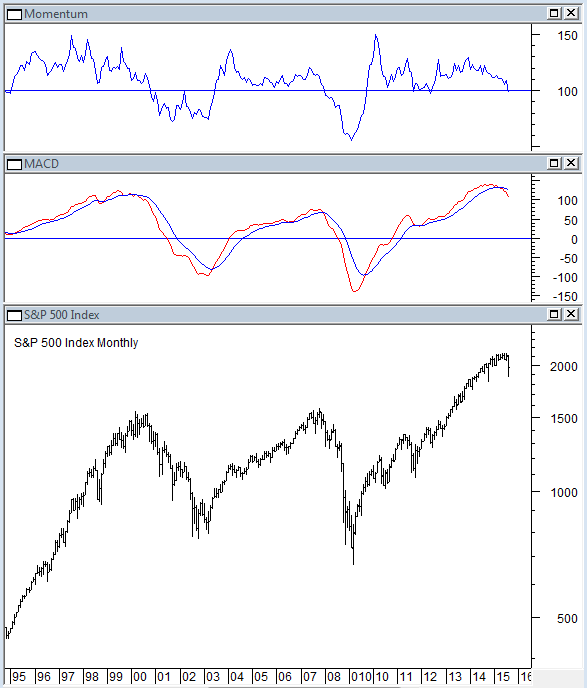

At the end of August monthly momentum for the S&P 500 Index (SPX) joined MACD in warning that the long term trend has changed from bullish to bearish. This is just one more domino to fall in the ongoing battle between bullish indicators and bearish.

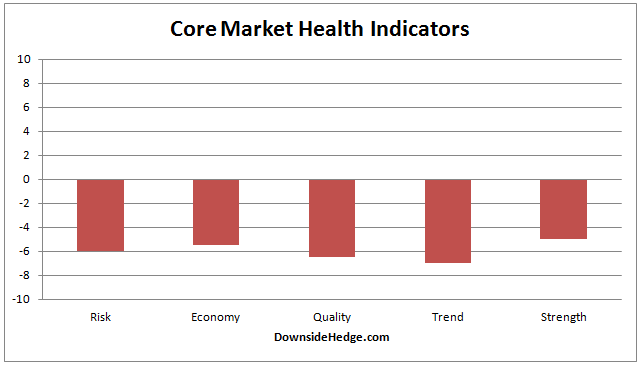

Over the past week my core market health indicators bounced around a bit, but all of them are still warning. In addition, my market risk indicator is still warning and is showing no signs of abating at the moment. As a result, the portfolios are still aggressively hedged. This post shows the current allocations.

Below is a chart with the current market health indicator categories.

Please note: If we get a good washout next week that basically retests the August low I’ll likely (based on my read of the washout) take more profit from the hedge and rebalance to the following allocations: 50% long, 25% aggressively hedged, and 25% short SPX.

Leave A Comment