introduced me to Stan Heathcock, who’s known as “Stan The Annuity Man.” His website is spot on with this description:

Leave A Comment