The U.S. stock market indexes gained between 1.3% and 1.7% on Friday, retracing most of their last week’s move down, as investors reacted to monthly jobs data release. The S&P 500 index got closer to its Monday’s local high, and it currently trades 7.3% below January 26 record high of 2,872.87. The Dow Jones Industrial Average gained 1.4%, and the technology Nasdaq Composite gained 1.7% on Friday, as Apple’s stock price led the technology sector higher.

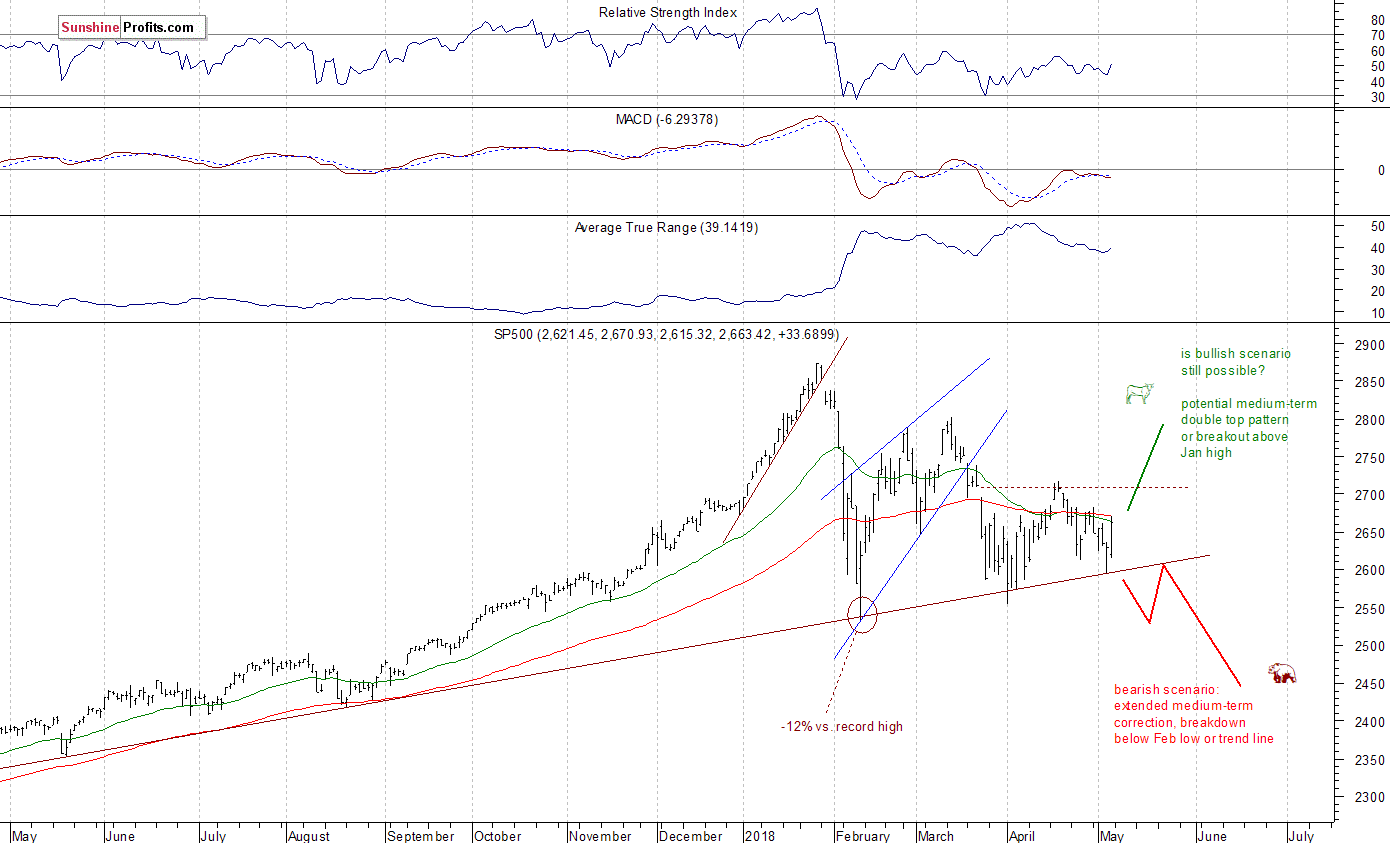

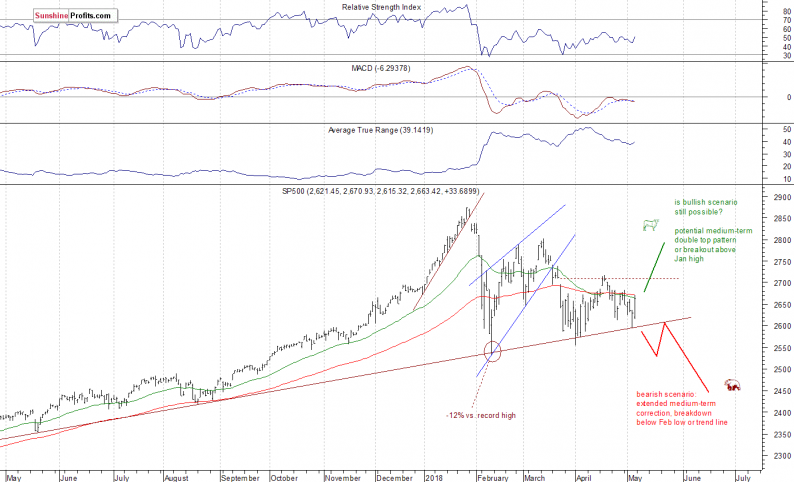

The nearest important level of resistance of the S&P 500 index is now at around 2,670, marked by Friday’s daily high. The next resistance level is at 2,685-2,710, marked by previous local high and March 22 daily gap down of 2,695.68-2,709.79. On the other hand, support level is at 2,595-2,615, marked by recent fluctuations and an over year-long medium-term upward trend line.

The broad stock market continues its medium-term consolidation following late January – early February sell-off. There are still two possible medium-term scenarios – bearish that will lead us below February low following trend line breakdown, and the bullish one in a form of medium-term double top pattern or breakout towards 3,000 mark. There is also a chance that the market will just go sideways for some time, and that would be positive for bulls in the long run (some kind of an extended flat correction):

Positive Expectations

The index futures contracts trade 0.3-0.5% higher vs. their Friday’s closing prices, so expectations before the opening of today’s trading session are positive. The main European stock market indexes have gained 0.1-0.8% so far. There will be no new important economic data announcements. However, investors will wait for more quarterly earnings releases. Friday’s uptrend may extend a little, but we may see more uncertainty, as the broad stock market gets closer to previous local highs. There have been no confirmed negative signals so far.

Leave A Comment